Insight:

- The Vietnamese construction materials market has faced many difficulties with a decline in production and consumption of products such as stone, cement, and glass.

- In 2024, the construction materials industry has shown positive progress and is expected to increase in the future.

- The trend of producing construction materials is also changing, towards a greener lifestyle in the future.

The construction materials market experienced a difficult period from 2022 to 2023. However, it has seen positive changes in 2024 and is projected to grow with a CAGR of 8.10% from 2024 to 2028. See the detailed analysis in the article.

Previous challenging context

The construction materials market has undergone continuous changes. After experiencing difficulties due to the economic situation and the Covid-19 pandemic, the industry is now showing more positive signs of recovery. This industry is currently forecasted to have promising prospects for recovery and development after a difficult period.

In 2022, the real estate market faced many difficulties with many projects and construction being delayed. Due to the decrease in production and consumption demand, the construction materials industry was also affected. Many businesses in the construction materials sector incurred losses, product consumption slowed down, and inventory increased significantly, leading many to halt production lines.

According to the report of the Vietnamese Ministry of Construction, cement production in 2023 is expected to be 89.4 million tons, a decrease of about 5.45% compared to 2022. Consumption is also expected to decrease by 6% compared to 2022, reaching about 89 million tons. Domestic cement consumption is about 56.8 million tons, a decrease of 10% compared to 2022.

Not only cement, but many other market segments also declined. Specifically, the consumption of tiles decreased by 25% compared to 2022. Sanitary ware consumption decreased by 25% compared to 2022. Construction glass materials decreased by about 2% compared to 2022. This shows that 2023 was a difficult year for the construction materials market. Businesses were forced to adopt new business strategies to adapt to and cope with this challenging period.

Expectations for improvement

After a rather gloomy 2023, many businesses have taken new directions in 2024 with the expectation of improving the situation. At the end of 2023 and the beginning of 2024, the government took decisive steps to boost public investment. Many key infrastructure projects have been implemented.

In addition, the Vietnamese National Assembly has passed draft amendments related to real estate, which will help to overcome difficulties and have a positive impact on the recovery of the construction materials industry.

Businesses are also gradually changing their business strategies, strengthening marketing, expanding domestic markets and seeking export markets, thereby helping to improve product sales.

Signs of recovery

Thanks to government policies and changes in business strategies, the construction materials market has shown signs of recovery. Public investment is considered one of the main drivers of economic growth and the construction materials industry. According to Statista, Vietnamese wholesaler provide hardware and construction materials market is expected to reach a revenue of 13.19 billion USD in 2024 with an annual growth rate of 2.57% during the period 2024-2028.

Another data from Mordor Intelligence has estimated that Vietnam’s construction market will reach a value of 69.20 billion USD in 2024 and increase to 102.20 billion USD by 2028. The CAGR is also expected to reach 8.10%. This growth is driven by urbanization and increasing infrastructure development.

This shows that the construction materials industry is showing positive signs of recovery and has opportunities for further development in the future.

Barriers to the development of the construction materials industry

The construction materials and real estate industries have a close relationship and form a complete value chain with mutual impacts. Therefore, fluctuations in the real estate market are one of the main factors affecting the construction materials industry. Some key factors affecting the development of the construction materials market are:

Real estate market

The construction materials industry is directly affected by the real estate market cycle. When this market stagnates, the demand for construction materials also decreases, leading to a decline in production and sales.

Financial difficulties of buyers

In the face of a still difficult economic situation and not fully recovering from the pandemic, many people have changed their spending habits and focused on saving. This has become one of the obstacles for construction materials businesses. The imbalance between supply and demand also affects the price of construction materials, causing difficulties for industry.

Intense competition in the market

The construction materials industry is characterized by intense competition, with many domestic and foreign players vying for market share. This hyper-competitive landscape often leads to price wars as businesses strive to undercut rivals, compressing profit margins. Furthermore, the industry’s product homogeneity presents a significant challenge for differentiation.

With many products sharing similar characteristics, creating a unique value proposition that sets a company apart becomes increasingly difficult. This necessitates continuous innovation and investment in research and development to develop distinctive products and services.

High production costs

This is a special industry with high input material costs, which pushes up product prices, making it difficult to attract consumers. In addition to production costs, labor costs are also a big burden on businesses as these costs are also increasing. Another noteworthy expense is energy costs, as they account for a large proportion of total production costs, especially for businesses using kilns.

Environmental issues

Increasingly stringent environmental regulations require businesses to invest more in production technology and equipment to ensure environmental protection. This puts pressure on businesses to invest more in technology.

In addition, the public’s growing concern about environmental issues has forced businesses to change, even in their products, to meet public demands.

Limited capital

Due to the large number of businesses entering the market, small and medium-sized enterprises and new businesses will face many difficulties in accessing loans to invest in expanding production, upgrading technology, and investing in marketing.

In addition, the construction materials industry can face many financial risks, especially risks related to fluctuations in raw material prices, exchange rates, and interest rates.

Shortage of skilled labor

The construction materials industry is also facing a shortage of skilled labor, especially in the fields of engineering and production management due to its special nature.

In addition, the shortage of labor also affects production efficiency, prolongs time and product quality is unstable, causing difficulties in the production process.

Competition from imported products

Imported products have become increasingly diversified, offering a wider range of options to consumers in terms of segments, quality, and design. These products often incorporate advanced technologies and innovative features, presenting a formidable challenge to domestic businesses.

Small and medium-sized enterprises face significant pressure to compete with the superior quality, variety, and often lower prices offered by imported goods. This intense competition necessitates substantial investments in research and development, as well as improvements in production efficiency and marketing strategies for domestic businesses to remain competitive in the market.

Industry prospects

Since the end of 2023, the business situation in the construction materials sector has seen positive changes thanks to the boost in public investment. Projects approved and implemented by the Government have contributed to boosting the demand for construction materials.

In addition, the construction materials industry also has prospects for future development due to the positive trend of urban housing demand. Given the increasing Vietnamese population each year, the demand for housing and real estate projects has increased, boosting the use of construction materials.

At the same time, in the future, the government will promote the development of infrastructure, expanding the highway network. According to the plan, 172 national highways will be built, and the highway and coastal road networks will be oriented, further boosting the demand for construction materials.

Emerging trends in construction materials

The growing emphasis on environmental sustainability is driving significant innovation in the construction materials industry. The industry is witnessing a shift towards sustainable materials such as non-fired bricks.

Four key trends are shaping the future of construction materials: renewable and eco-friendly materials, insulation and cooling materials, materials with enhanced strength and flexibility, and decorative materials.

As sustainability emerges as a critical factor in consumer and regulatory decisions, businesses are under increasing pressure to adopt eco-friendly practices and develop products with minimal environmental impact. This shift towards sustainable operations is driven by a growing awareness of climate change, resource depletion, and the demand for ethical consumption.

To meet these challenges, companies are investing in research and development to create innovative materials that not only perform well but also contribute to a greener planet. These sustainable products are gaining traction in international markets as consumers and governments alike prioritize environmentally friendly solutions.

Efforts of Vietnamese enterprises in expanding the market

Faced with many challenges, exporting domestic materials is essential. Many enterprises are striving to export their products but face various challenges. These include difficulties in obtaining permits, language barriers, and complex transportation processes.

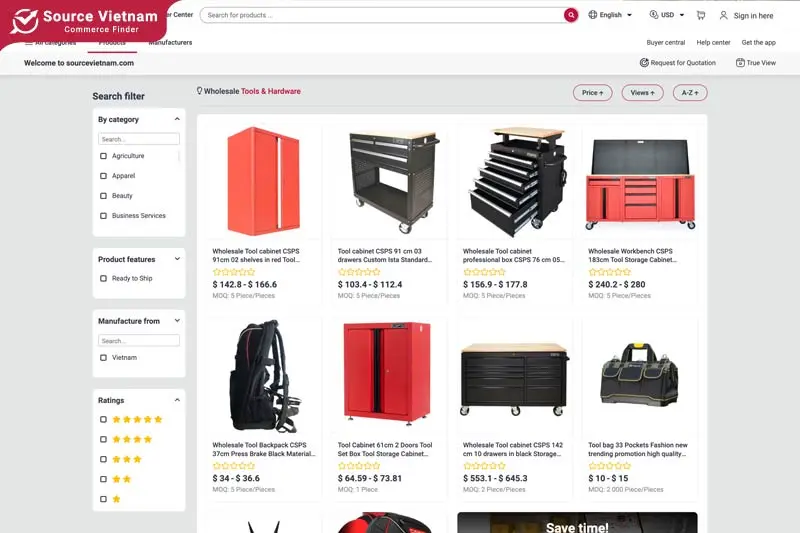

Understanding these difficulties, SourceVietnam is one of the platforms that strives to bring domestic products closer to the international market, not only construction materials but also all products traded on the market.

Connecting with export support platforms like SourceVietnam is an optimal solution to make it easier for businesses to export. In addition to being supported in posting products, converting product information into multiple languages, and being supported in transportation, the platform also helps businesses have more new business opportunities. This will be one of the solutions that Vietnamese building materials manufacturer and construction material businesses need to pay attention to.

Conclusion

Although going through difficult times and facing many challenges, the Vietnamese construction materials industry can still rise strongly and find new opportunities. Among them, export plays an important role in expanding the market and finding more customers. One of the effective export solutions is to use the SourceVietnam platform to find new opportunities.