Insight:

- Vietnamese exports to the US hit a record high in 2024, driven by booming demand for electronics, textiles, and furniture.

- Rising tariff threats and trade scrutiny from the U.S. are pushing Vietnam to diversify markets and strengthen economic resilience.

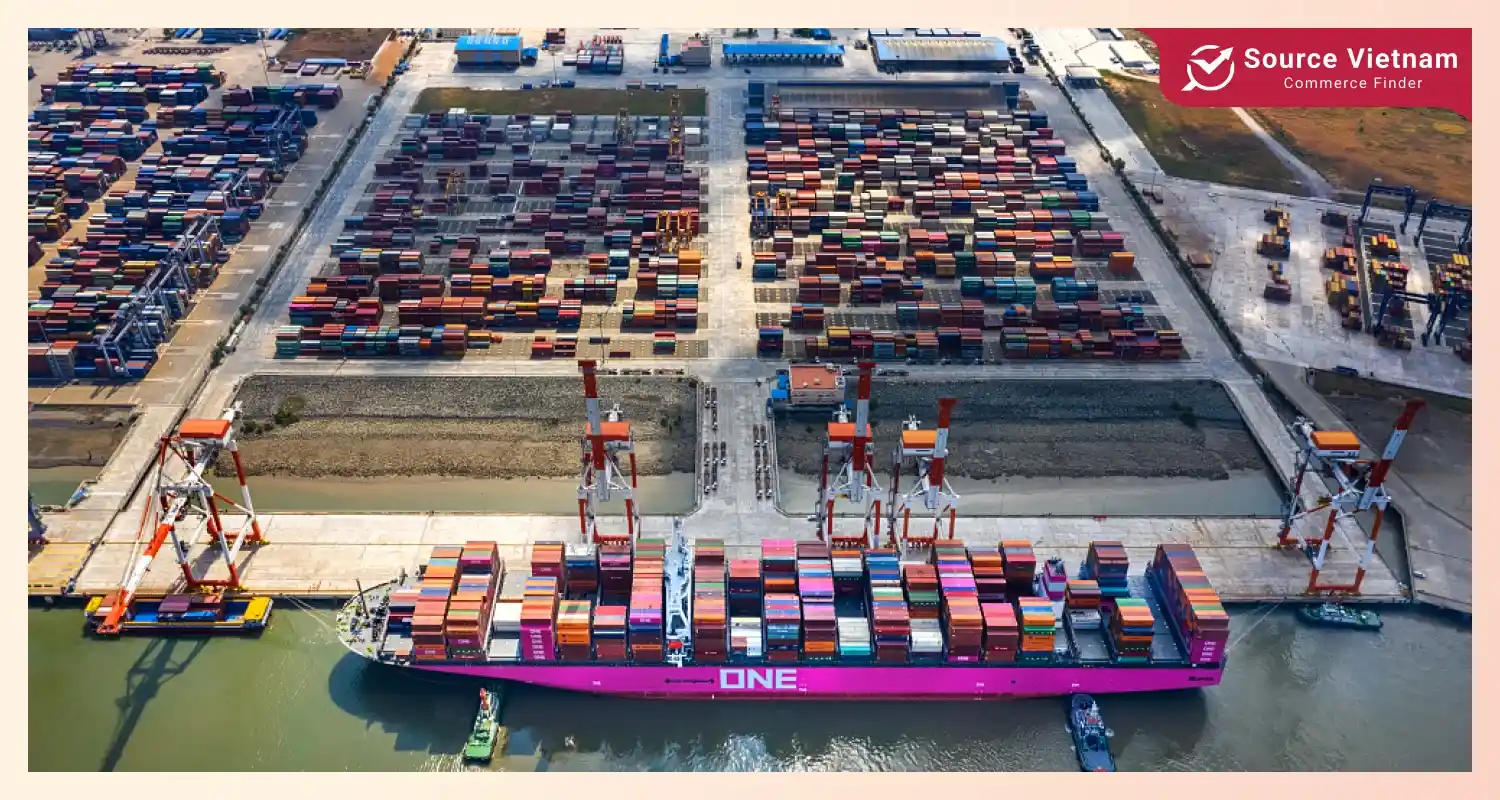

Vietnam’s trade relationship with the United States has reached new heights, with the Southeast Asian nation recording a staggering trade surplus of over US$123 billion in 2024—a nearly 20 percent increase year-over-year. This surge has elevated Vietnam to the fourth-largest trade surplus holder with the U.S., following China, the European Union, and Mexico.

As Vietnam strengthens its position as a key manufacturing and export hub, especially in sectors like electronics, textiles, and furniture, concerns are rising over potential trade frictions. U.S. policymakers have signaled possible tariff escalations, viewing the growing imbalance with caution. While this growth underscores Vietnam’s expanding role in global supply chains, it also exposes the country to risks tied to shifting U.S. trade policies, particularly under renewed “America First” rhetoric. These dynamics set the stage for a critical period in Vietnam-U.S. economic relations.

Vietnam’s trade surplus with the U.S. reaches record levels

In 2024, Vietnam’s trade surplus with the United States soared past US$123 billion, marking a nearly 20 percent year-on-year increase. This dramatic growth positions Vietnam as the fourth-largest surplus holder with the U.S., trailing only behind China, the European Union, and Mexico. The key contributors to this surplus include high-demand exports such as consumer electronics, garments and textiles, wooden furniture, and agricultural products.

As global corporations continue diversifying their supply chains away from China, Vietnam has emerged as a strategic alternative, thanks to its competitive labor market, improving infrastructure, and active trade agreements. This upward trajectory underscores Vietnam’s growing influence in the global trade arena, but it also brings the country into the spotlight of American economic scrutiny.

Potential tariff threats cast shadows over Vietnamese export growth

Despite its success, Vietnam now faces rising headwinds from potential U.S. trade policy shifts. American lawmakers, particularly under the influence of former President Donald Trump’s revived protectionist agenda, have floated the idea of imposing “reciprocal tariffs” as high as 46 percent on goods from countries with persistent trade imbalances—Vietnam included. This has raised alarms among Vietnamese exporters, especially those in sectors heavily reliant on the U.S. market.

There is also growing concern that Vietnam could be labeled a currency manipulator or accused of engaging in unfair trade practices, designations that could trigger further punitive measures. For companies operating in Vietnam, such developments could severely disrupt supply chains, raise production costs, and dampen foreign investor confidence. The looming tariff risk places pressure on both governments to navigate the complexities of trade diplomacy, while Vietnamese businesses may need to rethink their U.S.-centric strategies.

Vietnam’s strategic response to U.S. trade pressures

In response to growing trade tensions, Vietnam has begun actively engaging in bilateral dialogues with the United States to maintain a stable and predictable trading environment. Government officials have underscored Vietnam’s willingness to address trade imbalances through cooperation, rather than confrontation. At the same time, Vietnam is diversifying its export destinations by strengthening ties with partners in the European Union, Japan, South Korea, and within major trade agreements such as the CPTPP and RCEP.

To reduce reliance on the U.S. market, the Vietnamese government is ramping up public investment in infrastructure, particularly in logistics and industrial zones. This is paired with an emphasis on developing local supporting industries to enhance value-added production and reduce dependence on imported components. These strategic efforts aim not only to mitigate immediate risks but also to transform Vietnam into a more resilient and self-sustaining manufacturing hub in the long run.

Long-term opportunities in a shifting global landscape

Despite short-term uncertainties, Vietnam stands to benefit from structural changes in global trade. The country is accelerating its transition toward a more sustainable, high-quality economy, emphasizing innovation, green manufacturing, and digital transformation. This makes Vietnam an increasingly attractive destination for foreign direct investment, especially from U.S. companies seeking alternatives to China under the “China +1” strategy.

As global supply chains reconfigure in the wake of geopolitical tensions, Vietnam’s integration into international trade frameworks and its stable political climate enhance its role as a key link in Asia-Pacific production networks. By seizing these opportunities, Vietnam can strengthen its long-term competitiveness and global trade standing.

Conclusion

Vietnam’s growing trade surplus with the U.S. reflects the nation’s rising economic influence, but it also brings strategic challenges. Navigating the fine line between opportunity and risk will require not only diplomatic finesse but also visionary policymaking. In this high-stakes trade environment, Vietnam must act decisively to turn pressure into progress.