Insight:

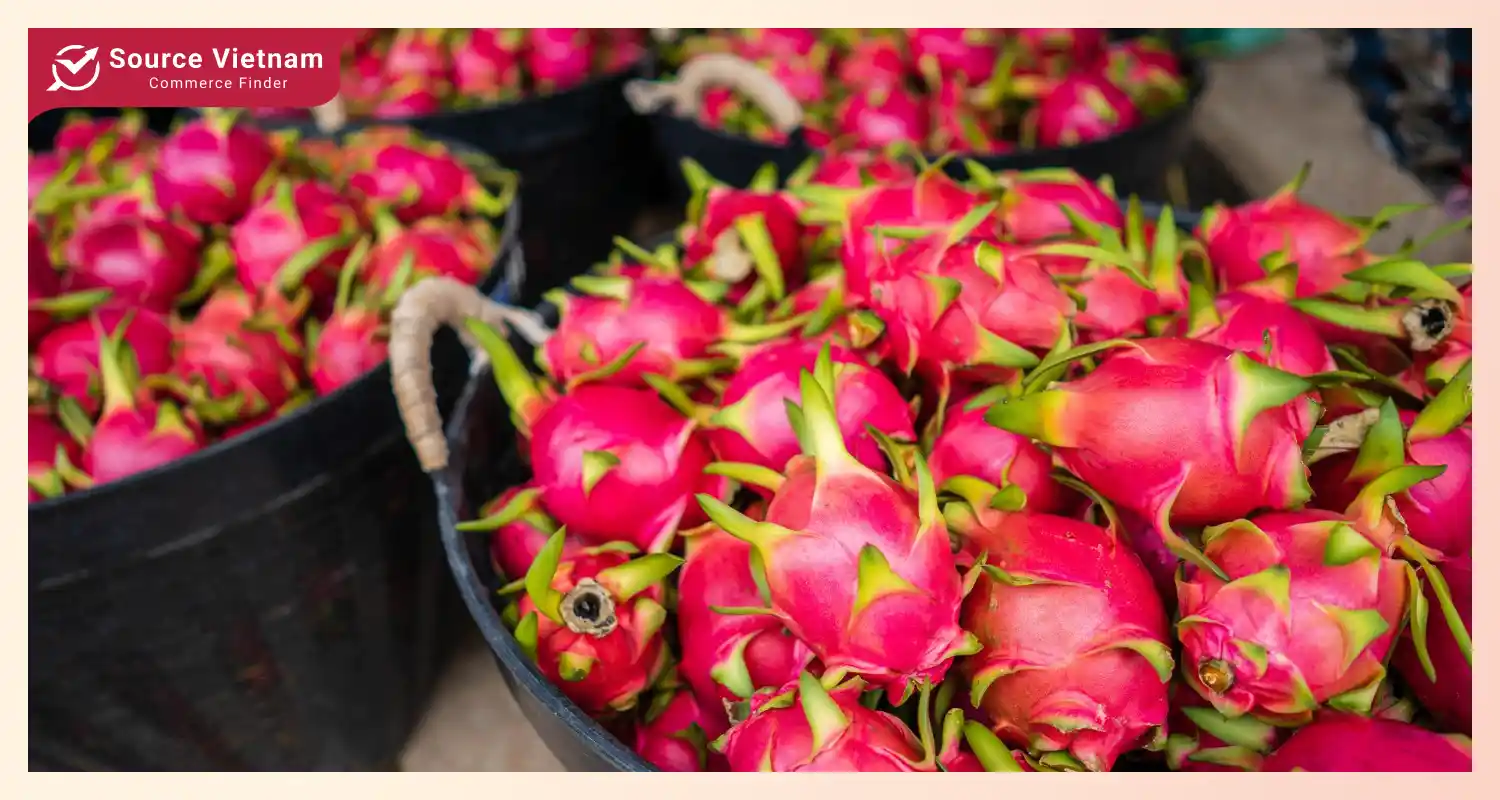

- Dragon fruit is becoming a popular choice worldwide due to its nutritional benefits.

- Vietnam is a leading exporter of dragon fruit, but has been dealing with challenges recently.

The dragon fruit market is experiencing significant growth due to the increasing demand from consumers. Driven by media and social media, people in European countries are increasingly eager to try this unique tropical fruit. Although temporarily disrupted by the Covid-19 pandemic, the supply chain has gradually recovered.

The dragon fruit market is estimated to reach $14.73 billion in 2024 and is projected to reach $18.27 billion by 2029, with a compound annual growth rate (CAGR) of 4.40% during the 2024-2029 period.

In terms of consumer demand, consumers are focusing on investing in healthy products with a longer shelf life, leading to a decrease in demand for fruits like dragon fruit in Asian countries such as China. However, after the pandemic, the dragon fruit market has finally shown signs of recovery.

Currently, the market for this fruit is developing rapidly, and demand is increasing. In Europe, although dragon fruit is relatively new and not widely advertised, it is still a promising market with many consumers.

Health-conscious consumers are increasingly demanding dragon fruit, particularly in the United States. Dragon fruit is available year-round in the US, but it is also imported from several other countries.

Because dragon fruit is considered a specialty product, the maximum residue limits (MRLs) for dragon fruit in the US are significantly different from those of traditional products like apples or cherries. Only about 13 chemicals can be used on the fruit for supply to the United States.

The Asia-Pacific region is the leading market for dragon fruit

Regarding dragon fruit, the Asia-Pacific region, specifically Vietnam, China, and Indonesia, are the largest producers (as of the time of writing). Vietnam alone has contributed more than 50% of the global dragon fruit production and a significant portion of other fruits.

In Asia, Vietnam is the leading supplier to the Chinese market, but other markets like ASEAN and Hong Kong have become more competitive due to countries like Taiwan, Thailand, and Malaysia. Additionally, Asia not only leads in production but is also the largest consumer market for dragon fruit, especially within the Chinese community. China is the largest dragon fruit consumer in Asia and the world currently.

Dragon fruit demand in Indonesia, Singapore, Thailand, and the Philippines has also been increasing in recent years. Other Asian countries like Japan, Korea, etc., have also shown growing interest in this fruit. In South Africa, dragon fruit has become a popular fruit, although the market is still relatively young.

Dragon fruit is also one of Vietnam’s prominent export fruits

Dragon fruit is high in water content and rich in nutrients such as iron, magnesium, vitamin B, phosphorus, protein, calcium, and fiber. It is also a low-calorie fruit, high in fiber, and vitamins, and has been proven to reduce the risk of cardiovascular disease. Due to these benefits, consumers have changed their eating habits, leading to an increased demand for dragon fruit, especially in the Chinese market.

According to the Vietnamese Ministry of Industry and Trade, 80% of dragon fruit grown in Vietnam is exported to China. Another impressive figure is that up to 99% of dragon fruit in the Chinese market is imported from Vietnam. This makes China a potential market for exporting dragon fruit and other fruits from Vietnam.

In Vietnam, the total area of dragon fruit cultivation was about 55,000 hectares in 2019, with white-fleshed varieties accounting for more than 95% of the output, followed by red-fleshed varieties at 4.5%. Dragon fruit is mainly grown in Binh Thuan, Long An, and Tien Giang provinces, with over 48,000 hectares dedicated to annual production. However, recently, dragon fruit production in Vietnam has faced many difficulties, including the impact of climate change and the emergence of diseases.

Recently, Vietnam has signed a free trade agreement with the European Union, known as the EU-Vietnam Free Trade Agreement (EVFTA). This agreement allows Vietnamese imports to be traded almost duty-free and allows them to control the import price of red-fleshed dragon fruit in the region. Therefore, it is expected that Vietnam’s exports of red-fleshed dragon fruit to the European Union will increase rapidly in the forecast period.

According to dragonfruit.net.vn, Vietnam is currently the world’s largest supplier of dragon fruit, holding the highest market share in Asia, Europe, and sometimes even in the US. Meanwhile, Thailand and Israel are the second and third largest suppliers in the European market.

In the US, Mexico and other Central and South American countries are the biggest competitors for Asian dragon fruit suppliers due to geographical advantages. Among them, Colombian yellow dragon fruit is highly valued for its flavor and appearance, as they are the sweetest and most vibrant of all dragon fruit varieties. This type of dragon fruit also has a different harvest season compared to Vietnamese dragon fruit, usually from November to February each year.

According to US consumer websites, Vietnamese red dragon fruit is generally larger than other types of dragon fruit, with a beautiful and impressive appearance, but it is paler, less crisp, and not as sweet as yellow dragon fruit. However, Vietnamese red dragon fruit is still considered to have a superior flavor compared to other red dragon fruit varieties.

Asia remains the largest and most receptive market for Vietnamese dragon fruit, especially among the Chinese community, due to the belief in the good luck brought by the name, shape, and color of the dragon fruit.

In Asia, Vietnam is the leading supplier to the Chinese mainland market, but in other markets like ASEAN and Hong Kong (China), Vietnamese dragon fruit is facing tough competition from countries and territories such as Taiwan (China), Thailand, and Malaysia.

Dragon fruit is facing intense competition

Although leading the world in dragon fruit acreage and production, and ranking second in export value, Vietnam’s dragon fruit exports have declined sharply in recent years, facing competition from China, India, and Mexico.

This poses significant challenges, forcing Vietnam to adopt competitive measures and adapt to climate change. Vietnam needs to develop close cooperation and linkages along the value chain (including farmers, cooperatives, enterprises, and distributors), access export markets, and mitigate market and production risks.

The transformation requires a modern management system, promoting transparency through digital transformation in the production process, adhering to quality standards, and product traceability, including new jobs. Three key factors need to be focused on for the sustainable development of Vietnamese dragon fruit:

- Maintaining a competitive advantage must first focus on quality over quantity. Emphasis should be placed on applying innovative and environmentally friendly production techniques.

- The market should be the focus on adjusting production to suit export market demand, achieve sustainable production certifications, and establish an electronic traceability system.

- Environmentally friendly methods should be applied to adapt to climate change in production to meet the world’s growing demand for sustainable food and reduce carbon emissions. These methods will reduce resource consumption, increase fruit quality, and optimize economic value throughout the supply chain.

Conclusion

Beyond fresh dragon fruit exports, Vietnamese businesses are diversifying their product lines to include processed products like dragon fruit juice and dried dragon fruit. Additionally, research is underway to develop dragon fruit-based beauty products, expanding the fruit’s market potential. Stay tuned to our blog for more updates.