Insight:

- The Vietnamese plastics market is booming thanks to rising consumer demand and growth in various industries, creating many opportunities for bioplastics and new technologies.

- This industry faces pollution, price fluctuations, and tough competition, requiring innovation and sustainable development.

Rising demand for plastics

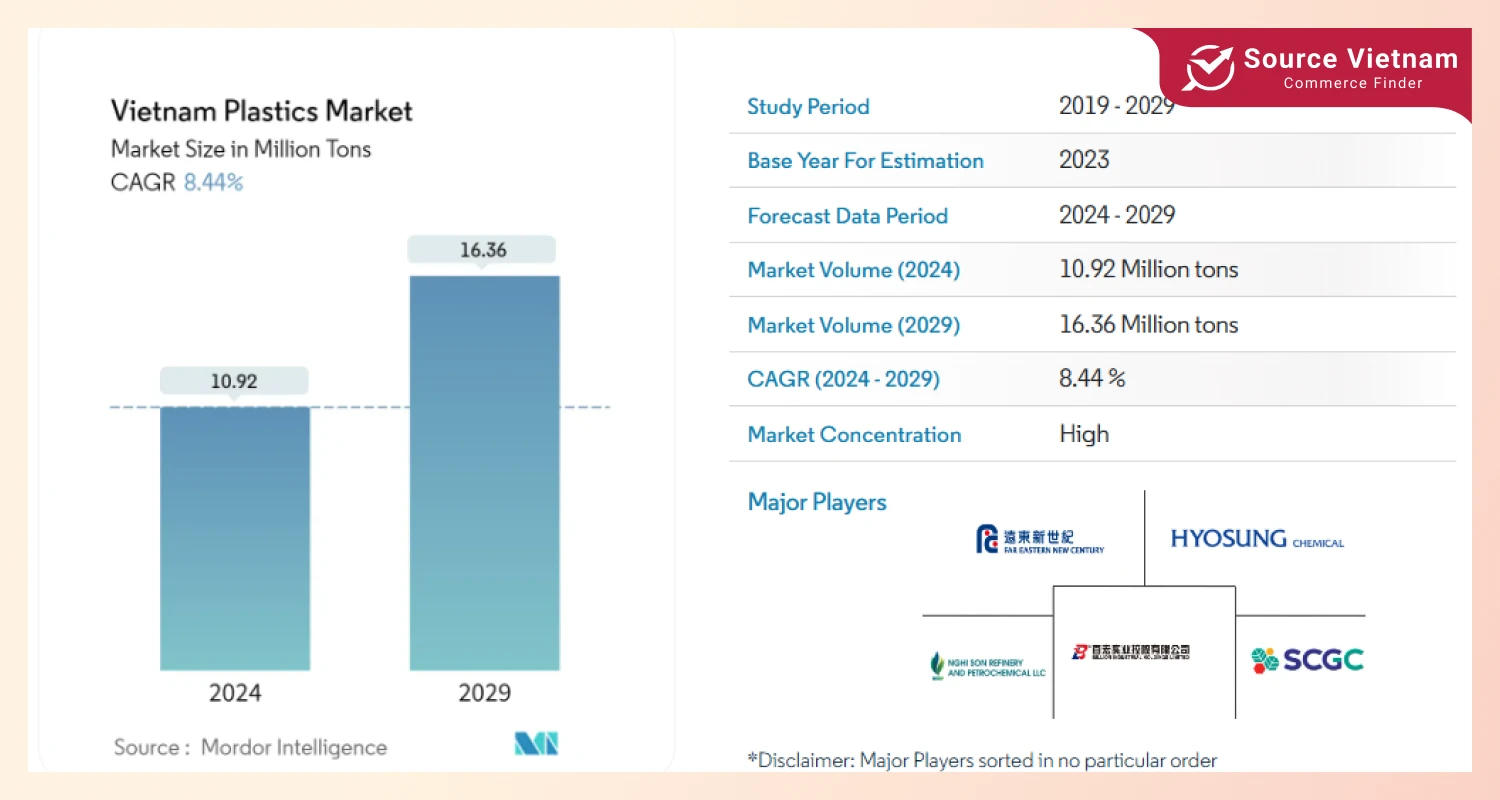

Vietnam’s plastics market is a real hotshot and a potential area for growth in Southeast Asia. As per Mordor Intelligence, the market will grow to 10.92 million tons in the year 2024, and it is expected to reach 16.36 million tons at the end of 2029, with an annual growth rate of 8.44% from 2024 to 2029.

The year 2023 witnessed rough waters for the plastic industry of Vietnam, as it reported a 5.7% decline in exports compared to 2022 levels. This industry recorded a $25 billion turnover, a slight dip of 0.7% from the previous year. In the first quarter of 2024, revenue declined to VND 13.7 trillion, down 13% from last year.

What’s behind this strong growth? It’s mainly thanks to Vietnam’s growing economy. This steady growth boosts plastic demand in many areas, like packaging, construction, electronics, and cars. Plus, a big jump in foreign investment (FDI) has helped manufacturing and processing industries take off, which means they need even more plastic.

Also, Vietnam has a young population with rising incomes, and cities are growing fast, all of which means people are buying more stuff made of plastic. And finally, all the new infrastructure projects are a big deal, too, because they use tons of plastic for buildings and pipes.

The rise of Extrusion technology

In Vietnam, extrusion is used to make all sorts of things like PVC pipes, PE pipes, pipes made of both aluminum and plastic, fibers, PVC doors and frames, roofing, and wall coverings. Extrusion is cheaper to do and gets up and running faster. But it’s not super precise and works best for simple shapes, not complicated ones.

You’ll find this technology used in construction, making things like PVC, HDPE, PPR pipes, plastic profiles, plastic windows and doors, wall panels, and even furniture.

In 2020, there was a plan to shake up the plastics industry, shifting away from packaging and everyday plastic stuff and focusing more on plastics for building and other technical uses.

Currently, plastics used for construction comprise about a quarter of all the plastic made in Vietnam. And with the building and real estate sectors growing, there’s a bigger need for these construction plastics.

On top of that, the government wants to build a million affordable homes in over 350 industrial zones. All these new infrastructure projects and more factories being built are pushing up demand for plastics used in construction and engineering.

Vietnam plastics market opportunities

Looking ahead to 2025, the Vietnamese plastics market is set to keep growing thanks to rising demand from many important industries. Packaging, driven by food, drinks, everyday goods, and online shopping growth, will be a big reason for this.

Further, with all new developments and infrastructure, buildings, and the increasing number of vehicles and electronics, the growth of agriculture and health sectors creates an enormous demand for all types of plastics, be they basic, high technology, or more specialized.

The transition toward more sustainable options creates enormous potential for bioplastics and recycled plastics. The Vietnamese government encourages green products, and with people increasingly concerned about sustainability, the market for greening becomes more and more appealing. This is making companies invest in ways to make bioplastics and recycle plastic, which is opening up a really promising market.

Using new tech for making, recycling, and removing plastic waste will be super important for this industry’s growth. Modern ways of making things, better recycling, and new ways to handle waste will make production more efficient and less polluting and lead to better quality and higher-performing products. On top of that, using AI and IoT can also help make things run smoother and improve how the whole supply chain works.

Thanks to free trade deals, Vietnam is becoming increasingly connected to global supply chains. This allows Vietnamese plastics companies to sell more stuff overseas and team up with international partners to access new tech, money, and markets. If they get more competitive and join global value chains, the Vietnamese plastics industry can grow sustainably and do well in 2025.

Challenges of the plastics market in Vietnam

Plastic waste is a critical concern in today’s society, throwing a huge challenge to industries and governments to come out with workable solutions to the problem for the long term. Tackling and reducing plastic waste should be a concern of environmental responsibility and vital to the plastics industry for its sustainable growth.

While oil prices fluctuate, they increase and decrease the costs of materials used for plastic production, which has brought headaches to plastic producers. It complicates the planning of costs, increases risks, and demands companies to have good management strategies that would allow them to sustain their profitability and operation.

The plastics market in Vietnam is becoming highly competitive, particularly when compared with companies from outside the country. Indeed, Vietnamese companies must keep innovating, improving their products, providing better services, and finding unique ways to distinguish themselves if they want to survive and succeed in this challenging market.

Conclusion

To sum things up, the Vietnamese plastics market is taking off, thanks to more and more demand, especially for packaging, building stuff, and other industrial uses. Extrusion is becoming a popular and efficient way to make things, especially in construction.

There are also some great opportunities for bioplastics, recycled plastics, and using new technologies, which is good news for businesses. But there are also big challenges, like pollution, changing material prices, and competition. For corporations to grow sustainably, they need to infuse innovation, incorporate cutting-edge technology, make a wide variety of efforts toward greenness, improve competitiveness, and join the global supply chain.