In 2024, the Vietnam steel industry performed extremely well, with production volume of key steel products at 20.06 million tons, up 16%, while finished steel exports amounted to 7.646 million tons, representing a 2.8% increase. Imports also increased to 14.709 million tons, up 38.17%, valued at more than $10.477 billion.

Global economic context

The global economy faced numerous challenges in the first eleven months of 2024. Strategic competition intensified, military conflicts escalated, and political instability grew. Non-traditional security threats also impacted countries and regions across the world. Global economic recovery remained slow, creating ripple effects on various industries, including steel production and trade.

Although facing the mentioned woes simultaneously, Vietnam’s economy gained some positive traction in the 11 months of the year. There were major results achieved in several sectors, which positively impacted the economy as a whole too. The following report aims to deeply review the steel market of Vietnam for Nov 2024 and the first 11 months of the year 2024.

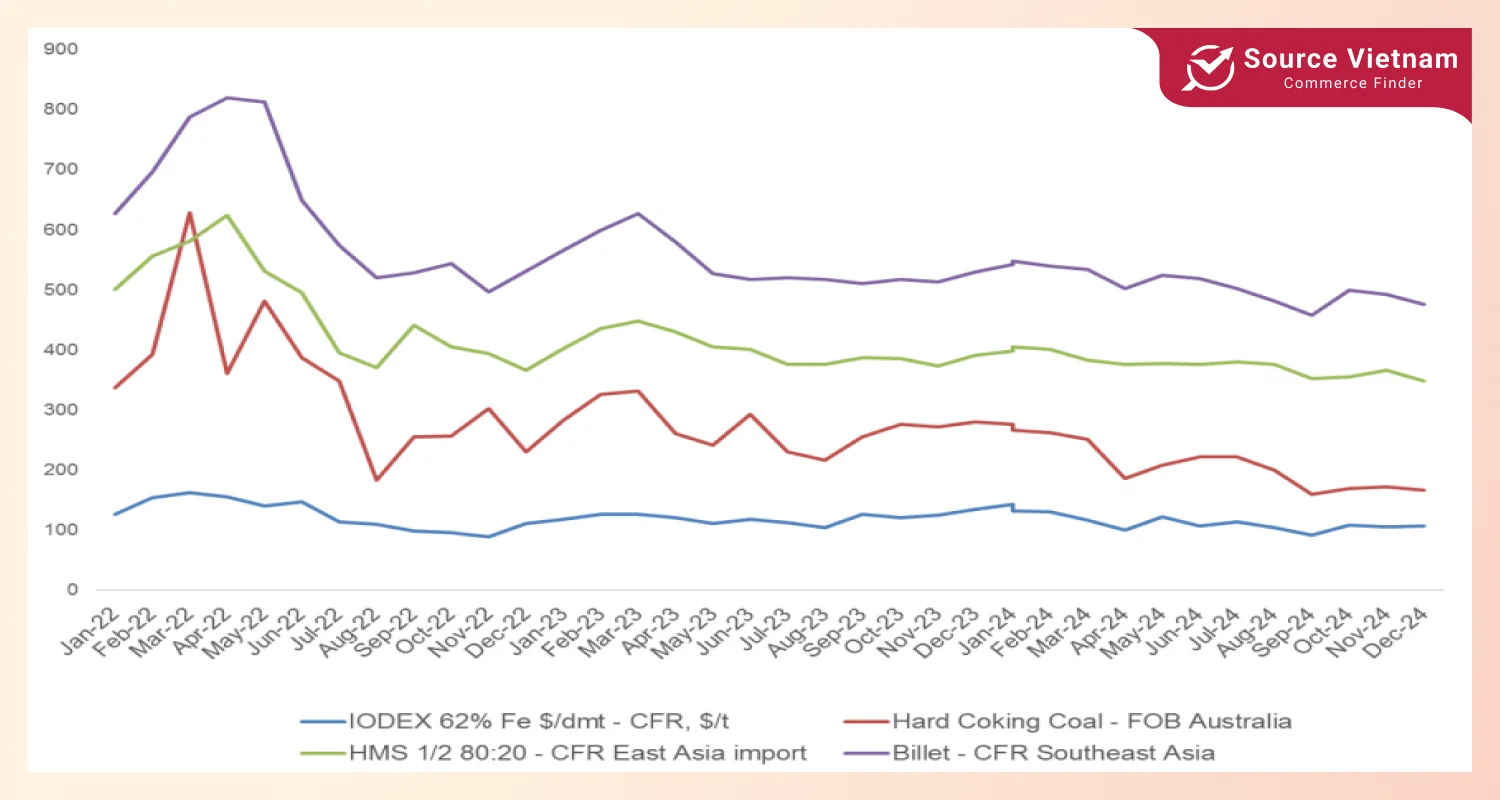

Steel production raw materials

Iron ore (62% Fe):

- On December 5, 2024, iron ore (62% Fe) was $104.4 per ton CFR Tianjin Port, China.

- This marked a $1.1 per ton decline compared to early November 2024.

Coking coal:

- The price of coking coal FOB Australia on December 5, 2024, was $166 per ton.

- This represented a drop of $5 per ton compared to the beginning of November 2024.

Scrap Steel:

- Scrap steel traded at $348 per ton at East Asian ports on December 5, 2024.

- The price fell by $17 per ton compared to early November 2024.

Graphite Electrodes: - In December 2024, the price of UHP450 graphite electrodes from China remained stable at 12,750-13,200 yuan per ton.

Hot Rolled Coils (HRC):

- On December 5, 2024, HRC prices were $503 per ton CFR Vietnam.

- This was a decline of $12 per ton compared to early November 2024, significantly lower than prices at the start of 2023.

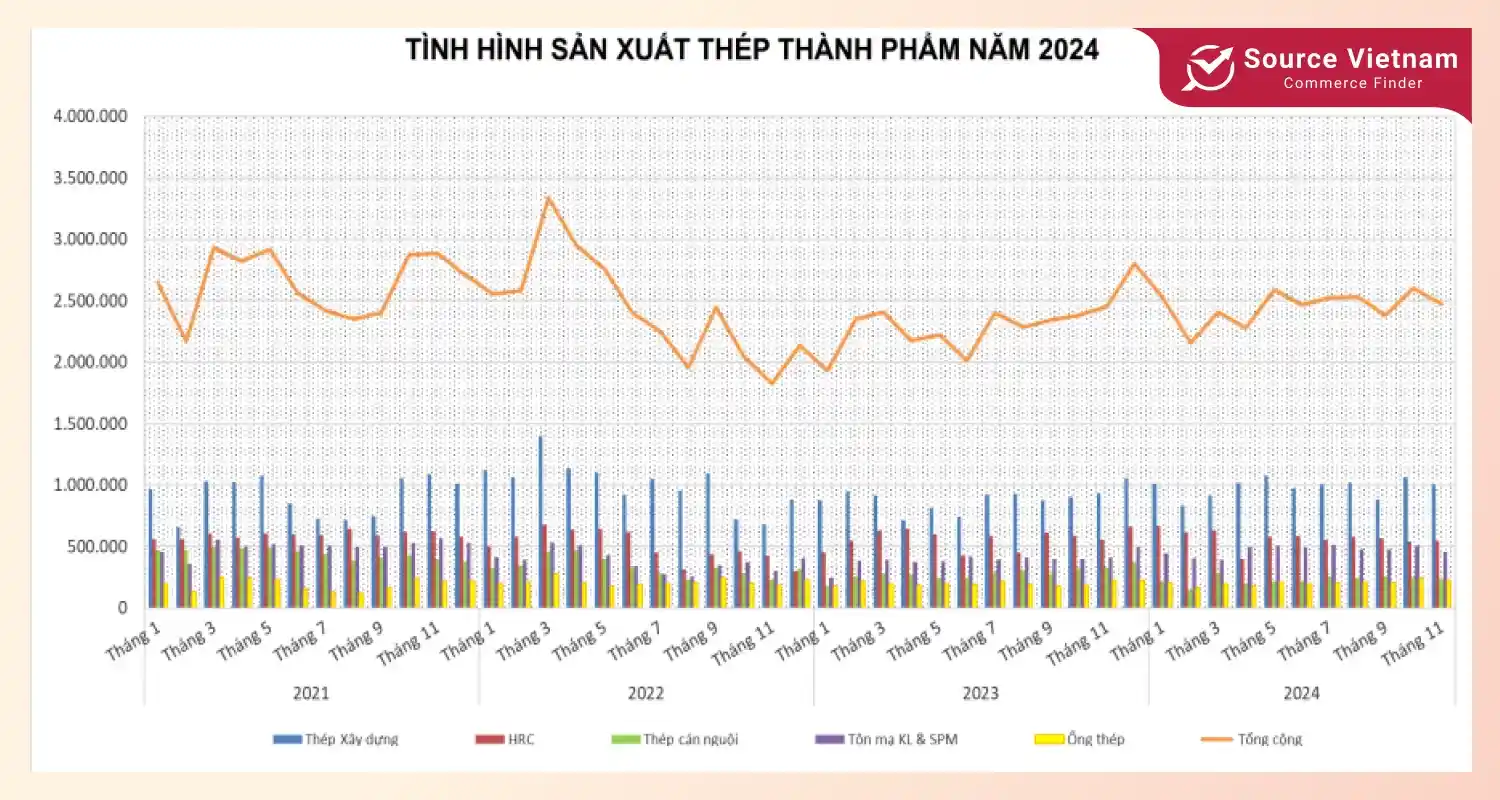

Steel production and sales performance

November 2024

Steel production and sales slowed in November 2024 compared to October 2024 and the same period in 2023.

Crude Steel: Production reached 1.87 million tons, up 1.8% from October 2024 and 13% from November 2023.

Finished Steel: Production totaled 2.471 million tons, a decrease of 5.2% from October 2024 but a slight increase of 0.8% compared to November 2023.

Notable trends:

- Enameled and Coated Steel: A yearly increment of 11.4%.

- Steel Construction: A yearly growth rate of 7.6%.

- Steel Piping: A decline of 1% on a year-on-year basis.

- Hot Rolled Coils: A yearly decrement of 1.3%.

- Cold Rolled Coils: Severe decline of 26.7% year-on-year.

First Eleven Months of 2024

- Crude steel:

- Compared to the same period in 2023, production increased by 16%, surpassing the 20.06 million ton mark.

- Compared to the previous year, domestic consumption and exports recorded a growth of 16%, amounting to 19.57 million tons.

- A significant increase of 59% year-on-year was noted in slab steel exports, which constitute the main export product, as crude steel export soared to 2.556 million tons.

- Finished steel: Production amounted to 26.948 million tons, up 7.7% year-on-year.

- Key growth contributors:

- Metal Coated & Painted Steel: Increased by 25.7%.

- Construction Steel: Increased by 11.7%.

- Steel Pipes: Increased by 4%.

- Hot Rolled Coils (HRC): Grew by 2.8%.

- Cold Rolled Coils (CRC): Declined by 17.3%.

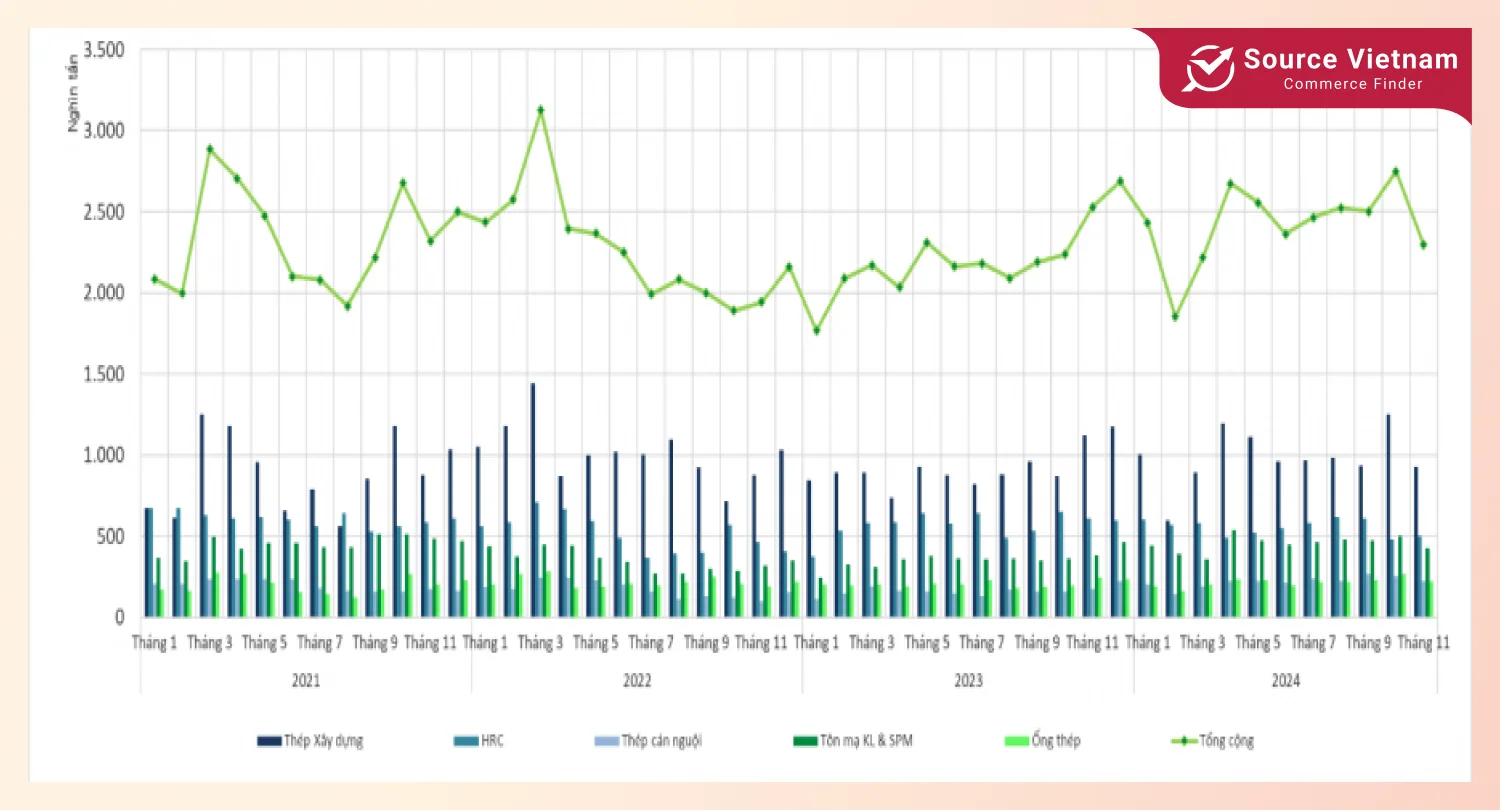

- Sales of finished steel: Totaled 26.776 million tons, an increase of 13% year-on-year.

- Product-specific sales trends:

- Cold Rolled Coils (CRC): Rose by 40.8%.

- Metal Coated & Painted Steel: Increased by 32.8%.

- Construction Steel: Grew by 11.9%.

- Steel Pipes: Increased by 4.8%.

- Hot Rolled Coils (HRC): Declined by 2.2% year-on-year.

- Exports of finished steel:

- Reached 7.646 million tons, a growth of 2.8% year-on-year.

- Growth was observed across most product categories, except for HRC, which decreased by 31.3%.

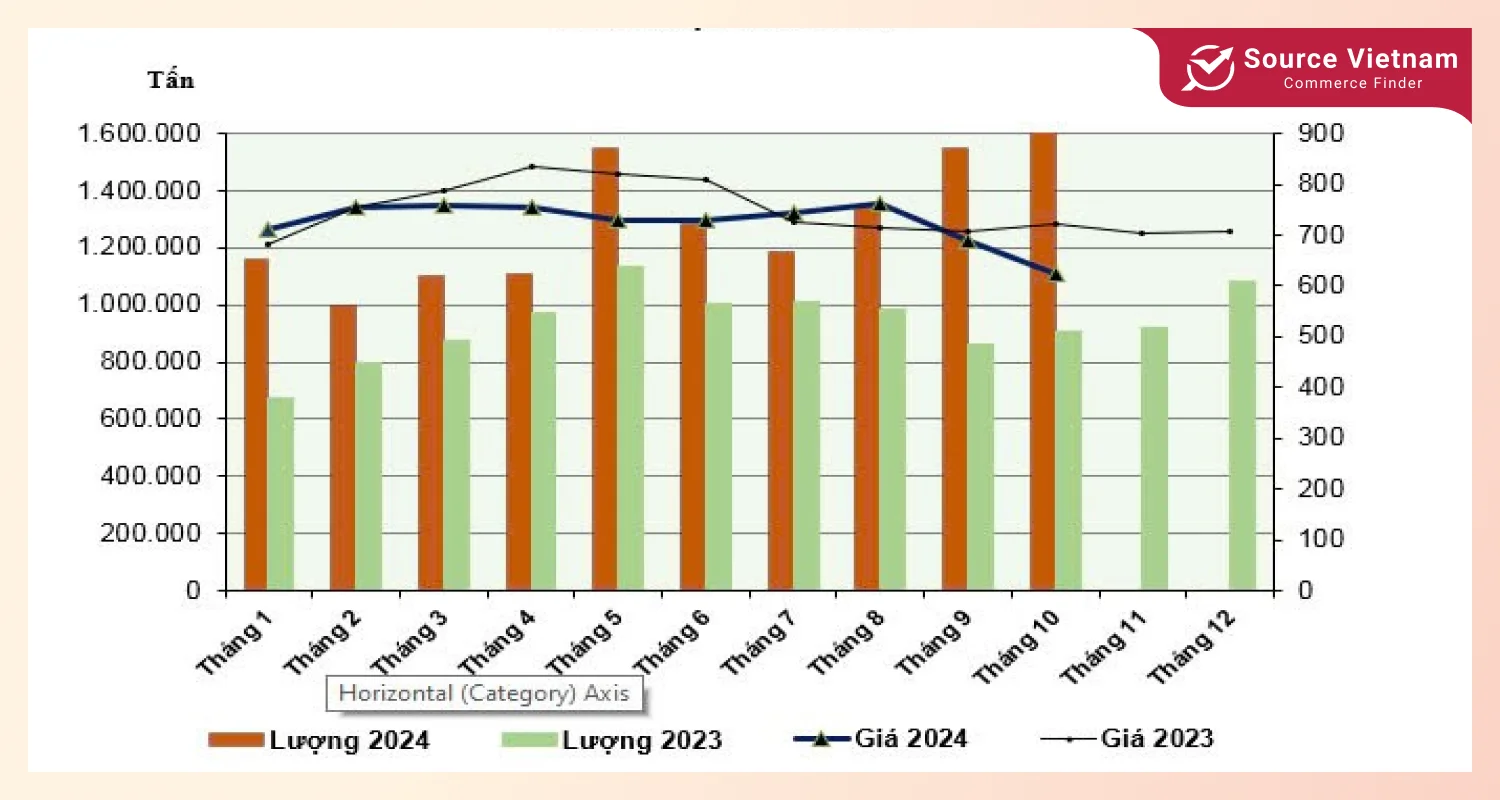

Steel import and export activities

Imports

In October 2024, Vietnam imported 2.41 million tons of steel:

-

- This was a 55.92% increase compared to September 2024 and an 85.1% rise year-on-year.

- The import value exceeded $1.5 billion, up 41.74% month-on-month and 56.87% year-on-year.

- For the first ten months of 2024:

- Vietnam imported 14.709 million tons of finished steel, valued at over $10.477 billion.

- This marked a 38.17% increase in quantity and a 23.19% rise in value compared to the same period in 2023.

Exports

- In October 2024, Vietnam exported 1.085 million tons of steel:

-

- This was nearly equal to September 2024 levels but represented a 20.09% year-on-year increase.

- Export value was over $749 million, similar to the previous month but up 14.68% compared to October 2023.

- For the first ten months of 2024:

- Vietnam exported 11.028 million tons of steel, a 20.88% rise year-on-year.

- Export value reached $7.961 billion, an increase of 14.72% compared to the same period in 2023.

Conclusion

Despite challenges in the global economy, in 2024, Vietnam’s steel production and export activities went up. The demand for crude steel rose greatly, resulting in increased finished steel production. However, some segments, such as cold-rolled coils and hot-rolled coils, did witness a drop.

Both imports and exports rose significantly on the trade side. Imports increased appreciably in volume and value as exports continued to increase for almost all steel products.

All these events show the flexibility, devotion, and strength of the Vietnam steel industry which enables them to be active participants in the global and regional steel markets.