Insight:

- Vietnam’s e-commerce market is experiencing significant advancements in 2024.

- Shifting consumer behaviors among Vietnamese consumers are driving the surge in online shopping.

Despite global economic slowdown, Vietnam’s e-commerce sector continues to thrive, presenting unique opportunities for both investors and businesses. Below are the reasons why Vietnam remains a promising market in 2024.

Overall context

Since 2022, the global economic landscape has darkened significantly as inflation has soared and geopolitical tensions have escalated. These uncertainties have had a profound impact on business operations, particularly for e-commerce giants. Many leading companies have been forced to adjust their strategies, downsize operations, or even withdraw from certain markets to cope with the challenging conditions.

However, while developed markets are experiencing a downturn, emerging markets like Vietnam are demonstrating remarkable vitality. With a young population, a burgeoning middle class, and a rapid increase in internet usage, Vietnam has become an attractive destination for e-commerce businesses.

According to industry analysts, Vietnam’s e-commerce sector continues to be driven by several key factors, including: the development of logistics infrastructure, the growth of electronic payment methods, and strong government support. These factors have created a favorable business environment, attracting investments from both domestic and international enterprises.”

Vietnam’s E-commerce sector continues to thrive

In 2024, Vietnam’s e-commerce sector remains vibrant, driven by increasing consumer demand and rapid digital adoption. Despite a global revenue decline in 2022, Vietnam’s e-commerce market exhibited only slower growth rather than a full-scale contraction. The Ministry of Industry and Trade (MOIT) forecasts that the sector will continue to grow steadily, albeit at a more moderate pace, reaching a 9% growth rate by 2025.

Looking ahead, global e-commerce revenue is projected to recover, with Statista forecasting a compound annual growth rate (CAGR) of 9.49% from 2024 to 2029. Vietnam is poised to benefit from this global resurgence, with its market expected to reach a value of US$32 billion by 2025. Major investors like Alibaba and SBI Holdings are already betting on this growth by investing heavily in Vietnam’s leading e-commerce platforms.

Vietnam surpasses Philippines to become Southeast Asia’s third largest E-commerce market

Vietnam and Thailand have emerged as the fastest-growing e-commerce markets in Southeast Asia, with Vietnam overtaking the Philippines to become the region’s third-largest market. The top eight e-commerce platforms in Southeast Asia achieved a combined Gross Merchandise Value (GMV) of $114.6 billion in 2023, a 15% increase year-over-year. Vietnam’s GMV surged by 52.9%, the highest growth rate globally.

Indonesia remains the largest e-commerce market in ASEAN, contributing 46.9% of the region’s GMV. Shopee dominates the market with a GMV of $55.1 billion, while TikTok Shop has emerged as the second-largest platform in Southeast Asia and holds a 24% market share in Vietnam. Key drivers of the industry include the effective use of key opinion leaders (KOLs) in e-commerce, the application of AI to enhance user experience and operational efficiency.

During the pandemic, Vietnamese consumer spending shifted towards food and personal care products, with consumer goods becoming the largest e-commerce category in 2022. This trend has continued, indicating sustainable growth in online grocery shopping and the broader e-commerce industry.

Vietnam’s E-commerce Spending Trends

A report by Vietnam News Agency, citing market research firm Metric, highlighted the significant growth and potential of Vietnam’s e-commerce market in the first half of 2024. Vietnamese consumers spent 143.9 trillion Vietnamese Dong (equivalent to 5.68 billion USD) on e-commerce platforms in the first half of the year. This spending represents a value growth of 54.91% and a quantity growth of 65.55% compared to the same period last year.

TikTok Shop and Shopee were the key drivers of this growth, with revenue increases of 150.54% and 65.96%, respectively. This robust growth underscores Vietnam’s solid e-commerce market and the ability of sellers to capitalize on online shopping trends. Vietnam’s e-commerce market has seen an average annual growth rate of 16-30% over the past four years, the highest in Southeast Asia.

Vietnam’s digital generation: The primary driver of E-commerce

Vietnam’s e-commerce industry is propelled by a young, tech-savvy population. As of 2024, approximately 57 million Vietnamese consumers engage in online shopping, with 43% belonging to Generation Z. These digital natives are pushing the boundaries of online shopping, with platforms like Shopee, Lazada, Tiki, and TikTok Shop leading the charge.

The rise of social commerce, particularly on platforms like TikTok, is reshaping the e-commerce landscape. In 2024, TikTok Shop captured 23.2% of Vietnam’s e-commerce market share, underscoring the growing importance of social media in driving online sales.

- Generation Z: Born between the mid-1990s and early 2010s, Gen Z is known for their innate ability to use technology and their high demand for online consumption.

- TikTok Shop: As an emerging e-commerce platform, TikTok Shop allows users to directly purchase products featured on the platform.

- Online shopping trends: In addition to using traditional e-commerce platforms, Vietnamese people are increasingly favoring shopping on social media and messaging apps.

- Challenges and opportunities: Although Vietnam’s e-commerce sector is thriving, there are still many challenges to be addressed, such as ensuring transaction security, developing logistics infrastructure, and improving customer service quality.

With the rapid advancements in technology and the evolving preferences of Vietnamese consumers, the e-commerce sector in Vietnam is poised for continued robust growth in the coming years.

Moreover, the rise of social commerce, driven by platforms like TikTok and Facebook, has presented new opportunities for businesses to engage with consumers and drive sales. This trend has been particularly successful in reaching younger demographics, who are increasingly comfortable with shopping directly through social media channels.

E-commerce is overtaking traditional retail

Rapid urbanization and the increasing popularity of online shopping are diminishing the role of traditional retail in Vietnam. The convenience and cost-effectiveness of e-commerce are making large shopping malls and retail stores less relevant. McKinsey & Company predicts that by 2025, Vietnam’s e-commerce market could rival traditional retail, a trend not commonly seen elsewhere in the world. E-commerce offers a multitude of compelling benefits to consumers, including:

- Convenience: Consumers can shop anywhere and at any time.

- Product variety: E-commerce platforms offer a wide range of products and services.

- Competitive pricing: Prices are often more competitive compared to traditional stores.

- Reviews and comparisons: Consumers can read product reviews and compare prices between different suppliers.

Leading E-commerce platforms in Vietnam

In 2024, Shopee continues to dominate Vietnam’s e-commerce market, capturing a substantial 67.9% of the market share based on Gross Merchandise Value (GMV). Despite being a relatively new entrant, TikTok Shop has rapidly gained traction, securing a significant portion of the market.

Other platforms such as Lazada and Tiki are facing intensified competition, with their market shares shrinking due to TikTok’s rapid growth. However, Vietnam’s e-commerce landscape remains dynamic, presenting ample opportunities for both new entrants and established players to innovate and carve out market share.

A recent report revealed that TikTok Shop has significantly increased its market share in Vietnam, surpassing Lazada to become the second-largest e-commerce platform after Shopee. The rapid growth of TikTok Shop is driven by its ability to reach a younger demographic and the increasing trend of social commerce.

Beyond international platforms, several domestic e-commerce platforms in Vietnam are also thriving, including Sendo and Voso. These platforms focus on providing personalized user experiences and supporting small and medium-sized enterprises.

Challenges and opportunities

The e-commerce landscape in Vietnam has become increasingly competitive, with a proliferation of new platforms and escalating rivalry among existing players. This heightened competition has ignited a price war, as companies strive to attract customers with lower prices and attractive promotions.

The influx of new entrants, often backed by significant investments, has disrupted the market dynamics and forced established players to adapt or risk losing market share. This competitive pressure has led to a race to the bottom in terms of pricing, potentially squeezing profit margins for all participants.

- Regulatory uncertainty: Vietnam’s evolving e-commerce regulations pose significant challenges for businesses and create potential risks for consumers.

- Generational shopping habits: While younger consumers are driving e-commerce growth, older demographics remain less comfortable with online shopping, limiting market penetration.

- Talent shortage: The sector faces a shortage of skilled professionals with the expertise required to compete on a global scale.

- Developing logistics infrastructure: Vietnam’s logistics and warehousing infrastructure is still under development, presenting both challenges and opportunities for early investors. This directly impacts the challenges faced by sellers in parcel delivery services.

The emergence of numerous new platforms is driving export growth

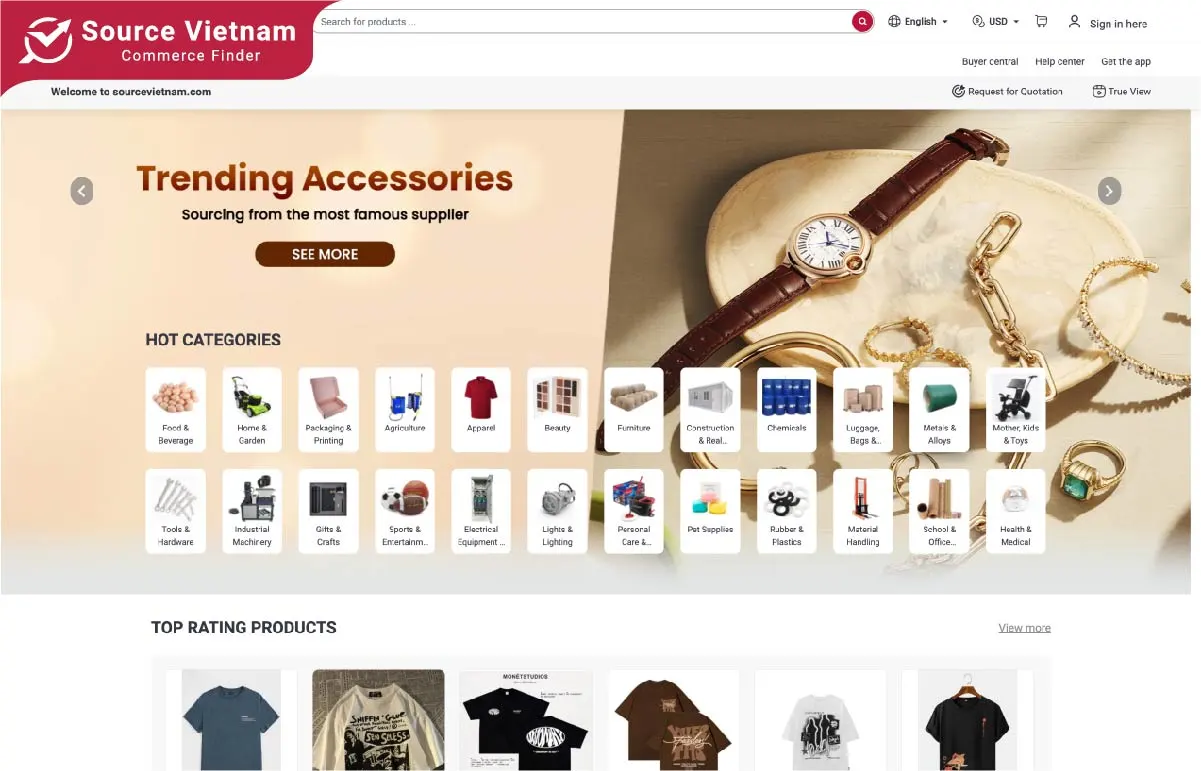

Alongside the development of e-commerce platforms, the Vietnamese market is also witnessing the emergence of many promising export platforms. SourceVietnam.com is a B2B (Business-to-Business) e-commerce platform specifically designed to connect Vietnamese businesses with global importers.

This platform acts as a bridge, helping Vietnamese businesses to access international markets more easily, expand their customer network, and enhance their competitiveness. Advantages SourceVietnam.com brings to Vietnamese trade:

- Enhanced global market access: SourceVietnam.com enables Vietnamese businesses to expand their market reach, mitigate risks, and enhance competitiveness.

- Cost savings: The platform helps businesses save costs on marketing, advertising, and customer acquisition.

- Improved brand reputation: SourceVietnam.com assists businesses in building a professional and trustworthy image in the international market.

With these outstanding advantages, SourceVietnam.com promises to become one of the leading platforms to promote Vietnam’s exports, contributing to bringing Vietnamese products to consumers worldwide.

Conclusion

As the global e-commerce market recovers, Vietnam is poised to emerge as a key regional player, presenting significant opportunities for businesses capable of navigating its unique market dynamics. While not immune to global trends, Vietnam’s e-commerce sector demonstrates resilience and is primed for sustained growth, making it a compelling market to watch in 2024 and beyond.