Insight:

- Vietnam’s seafood industry is experiencing robust growth in 2024, with export revenue hitting an all-time high.

- The US, China, Hong Kong, and Japan continue to be the primary destinations for Vietnam’s seafood exports.

With Vietnam’s seafood exports surging in the first few months of 2024, the Vietnam Association of Seafood Exporters and Producers (VASEP) has set a revenue target of 9.5 billion USD for this year. Major export markets remain the US, China, Hong Kong, and Japan.

The Vietnamese seafood industry has started 2024 strongly, with exports reaching nearly 2 billion USD in the first quarter, an 8% increase year-on-year, according to VASEP. This growth is driven by rising demand from key markets, including the US, Japan, China, and Hong Kong. The association is confident that Vietnam can export seafood products worth 9.5 billion USD by the end of 2024, higher than last year.

Core market and primary product

The US has emerged as the largest importer, with Vietnamese seafood exports to the country surging 16% to reach 330 million USD. Particularly strong growth was seen in shrimp, tuna, pangasius, and crab, with increases ranging from 13% to 53%.

The recovery of pangasius prices in the US, after hitting lows late last year, contributed to this growth. Additionally, whiteleg shrimp prices have seen a slight uptick, although they remain below the five-year average.

A significant development supporting this growth is the final results of the U.S. Department of Commerce’s (DOC) 19th administrative review of anti-dumping duties. This review set the anti-dumping duty rate for five Vietnamese companies at $0.18 per kilogram for frozen catfish fillets exported from August 2021 to July 2022, down from the previous rate. This favorable outcome offers positive prospects for Vietnamese catfish exporters.

Another driving force is the preliminary anti-subsidy duties announced by the DOC on shrimp from Vietnam, India, and Ecuador, which were significantly lower for Vietnam compared to the other two countries.

China and Hong Kong have stood out with a surge in demand for Vietnamese seafood. Exports of key products such as lobster, crab, and whiteleg shrimp have increased 11 times, 7 times, and 2.5 times, respectively, compared to the same period last year. This sharp increase is partly due to China’s tightened inspections on shrimp imports from Ecuador, leading to a decline in supply from Ecuador and opening up more opportunities for Vietnamese exporters.

In Japan, Vietnamese seafood is becoming increasingly popular, with significant growth in exports of whiteleg shrimp (20%), crab (23%), and pangasius (25%) in the first quarter. The strong performance in this market underscores Vietnam’s growing reputation as a reliable seafood supplier.

Although shrimp and pangasius exports to the EU and South Korea have yet to show significant recovery, tuna exports to these regions have increased by 27% and 15%, respectively. Overall, tuna exports to major markets have been stable, with a 30% increase to the US and a 9% increase to Japan. Squid and octopus exports to South Korea also increased by 16%, although exports to the US and Japan decreased by 3% and 21%, respectively.

Vietnam’s seafood exports are booming, hitting record levels

Although the average export price is higher compared to the end of 2023, it is still lower than the historical average. VASEP is optimistic that upcoming international seafood fairs in the US, EU, and Japan will help companies win more orders at better prices.

After all, in the first four months of 2024, Vietnam’s seafood exports reached $2.7 billion, a 6% increase year-on-year. In April alone, Vietnam’s seafood export revenue reached $770 million, a 4% increase year-on-year. According to VASEP, exports of tuna, pangasius, crab, and other seafood products all showed positive growth from January to April compared to the same period last year. Finally, Vietnam’s shrimp export revenue in April reached $285 million, the highest level recorded since the beginning of the year.

Le Hang, VASEP’s communications director, emphasized that Vietnam, the world’s leading exporter of frozen shrimp after India and Ecuador, can seize more opportunities as these competitors face warnings about antibiotic residues and labor issues. However, she stressed the importance of Vietnamese businesses adhering to strict regulations both domestically and internationally to maintain their export momentum.

VASEP forecasts that Vietnam can earn $9.5 billion from seafood exports in 2024. This includes $4 billion from shrimp exports, $1.9 billion from pangasius sales, and $3.6 billion from other seafood products.

Exports surged 7% in the first six months

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam’s seafood export turnover in June 2024 is estimated at 875 million USD, a 14% increase compared to the same period last year. This is also the highest export turnover since the beginning of the year.

Exports of most major seafood products saw high growth in June: pangasius increased by 22%, tuna increased by 40%, and crab increased by 59%. Only shrimp saw a slight increase of 7%. Squid and octopus were the only products to decrease slightly compared to the same period last year.

In the first six months of 2024, seafood exports brought in over 4.4 billion USD, an increase of nearly 7% compared to the same period in 2023. In the first half of this year, shrimp exports brought in more than 1.6 billion USD, 7% higher than the same period last year. Of which, whiteleg shrimp reached nearly 1.2 billion USD, a slight increase of 3%; black tiger shrimp reached over 200 million USD, down 10%. Notably, lobster exports increased sharply by 57 times compared to the same period, reaching over 130 million USD.

Catfish exports reached 922 million USD in the first half of this year, a nearly 6% increase year-on-year. Despite improved demand, export prices for catfish to markets such as China, the EU, and the UK remained low. Only the US market showed more positive signs in terms of both price and import volume of Vietnamese catfish.

Tuna exports increased nearly 25% to 477 million USD in the first half of the year, mainly driven by a strong surge in canned and pouched tuna. Tuna exports to almost all markets increased compared to the same period in 2023. Notably, the two largest markets, the US and the EU, accounted for 37% and 22% of Vietnam’s tuna exports, respectively, and recorded growth of 30% and 37% year-on-year. Notably, tuna exports to Israel increased the most, by 64%; to Russia by 58%, and to South Korea by 66%.

The Vietnam Association of Seafood Exporters and Producers (VASEP) reported that since 2021, Vietnam’s canned tuna exports have been on an upward trend. The export value of this product has increased from 169 million USD in 2021 to 255 million USD in 2023, a 51% increase compared to 2022. Notably, in 2024, Vietnam’s canned tuna exports have shown a faster growth trend month by month.

Meanwhile, exports of squid and octopus decreased slightly by 1% year-on-year in the first six months to 289 million USD. In addition to tuna, many other types of fish have seen increased demand and sales in the first half of the year.

Among them, barramundi exports grew by 27% to over 36 million USD, golden threadfin bream increased by 14% to over 29 million USD, mackerel increased by 6%, pollock increased by 8% to 38 million USD, and orange roughy increased by 96%. Some freshwater fish species with increasing consumption include red tilapia increased by 32%, catfish increased by 18%, and eel increased by 93%.

Driving factors and challenges

Driving factors

- Growing global demand: The increasing global population and living standards have led to a growing demand for seafood consumption.

- Improved product quality: Thanks to the application of modern production processes and ensuring food safety and hygiene, the quality of Vietnamese seafood products has been increasingly affirmed in the international market.

- Government support policies: Policies to encourage seafood production and export have created favorable conditions for businesses.

Challenges

- Intense competition: Vietnam faces strong competition from other major seafood-producing countries such as India and Ecuador.

- Technical barriers: Strict food safety and traceability regulations in import markets pose many challenges for Vietnamese businesses.

- Climate change: Climate change affects the yield and quality of seafood.

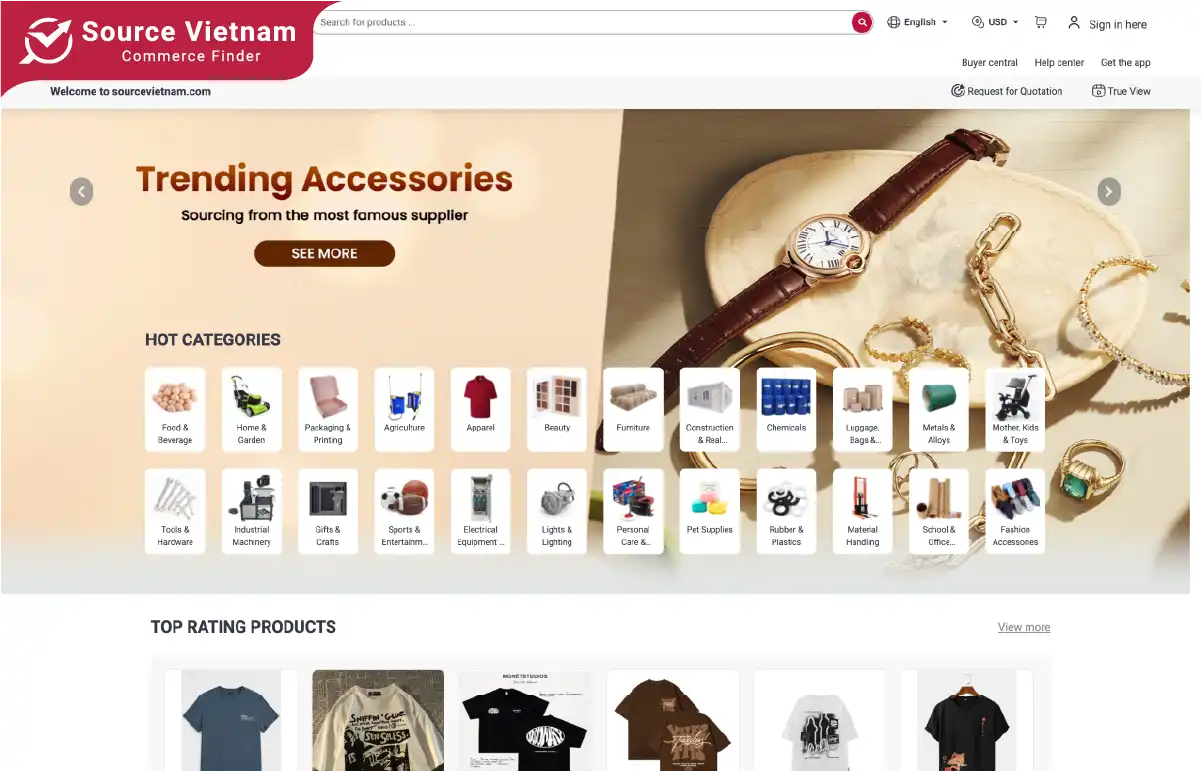

Diverse platforms support Vietnam’s export activities

Currently, Vietnam is one of the countries with the most potential for development in the export sector. With a diverse range of products offered to the market, more and more countries are eager to import products directly from Vietnam. To facilitate the connection between foreign businesses and suppliers from Vietnam, the SourceVietnam platform was created as an optimal solution for this purpose.

SourceVietnam is a solid bridge between Vietnamese businesses and the international market. With a modern technology platform, SourceVietnam helps businesses easily reach global customers and promote high-quality Vietnamese food products to the world.

This trading platform is not only a place to connect supply and demand but also a place to share information and knowledge about exports, helping Vietnamese businesses enhance their competitiveness. This will be a platform to support the process of exchange, payment, and transportation, making it more convenient for businesses to optimize costs.

Conclusion

The Vietnamese seafood industry has achieved significant milestones in recent years, but there is still much potential to be exploited. To maintain sustainable growth, the industry needs to focus on improving product quality, building a strong national brand, and adapting to changes in the global market. With the efforts of all stakeholders, the Vietnamese seafood industry is sure to make an increasingly significant contribution to the country’s socio-economic development.