Key takeaways:

- Reinstated steel/aluminum tariffs and potential reciprocal tariffs threaten Vietnamese export competitiveness.

- Vietnam’s large US trade surplus makes it a target for further US trade measures.

- Vietnam must diversify its export markets to reduce reliance on the US.

- Enhancing domestic industry competitiveness and addressing non-tariff barriers are vital.

- Ongoing communication and negotiation with the US are necessary to navigate trade challenges.

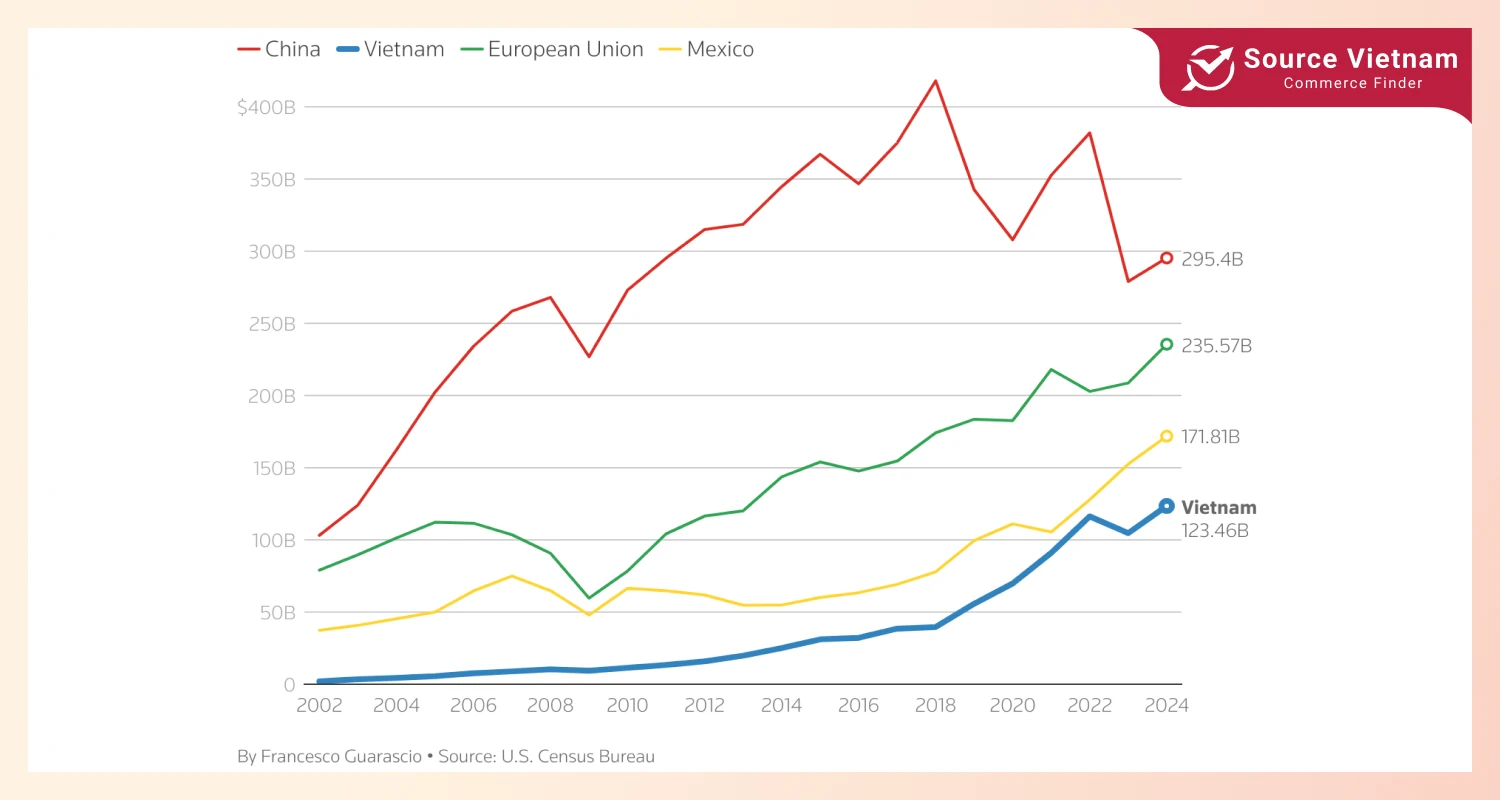

The return of Donald Trump to the US Presidency in 2025 has triggered a recalibration of global trade dynamics, with Vietnam, a pivotal player in the US supply chain, facing heightened uncertainty.

Trump’s February trade policy announcements, echoing the protectionist stance of his prior term, herald a renewed focus on domestic industrial resurgence.

It necessitates a critical analysis of the evolving US-Vietnam trade relationship, particularly in light of Vietnam’s substantial trade surplus and the potential for targeted trade measures.

Key tariffs affecting Vietnamese exports

Steel and Aluminum tariffs reinstituted

On February 10, 2025, Trump reinstated a 25% tariff on all steel imports and raised aluminum tariffs from 10% to 25%. Effective March 12, 2025, these measures apply globally without exception. The reasoning stems from the administration’s assessment that previous exemptions and alternative agreements diluted the intended protective effects of the 2018 tariffs.

While some countries received exemptions in the past, Vietnam never did, meaning its steel and aluminum exports were already subject to these duties. The latest increase in aluminum imports from 10% to 25% adds additional pressure, while steel tariffs remain unchanged.

Reciprocal tariff plan introduced

On February 13, 2025, Trump signed a memorandum instructing officials to develop a reciprocal tariff plan. This initiative addresses imbalances in tariff structures, non-tariff trade barriers, and currency-related policies among US trade partners. Under this framework, the US intends to match tariffs other countries impose on American goods, potentially increasing tariff rates on Vietnamese exports.

For instance, Vietnam’s trade-weighted average tariff is 5.1%, compared to the US’s 2.2%. If the US implements a strict reciprocal tariff policy, Vietnamese goods entering the US market could face higher tariff barriers.

Analyzing US-Vietnam trade in 2024

In 2024, the US maintained its position as Vietnam’s second-largest trade partner, with bilateral trade reaching $149.6 billion, a 20.4% increase from the previous year. Vietnam became the US’s sixth-largest import source, driven by strong electronics, machinery, furniture, footwear, and apparel exports.

This culminated in a record trade surplus of $123.5 billion for Vietnam, a critical point of concern for the Trump administration.

Vietnam’s export composition to the US underscores its role as a key manufacturing center. Electronics and machinery, encompassing smartphones, computers, and components, constitute a significant portion of the trade. Furniture, footwear, and apparel reflect Vietnam’s competitiveness in labor-intensive sectors.

However, while increasing by 33.1% to $13.1 billion, US exports to Vietnam remain substantially lower. Key US exports include electronics, plastics, agricultural goods, and machinery. This trade disparity forms the basis of Trump’s concerns and fuels his push for reciprocal trade measures.

Major US imports from Vietnam (2024):

- Electrical machinery: $41.7 billion

- Nuclear reactors and machinery: $28.8 billion

- Furniture and bedding: $13.2 billion

- Footwear: $8.8 billion

- Apparel: $8.2 billion

Navigating existing tariffs: Steel and Aluminum sector impacts

Vietnam’s steel exports to the US surged by 143.4% in 2024, reaching 1.2 million metric tons. Given that Vietnamese steel was already subject to a 25% tariff, the current measures are unlikely to cause a significant change in export volumes. The uniform 25% tariff could benefit Vietnamese exporters by eliminating prior exemptions that competitors enjoy.

However, the aluminum sector faces more significant challenges. The 15-percentage-point tariff increase and a slight drop in 2024 export volumes could impede future growth. Moreover, the global steel and aluminum markets are set for disruption as major US suppliers seek alternative markets, increasing competition for Vietnamese exports.

The impact of these tariffs extends beyond direct trade flows. They also affect investment decisions and supply chain strategies. Companies dependent on steel and aluminum inputs may reassess their sourcing, potentially diverting investment from Vietnam.

Identifying flashpoints: The implications of reciprocal tariffs

The “Fair and Reciprocal Plan” presents a broader threat to Vietnamese exports beyond the steel and aluminum sectors. Vietnam’s higher trade-weighted average tariff compared to the US indicates that reciprocal tariffs could significantly increase the cost of Vietnamese goods entering the US market, potentially reducing their competitiveness.

Beyond tariffs, non-tariff barriers are a significant concern. Past US allegations of currency manipulation against Vietnam, despite resolutions under the Biden administration, could resurface. Similarly, the unresolved Section 301 investigation into Vietnam’s timber imports may be revived, potentially resulting in additional duties.

The plan’s focus on “unfair, discriminatory, or extraterritorial” taxes also scrutinizes Vietnam’s 10% VAT. Trump’s administration could argue that this tax unfairly burdens US businesses in Vietnam, potentially leading to retaliatory measures.

Strategic trade shifts: Beyond current tariff policies

Vietnam’s significant trade surplus and growing importance as a US import source make it a possible target for country-specific tariffs. Trump’s focus on trade imbalances suggests that additional measures could be enacted to address this issue.

The US’s ongoing classification of Vietnam as a non-market economy (NME) provides a legal basis for imposing antidumping and countervailing duties. It could target specific Vietnamese industries deemed to be unfairly competing with US producers.

Additionally, Vietnam’s potential role as a conduit for Chinese re-exports, aimed at circumventing US tariffs, adds complexity.

Trump’s administration will likely crack down on these practices, potentially affecting Vietnamese exporters.

Building resilience: Vietnam’s strategic options

Vietnam faces a complex and uncertain trade environment. To navigate the challenges posed by Trump 2.0, a multifaceted strategy is essential:

- Diversification of export markets: Reducing reliance on the US market by pursuing opportunities in other regions.

- Enhancement of domestic industries: Increasing competitiveness through investments in technology, innovation, and workforce development.

- Addressing trade disparities: Increasing US imports and facilitating greater market access for US businesses.

- Diplomatic engagement: Maintaining open communication with the US to address trade concerns and build trust.

- Regulatory compliance: Ensuring adherence to US trade regulations and addressing potential non-tariff barriers.

By adapting to these evolving trade dynamics, Vietnam can secure its export sector and maintain its role in the global economy.