Insight:

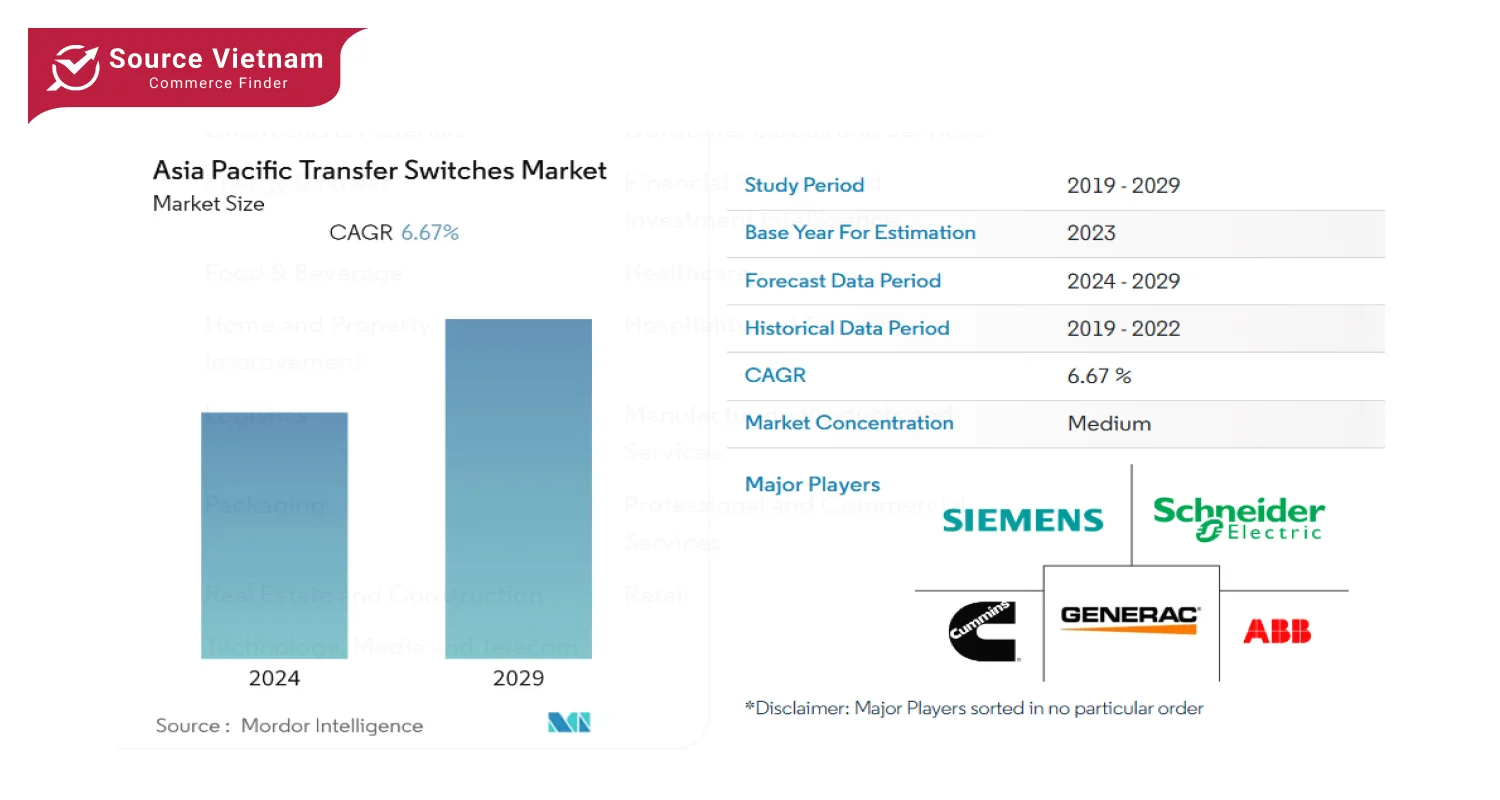

- The APAC transfer switches market was USD 461.35 million in 2020 and will reach USD 724.82 million by 2026.

- The market grows at a 6.67% CAGR, driven by urbanization and renewable energy shifts.

The Asia Pacific (APAC) transfer switches market is growing fast. This is because the cities in this region are growing quickly. They are also making more things in factories. More and more windmills and solar panels are being used to make electricity. As the weather changes, transfer switches are really important. They help electricity switch off without any problems. Industrial, commercial, and residential places all need them. This article looks at how this market is growing, who the important companies are now, and what can happen soon.

Market Overview

In 2020, the APAC transfer switches market was $461.35 million. It may become $724.82 million by 2026. It will likely grow yearly by about 6.67%. COVID-19 made a push for renewable energy. It caused a higher demand for switch-overs from coal to renewables in buildings and facilities.

Key Drivers of Growth

- Urbanization and Industrialization

The rapid expansion of cities in Asia Pacific countries has made the nations more social and increased the need of a stable and reliable electrical infrastructure. For example, Vietnam’s urbanization brought about a change from 36.63% in the year 2019 to 37.34% in the year 2020 while for Indonesia, the percentage increase was from 55.99% to 56.64% for the same period. This growth points to the potential for new energy innovations, driving the transfer switch industry.

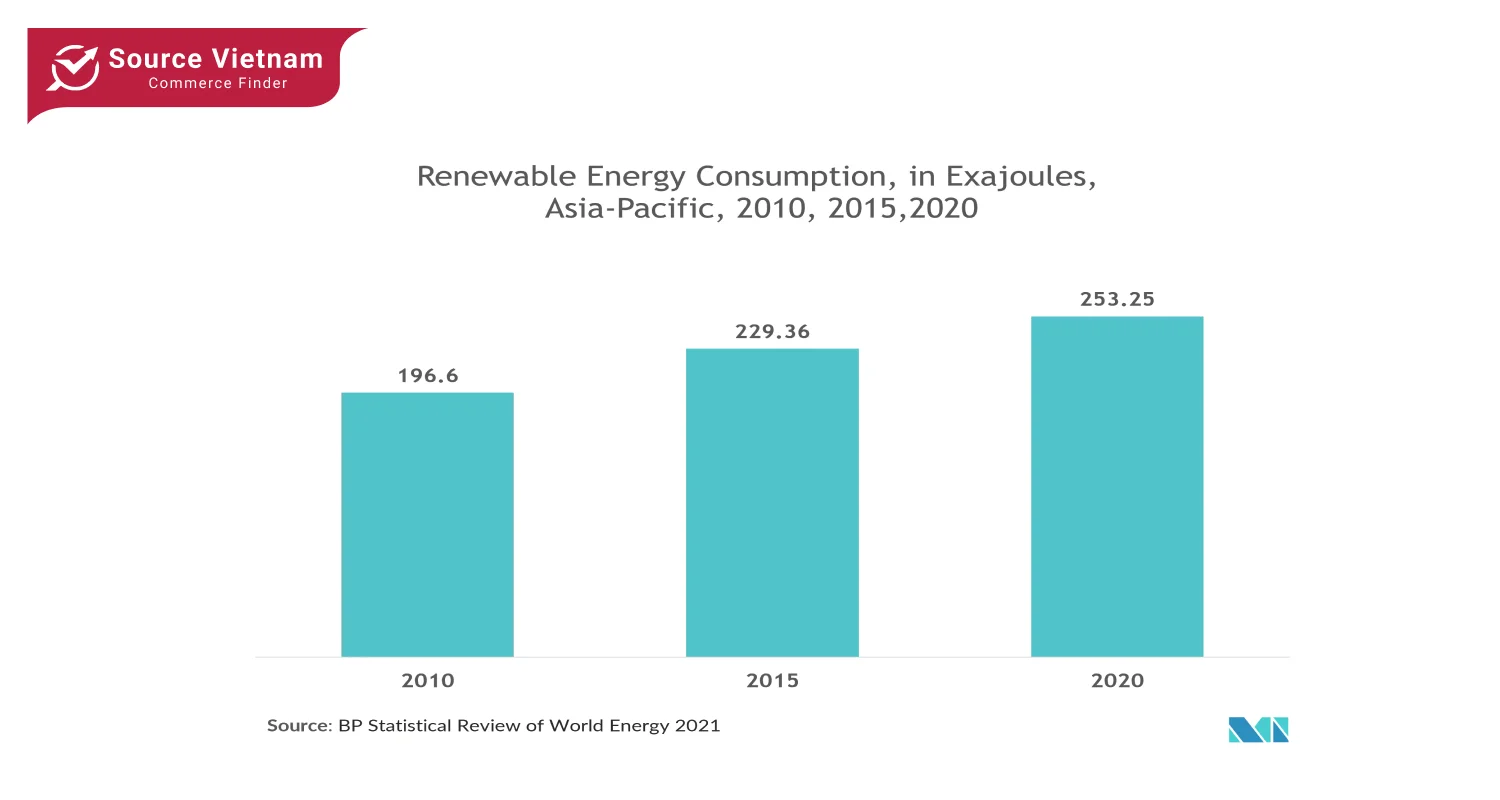

- Renewable Energy Focus

The pandemic underscored the importance of sustainable energy solutions. Utility companies began to pivot from coal-based energy generation to renewable sources, creating a greater need for equipment like transfer switches to manage distributed power systems.

Market Segmentation

The APAC transfer switches market is divided by type and application:

- Types: manual and automatic transfer switches.

- Applications: Industrial, commercial, and residential sectors.

Residential Applications Witness Growth

Southeast Asia is among the fastest rising electricity consumption markets due to increased usage of electric appliances and air conditioning. As the IEA states: Indonesia (26%), Vietnam (22%), Thailand (19%) and Malaysia (15%) are together responsible for over 80% of the region’s energy demand.

Residential transfer switches are integrating intelligent features to satisfy the demand of the consumers. A good example is the release of Generac’s Automatic Transfer Switch with built-in home energy monitoring capabilities that allow households to have a clear view of energy use and possible savings. Sophistications like these also cater to the transfer switch demand in the residential sector.

Technological Advancements

Leading market players are investing in innovative solutions:

- Cummins Inc. launched its PowerCommand X-Series transfer switches in May 2021. These switches, designed for mission-critical uses, offer ratings from 40 to 3000 amps and are known for their reliability and high endurance mechanisms.

- Schneider Electric introduced its next-generation TransferPacT ATSE in October 2021, emphasizing scalability and reliability. This product offers easy settings and user-friendly interfaces, ideal for a wide range of applications.

Challenges in the Market

Despite advancements, there are inherent risks associated with transfer switches if not handled properly. Hazards include electrical shock, fires, explosions, and heat build-up. These safety concerns could act as restraints, potentially slowing market growth.

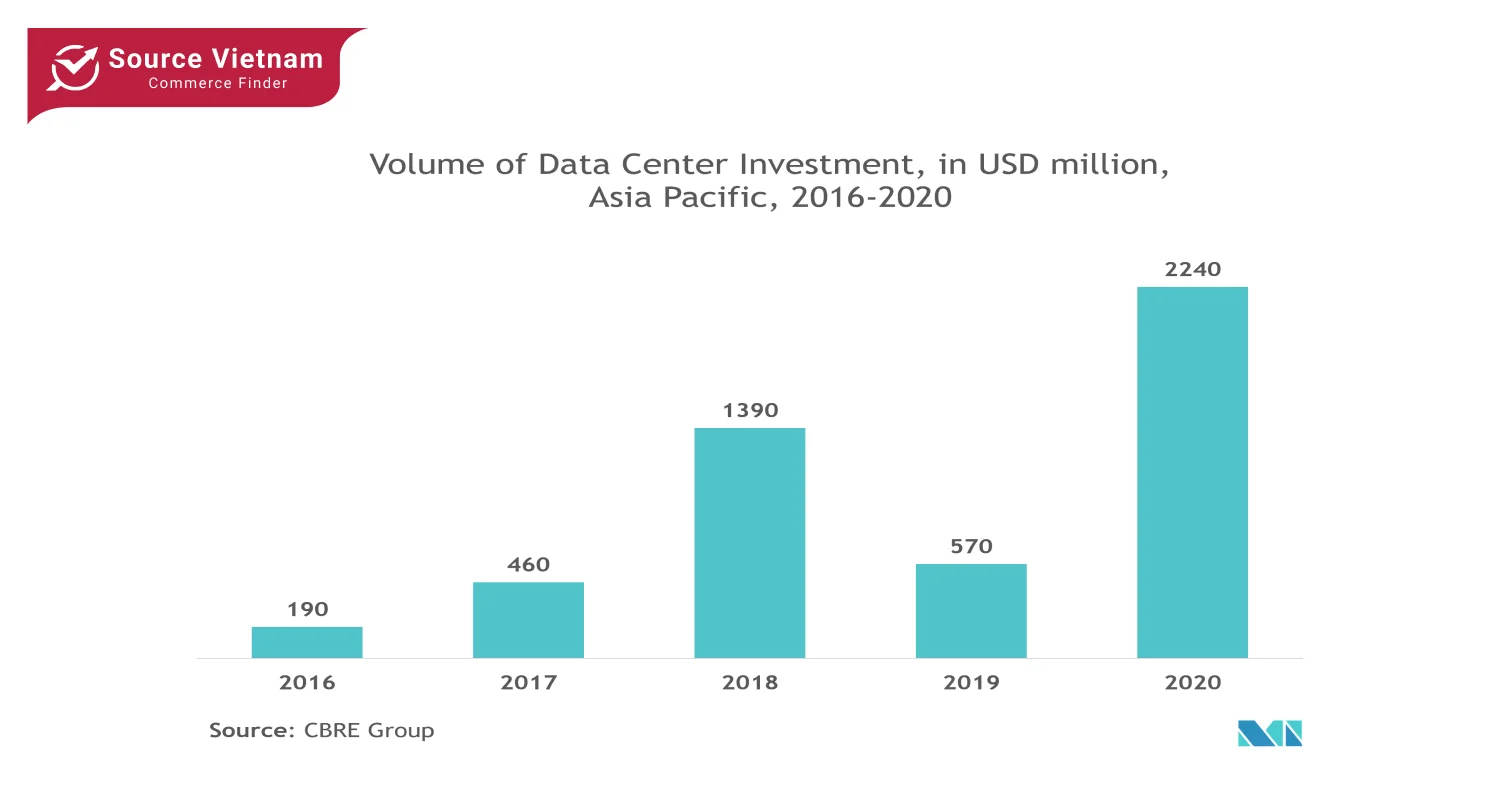

Regional Focus and Investment Trends

Countries such as Australia lead in the adoption of residential energy storage systems, supported by initiatives from organizations like the Australian Renewable Energy Agency (ARENA). Other APAC nations, like Japan, are encouraging the use of solar panels for energy independence, spurring further demand for transfer switches.

Competitive Landscape

The APAC transfer switches market is moderately consolidated. Key players include:

- ABB Ltd

- Schneider Electric SE

- Cummins Inc.

- Generac Power Systems Inc.

- Siemens AG

The market’s competitive nature is shaped by continuous investments and partnerships. For example, a Memorandum of Understanding between IRENA and the State Grid Corporation of China in April 2021 focuses on grid enhancements and the development of smart grid systems. Such collaborations foster technological growth and reliability in power systems.

Conclusion

The APAC transfer switches market is poised for robust growth, driven by urbanization, industrial needs, and renewable energy initiatives. As key players continue to innovate and expand their product offerings, the market is expected to thrive. While safety concerns pose challenges, the trend toward intelligent and user-friendly solutions indicates a promising future for transfer switches in the Asia Pacific region.