Insight:

- Consumer electronics last year (2022) was $1,068.22 billion which is expected to expand to $1,782.60 billion in 2030.

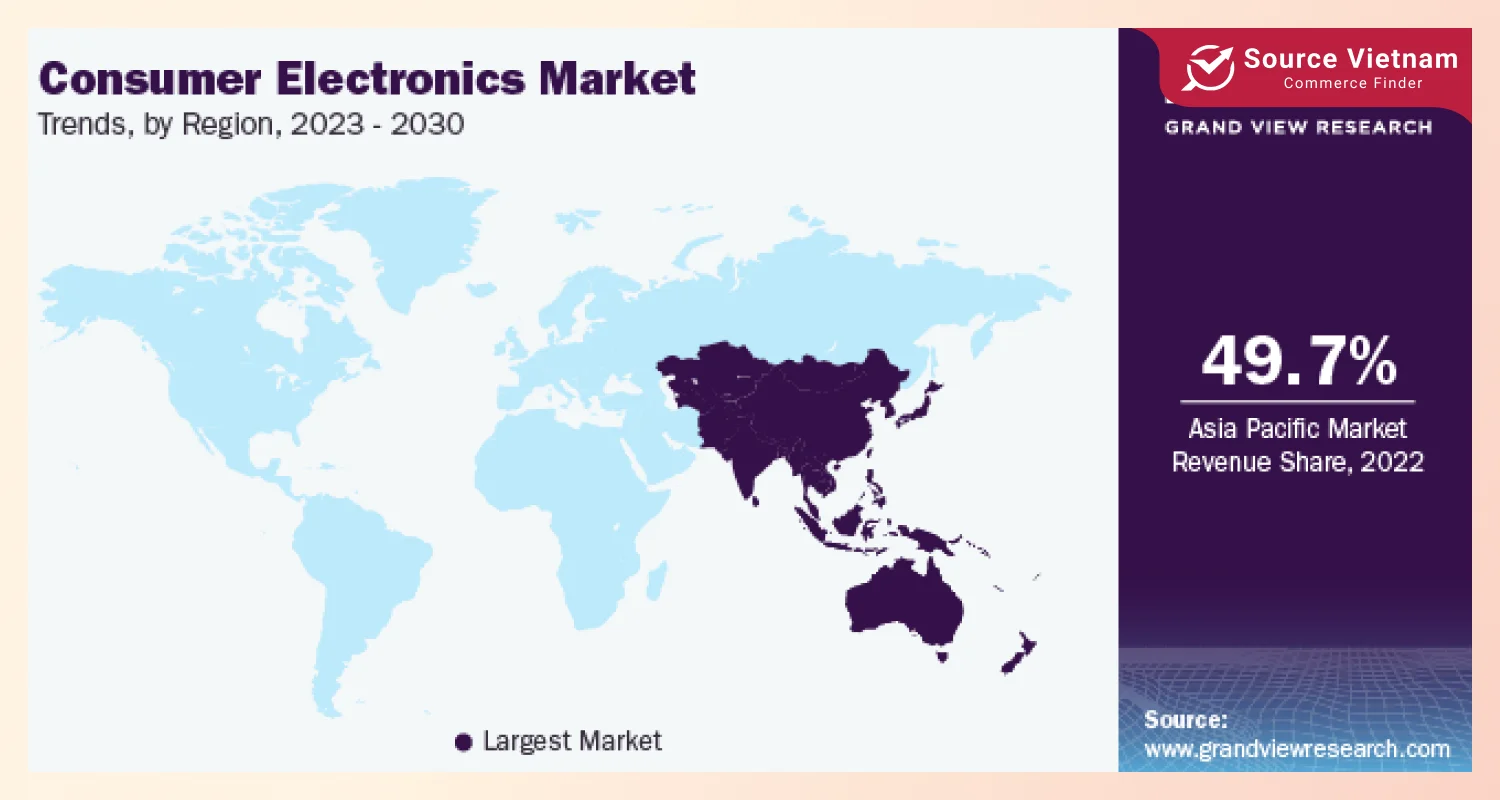

- In 2022, the Asia Pacific region possessed 49.7% of the market share with online sales growing at 8.7% CAGR.

Overview and market size

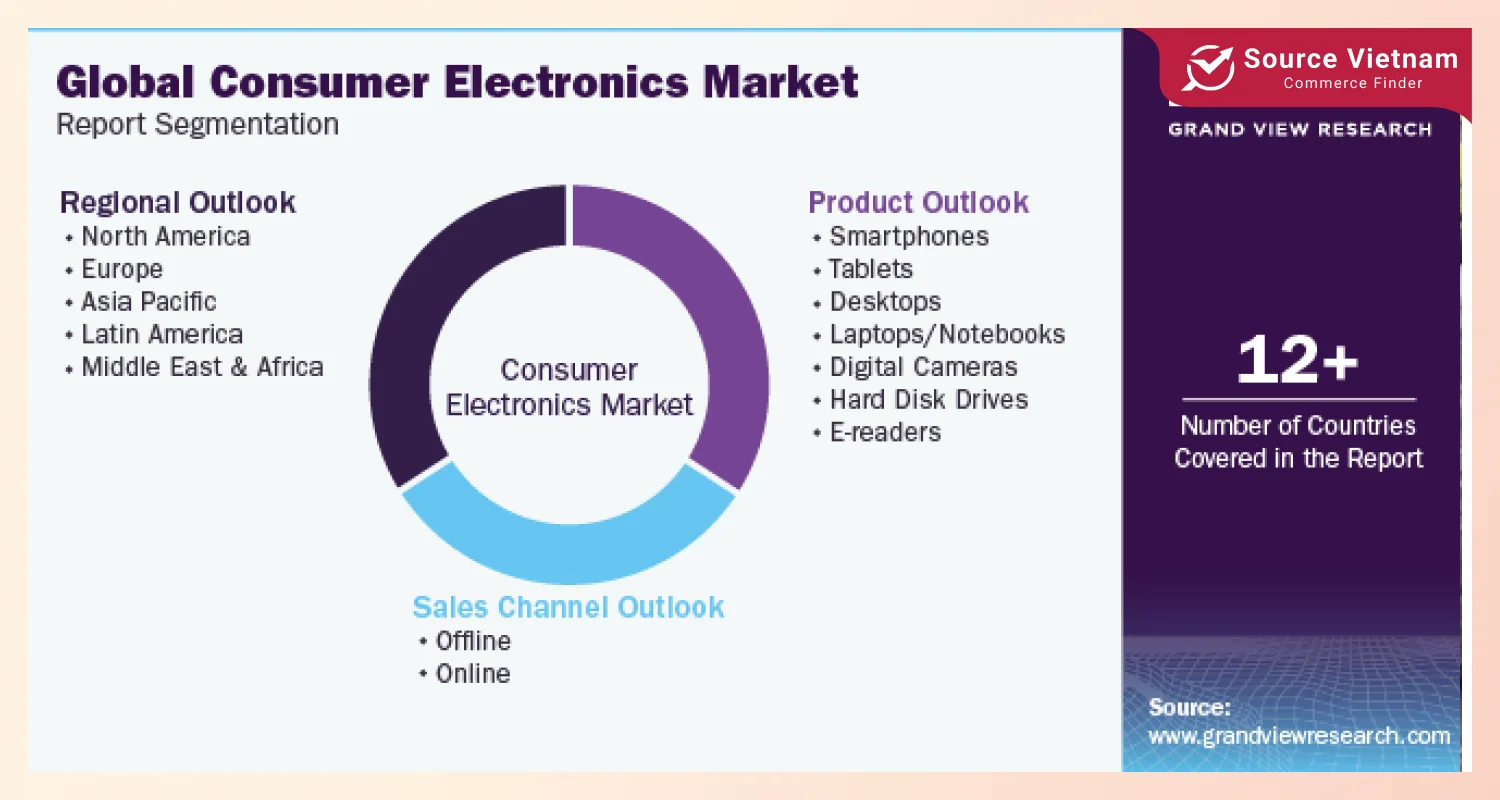

The global consumer electronics market was valued at about $1,068.22 Billion in the year 2022, with an expected CAGR of 6.6% in the period of 2023 to 2030. The global electronic market should reach approximately $1,782.60 billion by 2030. The factors driving such growth are rapid pace growth in technology and the rising number of smartphone users. The market dynamics are also changing due to the new advancements in 3G, 4G, and development of IoT technologies.

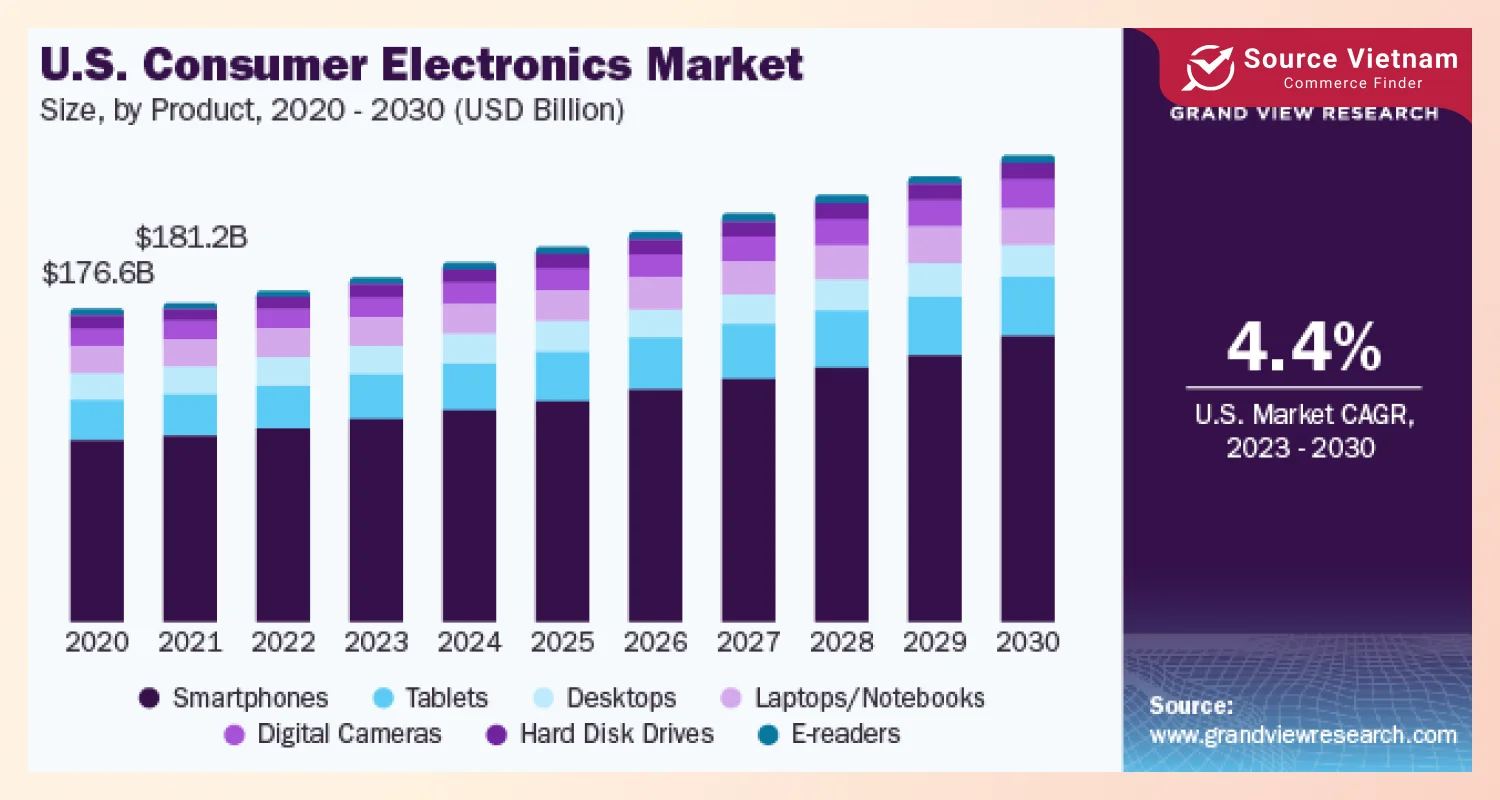

Product segments

The market comprises products such as mobile devices, tablets, laptops, personal computers, camcorders, hard disks, and e-readers. In 2022, the segment with smartphones as the main products contributed most sales revenues with more than 58.3%, and growth is expected to be 7.3% by 2030. This segment accounts for high popularity amongst users of Android, iOS, and Windows devices as well as digital mobility.

The tablet segment is projected to experience significant growth, expanding at a CAGR of 7.0%, due to new designs and the development of increased accessibility for users with motor disabilities. In contrast, desktop computers are ceding their market share to portable devices. Advanced camera smartphones are posing challenges to digital cameras as well.

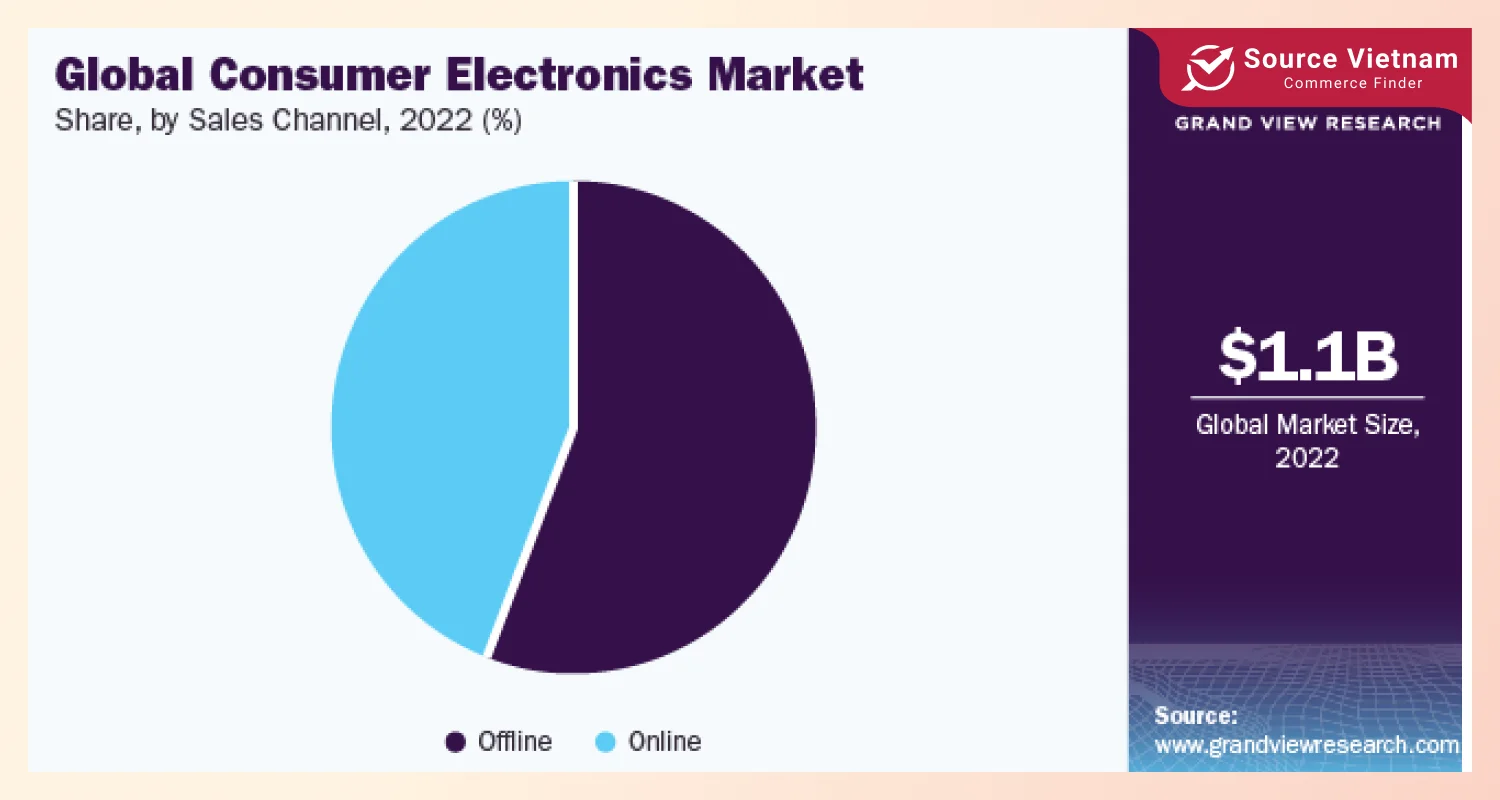

Sales channels

Consumer electronics are available for purchase through both offline and online channels. Offline sales made up 56 percent of revenues in 2022, which implies that the provision of personal contact is still very valuable. They help customers to choose the best option, leading to loyalty and repeat purchases.

The performance of the online segment is tremendous, as it’s growing at a CAGR of 8.7%. High internet usage and ownership of mobile devices make shopping very convenient for consumers. Options such as home delivery and hassle-free returns also help stimulate the growth of online sales.

Regional insights

In the year 2022, the market was majorly held by the Asia Pacific region, which accounted for a revenue share of 49.7%. Initiatives by governments in China, India, and South Korea to embrace digital technologies and set up local production facilities help in attracting foreign investment.

North America is another significant region, benefiting from early technology adoption and upgrade programs. Replacement sales dominate smartphone purchases, driven by Android platforms and reference design availability. Latin America is projected to grow at a CAGR of 6.8% due to increased digital connectivity and mobile network expansion.

Key market trends

Demand for phablets (large-screen smartphones), rising disposable incomes, and IoT adoption are shaping the market. The BYOD (Bring Your Own Device) trend is creating opportunities for manufacturers to align with consumer needs.

The widespread use of high-quality camera phones and the introduction of new smart tablet devices are driving shifts in the market. Manufacturers are actively using trends as consumer behavior to remain competitive.

Recent developments

In association with ZEISS, Vivo Mobile Communication Co., Ltd. released the X90 and X90 Pro as their flagship smartphones in February 2023 that mainly concentrated marketing on the camera features.

Ekka Electronics announced expanding their business in India by building a new manufacturing facility worth $121.1 million, which is expected to increase production of consumer electronics smartwatches and wearables.

OnePlus launched its premier tablet, dubbed the OnePlus Pad, on April 2023, which not only has interesting designs but powerful performance as well.

The Indian government also made an announcement detailing a plan that aims to reach $300 billion in electronics manufacturing by FY26 with applications such as the PLI scheme to boost the industry.

Competitive landscape

The market is vibrant and active where players are growing through acquisitions and partnerships. Market share holders are Apple Inc., Samsung, Dell Inc., Huawei, Lenovo, Sony Corporation, Google LLC.

In June 2022, the HP Development Company, L.P. completed the acquisition of Poly to increase the resources within the company that enables them to augment the offerings of hybrid IT environments. In October 2022, Electrolux also revealed the launch of its first dedicated retail branding store in Bangalore as part of its wider market penetration strategy.

Conclusion

The changes within the target market are positive since the sphere in question keeps on developing. With the sector developing, there are great chances for manufacturers and services suppliers to meet the needs of consumers and of some upcoming trends as well.