Insight:

- The market was USD 259.04 billion in 2023 and will reach USD 379.76 billion by 2032.

- Asia Pacific’s share was 35.88% in 2023, and the US is projected to reach USD 85.22 billion by 2032.

Market overview

In 2023, the worldwide market for household maintenance products was worth 259.04 billion dollars. It is forecasted 2024 to attain 270.36 billion dollars, while in 2032, its value is anticipated to come to 379.76 billion dollars. During the period, the market will expand by 4.4% CAGR.

The Asia Pacific region held a considerable market share of 35.88% in 2023. In the US, however, the market size is anticipated to reach an extraordinary size of 85.22 billion USD by 2032. The pressure for safe and environmental homecare products drives this growth.

What are household cleaning products?

Household cleaning products are items designed for cleaning and maintaining homes. They are used for surfaces like floors, kitchens, bathrooms, and furniture. These products include liquids, sprays, powders, wipes, and gels. They help remove dirt, stains, and germs, leaving surfaces clean and sanitized.

The impact of COVID-19

The pandemic boosted demand for cleaning products. People became more focused on hygiene. Manufacturers faced supply chain issues like raw material shortages and distribution delays. Some products experienced price increases due to limited availability. As demand stabilizes post-pandemic, awareness of cleaning products is expected to drive long-term growth.

Key trends in the market

Transparency in ingredients:

Consumers demand transparency about product ingredients. Many companies now display detailed ingredient lists. This builds trust and boosts sales.

Rising demand for natural products:

Consumers prefer eco-friendly and skin-safe products. Natural cleaning solutions are in demand due to environmental concerns. This trend is reshaping the market.

Convenience and urbanization:

Busy lifestyles lead to a higher demand for easy-to-use cleaning solutions. Compact, multi-functional products are popular among urban dwellers.

Challenges in the market

Lack of customer retention: Consumers often switch brands, making it hard to build loyalty.

Limited product differentiation: Smaller manufacturers struggle to keep up with changing trends. This limits their growth.

Market segmentation by product type

- Laundry detergents: The most active segment in 2023 is. Detergents are mostly employed to enhance the cleanliness of garments. Growth is fueled by innovative products like Unilever’s laundry capsules centered on reducing carbon emissions.

- Surface cleaners: The forecast period will see the slowest increase of 4.9% CAGR

- Dishwashing products and toilet cleaners: These segments are also growing, driven by product innovations that enhance performance.

Regional insights

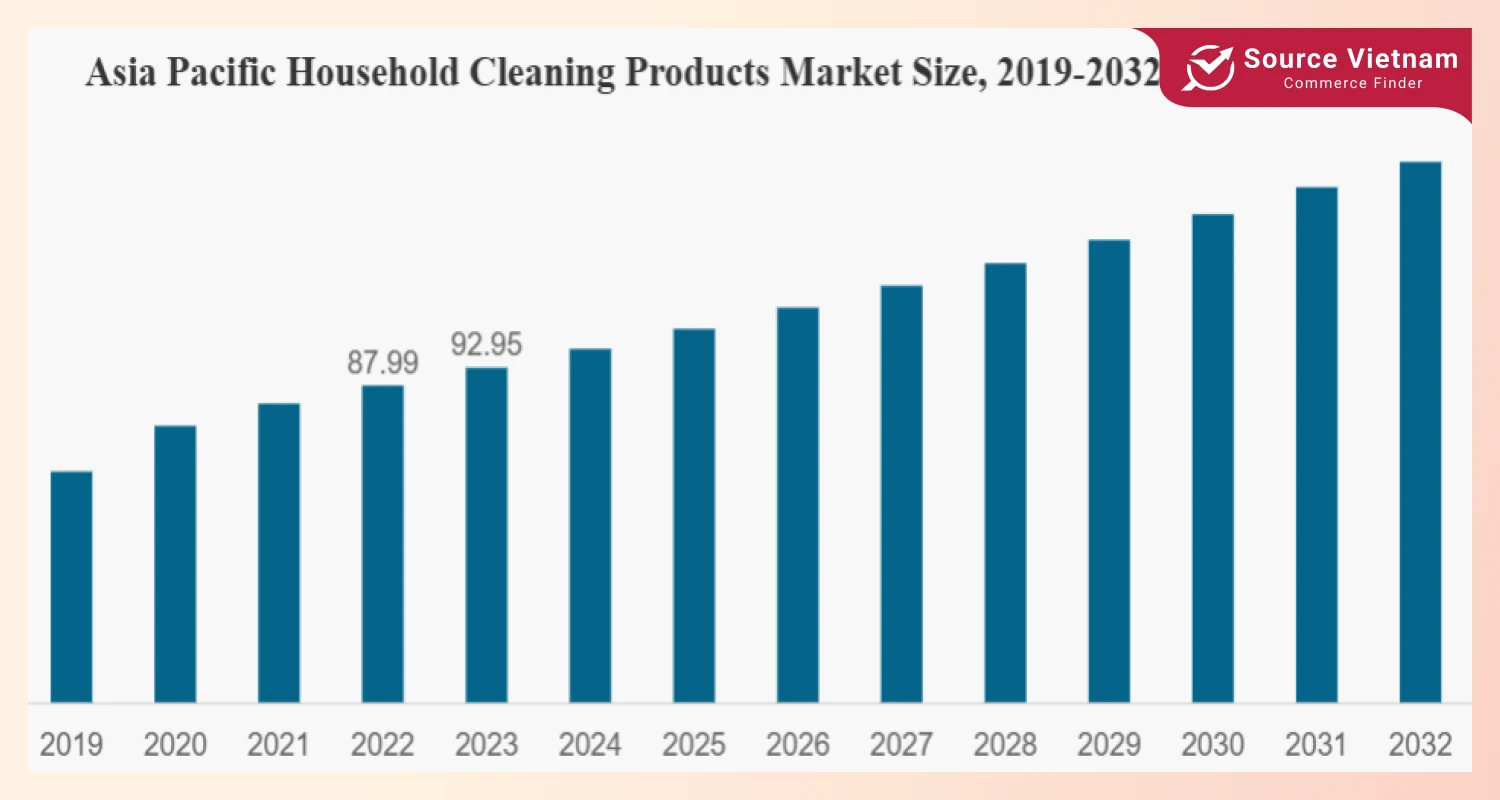

- Asia Pacific: Expected to be valued at 92.95 billion US dollars by 2023. This region is in the lead as it has the greatest population and increasing disposable incomes of the members. Consumers are shifting to bio-friendly products. For instance, Proklean Technologies launched green floor cleaners in India.

- North America: A significant market due to environmental concerns. The U.S. is the largest consumer in the region.

- Europe: Growth is slower but steady. Companies focus on environment-friendly innovations to meet strict regulations.

- Middle East & Africa: Urbanization and population growth are driving demand. The region is expected to grow rapidly by 2050.

- Latin America: Growth is gradual, with Brazil predicted to lead the region due to rising awareness about home hygiene.

Key players in the market

- Church & Dwight Co. Inc. (US.)

- Colgate-Palmolive Co. (U.S.)

- Godrej Consumer Products Ltd. (India)

- Henkel AG & Co. KGaA (Germany)

- Kao Group (Japan)

- The Procter & Gamble Co. (US.)

- Reckitt Benckiser Group Plc. (U.K.)

- S. C. Johnson & Son Inc. (US.)

- Goodmaid Chemicals Corporation (Malaysia)

- Unilever NV (U.K.)

Key developments

- Jan 2023: Henkel and Shell Chemical joined forces to save 200,000 tons of crude oil using renewable raw materials in surfactants.

- Mar 2022: Through a partnership with BASF, Henkel achieved a reduction of 200,000 tons of CO2 emissions every year.

- Dec 2021: Unilever presented dishwashing liquid with all naturally obtained materials.

- Apr 2021: Unilever launched the first industrial carbon kitchen capsule in the world for laundry powder.

Conclusion

The household cleaning products segment is changing fast due to technological advancements, increased concern for the environment, and the growing need for easier solutions. Asia Pacific occupies the leading position in the market, whereas North America and Europe seek natural derivatives. The segment will maintain healthy growth rates in the future with an emphasis on the openness, naturalness, and ecological security of the products.