Vietnam’s furniture industry is growing rapidly due to urbanization and rising incomes. Local companies are competing with global brands by focusing on quality and design, while trends like sustainability and e-commerce are driving further growth.

Over the years, Vietnam has emerged as a significant player in furniture manufacturing in the world market. The growth is because the industry is flexible enough to adjust. With vast timber reserves, experienced local artisans and a burgeoning Vietnamese domestic market, Vietnam has become the sixth-largest furniture producer globally.

The global furniture market had a value close to USD 1.4 billion in 2023. The market is expected to grow by 4.95% each year until 2032. It should reach about USD 2.23 billion in value.

Furniture in Vietnam is exported to over 120 countries. Nevertheless, the primary customers are the United States, United Kingdom, Canada, Australia, and Japan.

Key drivers of market growth

Urbanization and housing demand

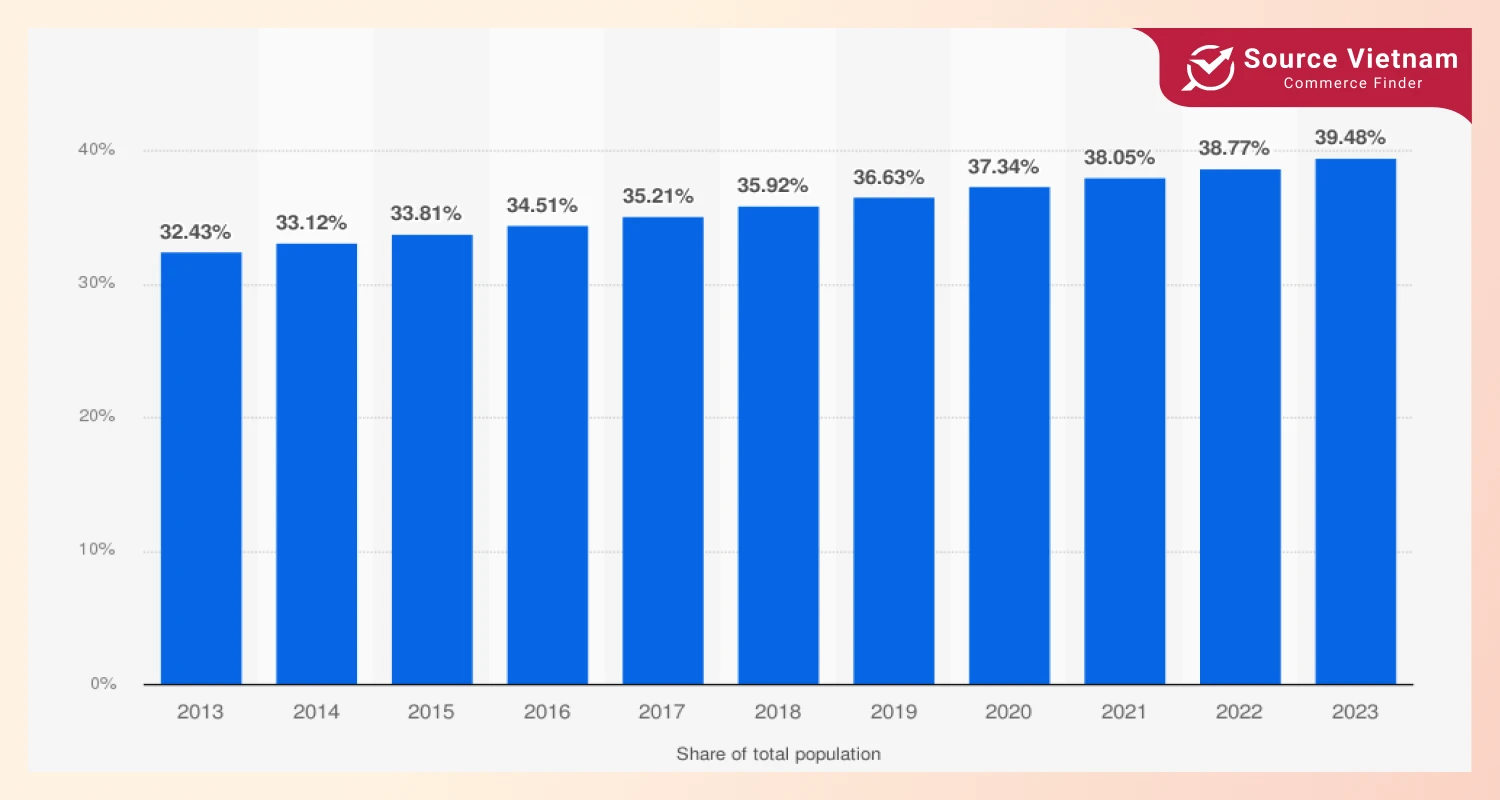

With an urbanization rate of 39.48% in 2023, Vietnam performed good growth in prior years. The growing urbanization has made an urgent requirement for renting/ residential furnishing in apartments and townhouses.

2023, there will be a 10% increase in permits and construction for family-sized furniture compared to 2022. This rise is due to more families moving to cities, which increases demand for larger furniture.

Read more >>> Top 10 Furniture Manufacturers in VietNam You Should Know in 2025

Rising middle-class incomes

As Vietnam’s middle class grows, there will be a greater demand for quality furniture. In 2023, the average income per person is USD 3.7k, a 7.1% increase from last year.

Consumers are beginning to attach more value to available visually appealing and functional furniture, which has an additional growth margin in the market.

Growth in the tourism and hospitality sector

In 2023, Vietnam received 18 million international tourists, reflecting a 15% rise from the previous year, 2022. Tourism has enhanced the hospitality industry, increasing investments in hotels, resorts, and inns. As a result, the need for furniture in these venues has increased, especially for high-end and tailor-made items.

Read more >>> TOP 10 Best Wholesale Home Decor Vendors for Retail and E-commerce

Market segmentation

The furniture market in Vietnam can be broadly segmented by application, material, and distribution channel:

- By application: Home furniture dominates this segment, followed by office and hospitality furniture. The growing trend of home renovation projects and increased residential construction drives this category.

- By material: Wooden furniture remains the top choice, thanks to Vietnam’s abundant timber resources and skilled artisans. Other materials like metal and plastic also have a presence, catering to various consumer preferences.

- By distribution: Distribution channels’ traditional speciality stores still dominate the market, but we see e-commerce platforms on a rapid rise that have transformed the retail chart.

With the convenience of online platforms, various alternate options and competitive offers exist. Consumers are increasingly gravitating towards online platforms.

Competitive landscape

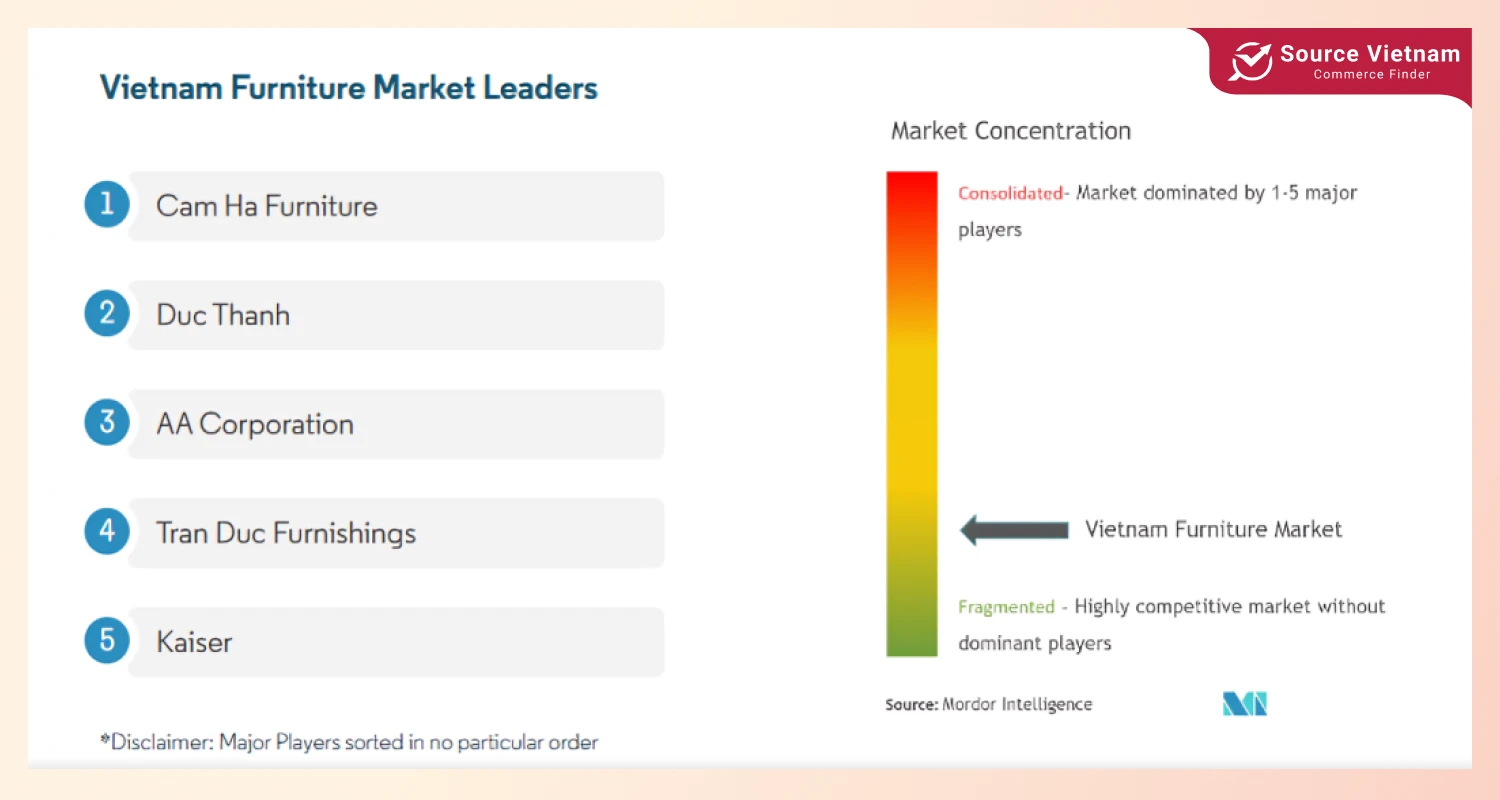

Vietnam’s furniture market is a dynamic mix of local manufacturers and global brands. While a few large companies dominate, smaller businesses are steadily gaining ground.

They focus on quality, design, and building their brands to compete with international companies. They are also using technology and developing new products to gain new customers and enter new markets.

The furniture industry is currently experiencing exciting growth, driven by key players like Cam Ha Furniture, Duc Thanh, AA Corporation, Tran Duc Furnishings, and Kaiser. More competition means consumers have more choices and styles.

Challenges facing the market

Competition from imports

Low-cost imports, particularly from China, pose a significant challenge for domestic manufacturers. These products often undercut local prices, making it harder for Vietnamese companies to maintain their market share.

Skilled labour shortages

The sector is experiencing a significant lack of skilled labour. In 2023, the furniture sector required around 500,000 workers, but only 300,000 met the necessary qualifications. This gap affects production efficiency and innovation capacity.

Quality assurance

Maintaining consistent quality is essential for Vietnam’s furniture industry to compete in international markets. Ensuring that products meet global standards remains a critical area for improvement.

Future trends and opportunities

Sustainable and eco-friendly furniture

Consumer demand for environmentally friendly furniture is growing. Products from renewable resources, recycled materials, or certified sustainable wood are becoming increasingly popular. Manufacturers that adopt sustainable practices stand to gain a competitive edge.

Customization and personalization

The market is seeing a shift toward personalized furniture solutions. Consumers seek designs, materials, and colours tailored to their preferences, prompting manufacturers to offer more made-to-order options.

Technological integration

Consumers have adopted IoT-enabled furniture with features like innovative charging bays and flexible designs. This trend appeals to young tech-savvy buyers who see function and form as equally valuable.

Expansion of e-commerce

The emergence of online furniture retail platforms has fundamentally changed the industry. E-marketplace allows manufacturers to target more clients and provides consumers with a convenient, easy shopping experience. It will likely blossom, especially with a younger tech user-tailored demographic.

Conclusion

Vietnam’s furniture scene is on fire! Why? Well, more people flock to the cities; they are richer and are starting to fancy nice furniture. Of course, nothing comes without a hitch. Imported furniture threatens to take over the local market and, above all, it is hard to find skilled labour.

Vietnam’s furniture companies are ready to take on the challenge, though. Each is in its own way – from using more sustainable materials, custom pieces that are literally the only ones out there, and the newest tech. This shows Vietnam is ready to breathe fire in a world of these attributes.