Insight:

- In what was surely a great year for the beauty industry, it achieved a 10% growth. Skin care, unique scents, and a makeup revival boosted sales.

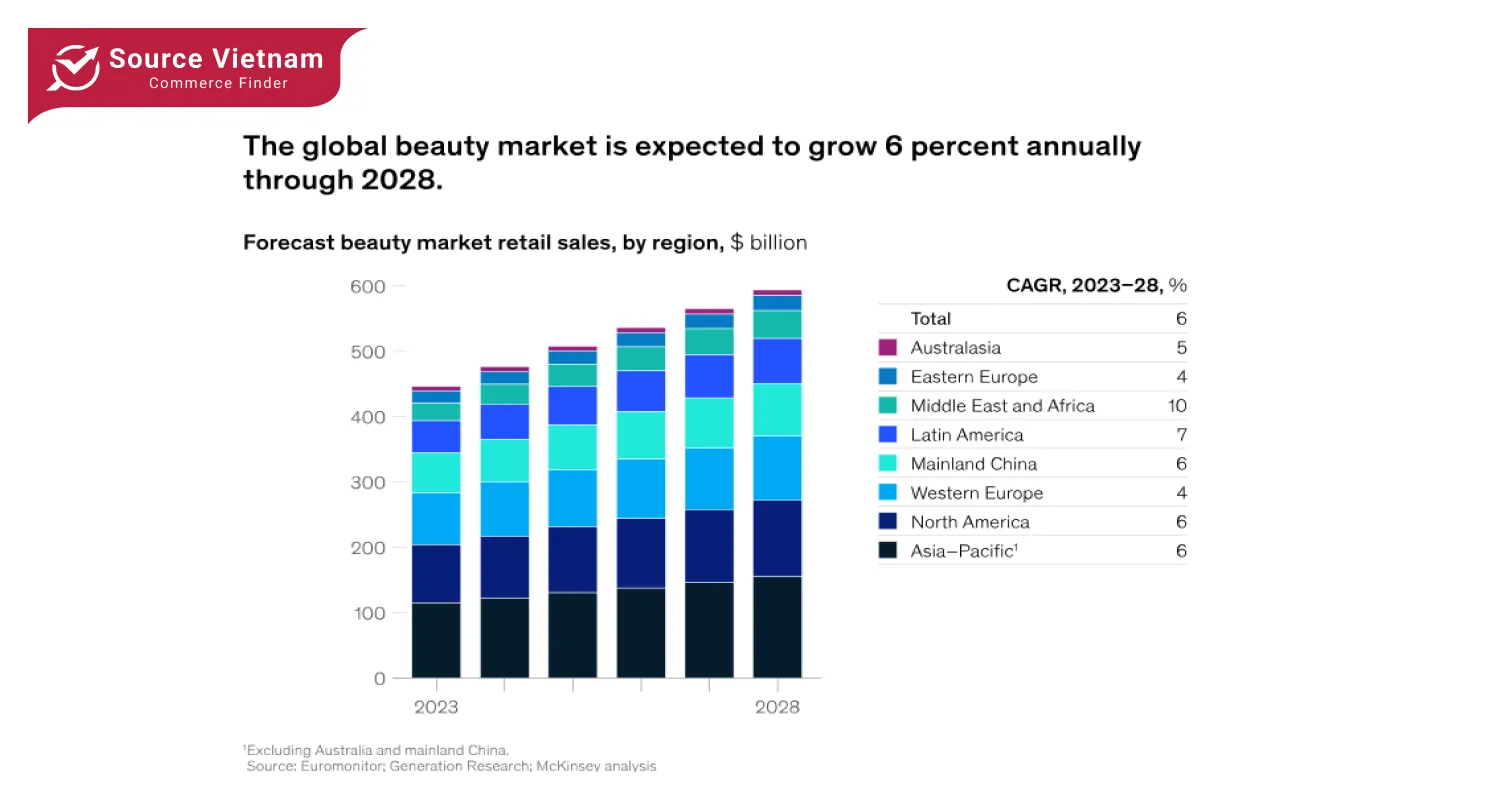

- Where revenues are projected to be approximately $590 billion in 2028, at an annual growth of 6%.

Despite all of the world’s economic issues, the global market for the beauty industry keeps increasing. By 2023, the market grew to $446 billion which is $40 billion more than the previous year’s revenue of $406 billion. In general, the demand for goods by end-users remains strong; however, the industry is undergoing changes in scenarios that develop its further growth. What does the future hold for the industry?

Regional market trends

Growth across regions has varied significantly. The Asia-Pacific market, excluding China and Australia, is expected to expand by 6% annually through 2028, driven by higher volume sales rather than price hikes. On the other hand, China’s beauty market faced modest growth of 3% in 2023, primarily due to increased prices rather than demand. Lower consumer confidence, discounting, and macroeconomic factors dampened sales, though wealthier consumers will likely drive a recovery by 2024.

Europe and North America saw modest but steady gains, with both regions focusing on volume and price balance. Meanwhile, the Middle East and Africa are emerging as standout markets, projected to grow 10% annually. Premium products are in high demand, suggesting a strong preference for luxury beauty goods.

Category performance and forecasts

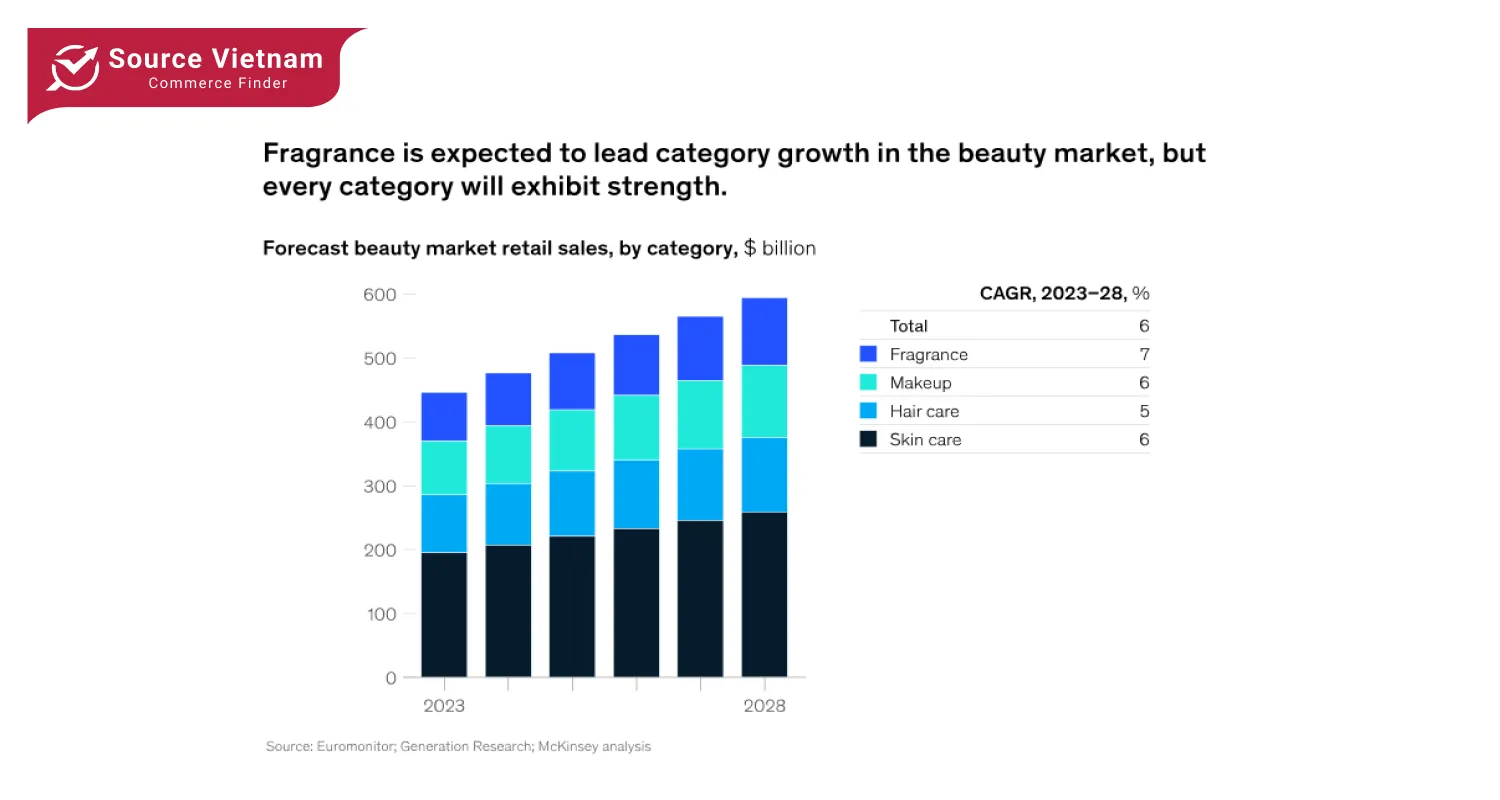

Skincare continues to dominate product categories, making up 44% of the market. In 2023, skincare products grew by 6%, fueled by innovations like neuropeptides and the “skinification” of haircare-where routines typically associated with skincare are applied to hair products. Fragrance, although the smallest segment in terms of revenue, managed to record the highest growth rate of 14%, which was mainly supported by niche luxury fragrances.

Makeup, struggling at the onset of embarking on the pandemic, managed to recover the losses in 2023 and more than the sales before the pandemic. The growth of makeup is expected to mainly be driven by the Middle East, Africa, and Asia Pacific regions through 2028, with the increasing presence of specialist beauty retailers in these regions.

Shifting consumer behavior

The pricing landscape shows a mix of trade-up and trade-down behaviors among consumers. While many buyers in mature markets opted for lower-priced beauty products in 2023, others-particularly Gen Z in China and millennials in the UAE, chose to splurge on luxury items. The mass beauty segment, accounting for 48% of the market, grew 10% last year, indicating a shift towards more affordable options for some consumers.

The luxury beauty category shows promise as prestige and luxury beauty products have grown by 10% and 13% respectively. Though dampened by inflationary pressures, strong demand for high-end products still suggests that the luxury sector remains underdeveloped.

The future of retail channels

The retail environment of the beauty sector is changing. The sales in the stores bounced back in 2023 even though the pandemic caused online sales to skyrocket. More importantly, specialty beauty retailers witnessed a healthy growth of 14% last year. These outlets provide younger consumers who want trends, products, and services the ability to try the items in-store and interact with them firsthand.

Challenges and opportunities

Maintaining growth won’t come without hurdles. Brands must navigate increasing competition and evolving consumer expectations. Innovations like functional packaging and sustainable product development will be crucial in maintaining relevance. Moreover, expanding niche product lines without compromising their exclusivity will be essential for long-term success.

Though this situation is not easy, there is a good chance for the industry to grow at an annual rate of around 6% until 2028 and achieve a value of $590 billion. The largest opportunities are addressing new consumer niches, integrating sustainable development, and expanding internationally to lesser-served regions.

Conclusion

The beauty industry’s outlook remains bright, but businesses must stay agile to sustain growth. Understanding consumer shifts, focusing on product innovation, and balancing digital and physical channels will be vital. While challenges like inflation and changing consumer priorities persist, companies aligning with emerging trends will likely thrive in this competitive landscape.

This report highlights both the promises and pitfalls of the evolving beauty industry. For more details, the original analysis from McKinsey offers an in-depth look at key trends and strategies that could shape the future of beauty across regions and product categories. While consumer demand stays robust, industry growth is shifting towards new dynamics, leaving many wondering whether the sector can sustain its momentum through the coming years.