Insight:

- Supported by low-cost labor, materials, and technological advancement, Asia remains the most appealing footwear production center, accounting for 87.4% of the total footwear output globally.

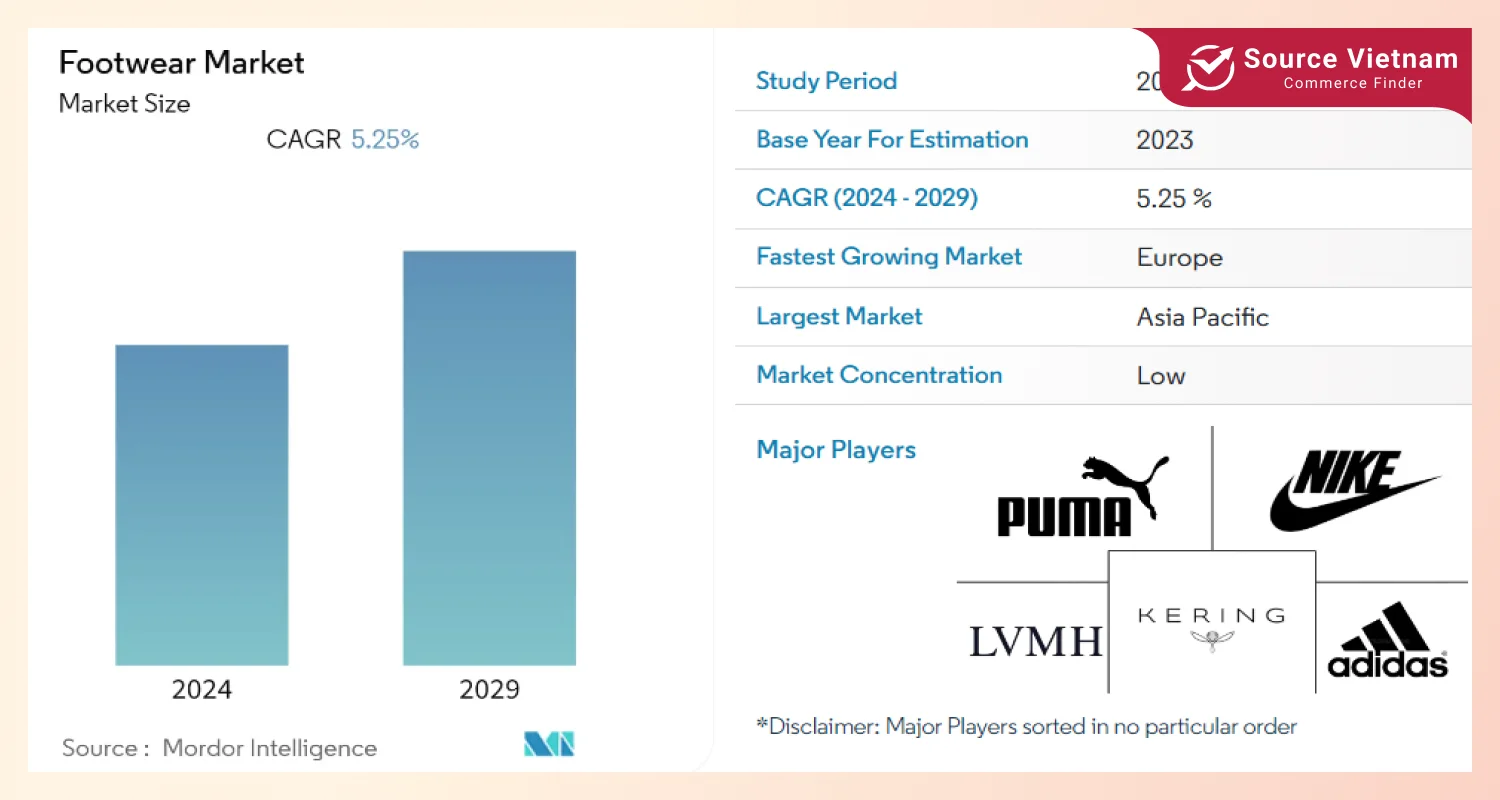

- Growing environmental concerns and the subsequent surge in demand for athletic footwear will contribute to CAGR growth of 5.25% in the global footwear market.

The world shoe market is heating up and expanding rapidly. It incorporates such products as footwear, including shoes, boots, sandals, sneakers, slippers, heels, loafers, flats, moccasins, or clogs. Stylish, comfy, and sportswear-oriented shoes are the key factors of such development. Countries such as China and India are the main sellers in this market. Prominent brands include Puma SE, Nike Inc., Asics Corporation, Fila Group and Adidas AG with their reputed strategies and products.

Market analysis

The footwear industry is anticipated to grow at a rate of 5.25% for the forecast period. This is partly due to the increasing demand for fashionable and comfortable footwear for people of all ages. There is a tremendous demand for sports-specific footwear, with football, basketball, cricket, and golf at the forefront. Several governments and organizations also pour in resources to advertise sporting leagues, enhancing the market’s growth.

Various Asian nations spearhead exporting of leather shoes. As per information from the Department for Promotion of Industry and Internal Trade, India’s export value for leather footwear in 2022 stood at 2,047.08 million USD.

Read more >>> What Are the New Trends in the Footwear Market?

Eco-Friendly Footwear on the Rise

It can be observed that eco-friendly footwear is on the rise. Companies that are passionate about lessening their carbon footprint are making use of sustainable materials. In August 2022, an Indian sustainable footwear company, Solecraft, introduced charcoal shoes that prevent sweating. These sneakers were created from Japanese bamboo charcoal, Australian merino wool, and oil from recycled coffee grounds.

Athleisure and Everyday Footwear

Millennial parents are exercising their parenting authority by forcing their children to wear athletic shoes, all thanks to the trend of athleisure footwear. This increased sales across the globe. However, other such as boots, sandals as well as flip flops are worn on a day to day basis in other parts of the world. Young people, in particular, have been the biggest demographic of sneaker year materials since they were light and designed well. For sneaker enthusiasts, the exclusive editions have become a great investment avenue.

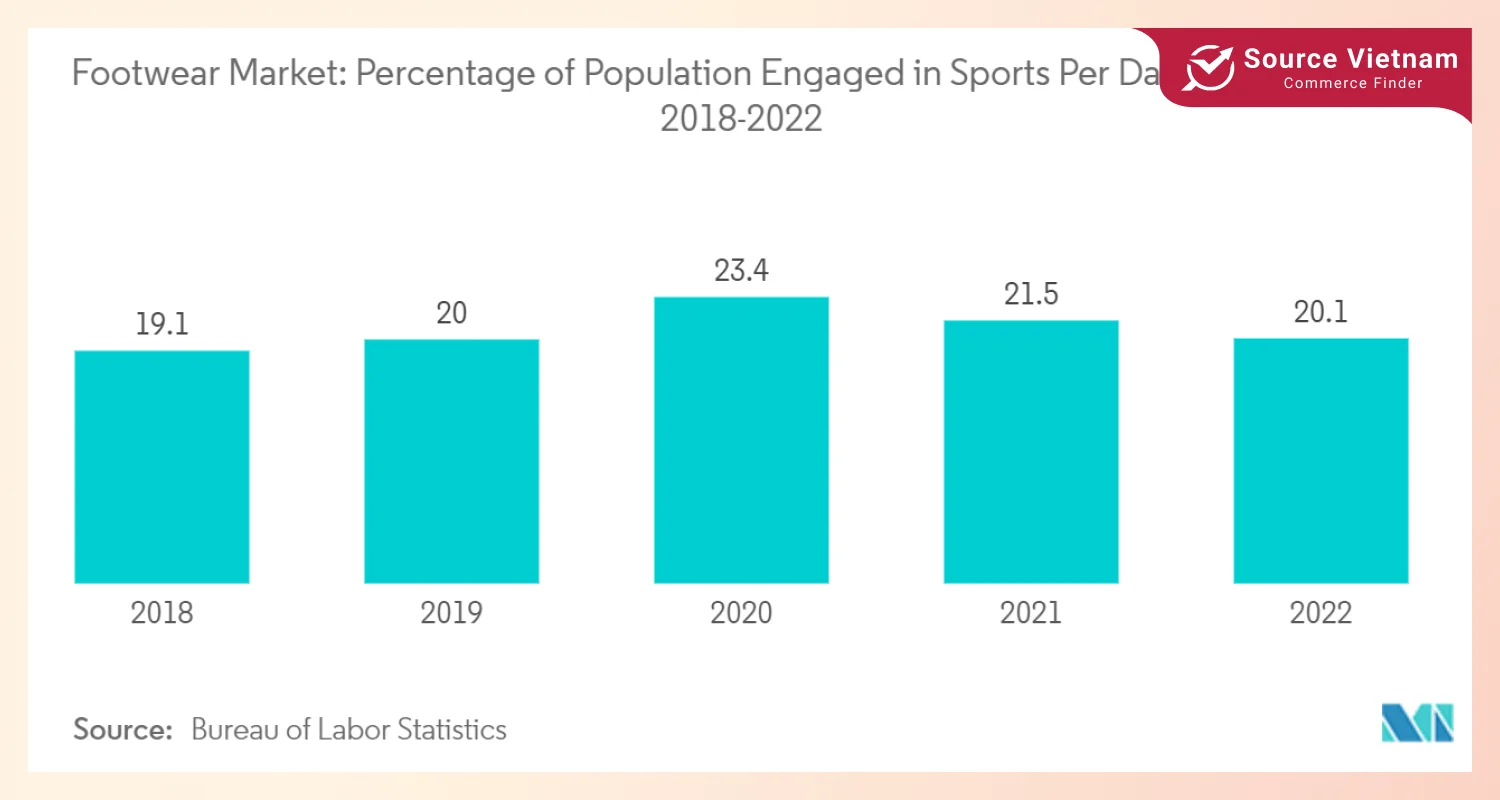

Growing Demand for Athletic Footwear

Sneakers have continuously been gaining popularity, all thanks to the shift towards practicing a healthier lifestyle. Other activities have also become the norm mast, such as running, going to the gym, and even playing sports such as soccer or basketball. Let’s say, in England between the years of 2021 and 2022 is an instance:

- 5,896.8 people participated in running

- 4,842.6 people attended gym sessions

- 2,012.3 people played soccer or engaged in similar activities

Also, events such as the Olympics or the Fifa World Cup increase demand. In March 2022, Puma teamed up with Lega Serie A as a technical partner and official athleisure and football equipment provider.

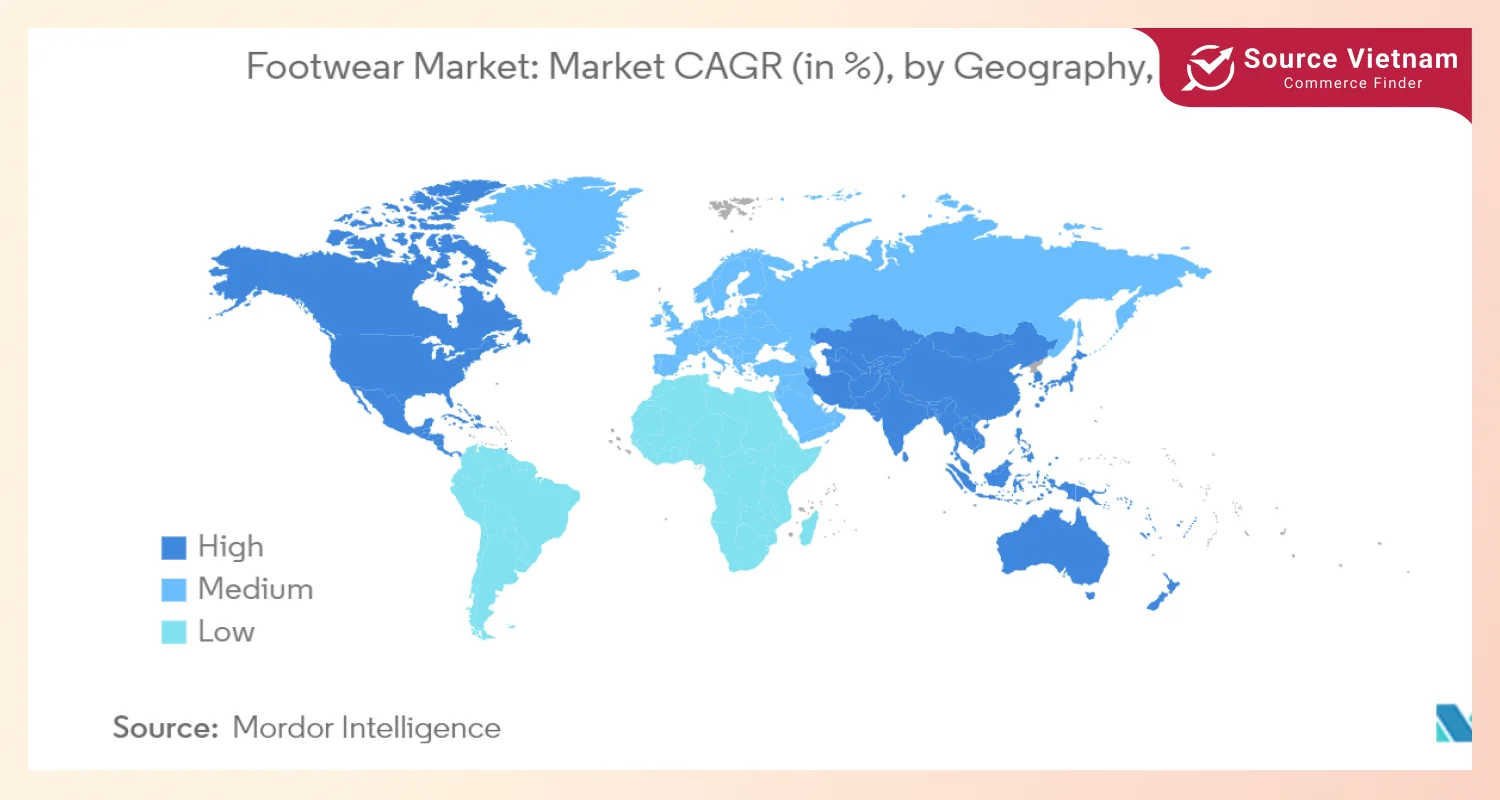

Asia-Pacific Leads the Market

Asia-Pacific is the largest region for the sale of footwear, with the example of countries like China and India, which constitute approximately 40% of the global market. Key drivers include urbanization, western lifestyle adoption, and the expansion of the middle class. The Thailand Textiles Institute reported that Thailand’s leather and footwear imports were valued at $ 2.16 billion in 2022.

Asia had the lion’s share, producing 87.4% of the world’s footwear in 2022. Global markets and economies rely more on Asian economies due to their affordable labor. Redistribution of resources is easily accomplished.

Online retailers like Amazon, Flipkart, Rakuten, Foot Locker, and Myntra are helping brands penetrate the Asia-Pacific market. Smaller cities and towns also contribute to market growth with affordable options.

Market Leaders and Strategies

The market share is controlled by Hennessy Louis Vuitton SE, Kering SA, and Puma SE. Aggressive and custom-madecustom-made digital campaigns are utilized with a focus on consumer-oriented eco-friendly products. Gender-neutral and kid-specific athletic shoes are gaining attention.

Recent Developments

In September 2023, Puma debuted part of its collaborations with Rihanna by launching Fenty * Puma. One of the new products was a vintage leather football shoe.

In September 2023, Nike was keen to promote their environmentally ‘friendly’ stance of the brand by issuing the Luka 2 shoe made up of 20% recycled material.

In September 2022, Asics follows up with the launch of the Novablast 3 slip-on, which features an Origami construction and advanced cushioning properties.

Market Segmentation

The footwear market is segmented based on:

- Type:

- Athletic Footwear: Running shoes, sports shoes, hiking shoes.

- Non-Athletic Footwear: Boots, flip-flops, slippers, sneakers.

- End Users: Men, Women, Kids.

- Distribution Channel: Offline Retail Stores, Online Retail Stores.

- Geography: North America, Europe, Asia-Pacific, South America, Middle East & Africa.

The market size is measured in USD across all these segments.

The footwear market continues to grow with evolving trends, innovative products, and regional dominance by Asia-Pacific.

Conclusion

The worldwide shoe market is growing due to alterations in consumer preferences, environmentally friendly style developments, and more engagement in sports and related activities. Favoring Asia-Pacific in both output and export as well as continual new developments from key players in the market, the market is set to grow continually. With athleisure and concern over climate change becoming more fashionable, the fashion industry will most probably evolve in more ways to cater to varied consumer tastes.