Insight:

- On-spot export and import is a streamlined trade process where goods are produced, sold, and delivered within Vietnam.

- To ensure successful on-spot export and import, businesses must understand the relevant laws and regulations, prepare accurate documentation, and comply with customs requirements.

On-spot export means Vietnamese businesses sell goods directly to foreign businesses within Vietnam. Foreign-invested companies can also use this method to export their products. The foreign buyer specifies where the goods should be delivered in Vietnam.

On-spot exports and imports are still considered export and import activities, so they are subject to the same taxes as goods purchased abroad. Domestic importers can ask the seller for a C/O form D to get tax benefits, but this is usually only for goods bought from companies in export processing zones or off-shore zones. However, some domestic companies still face difficulties getting these tax benefits during customs clearance. So, what are the current regulations for Vietnamese businesses involved in this type of export and import? Which companies need to pay close attention? Continue reading for more information.

How to succeed in on-spot export and import?

Understand all regulations and decrees

You must understand current regulations and related decrees to avoid legal violations. In particular, Circular 38/2015/TT-BTC and its amendments should be studied in detail. This is the key legal document governing import and export activities at your location.

Carefully study the regulations on customs procedures, documents, permitted goods, business conditions, etc. In addition to the above circular, you should refer to other decrees, government decisions, and guidance circulars from relevant ministries and agencies to fully grasp the current regulations.

Along with complying with the law, you should proactively expand your network by participating in industry forums and workshops. This is an opportunity to meet and exchange experiences with experts and other businesses in the field, thereby updating the latest market information, grasping new business trends, and seeking cooperation opportunities. By closely tracking changes in the law, your business can make the most of these opportunities.

Prepare complete and accurate information

Begin by identifying the goods’ information needed for the procedure. It’s important to ensure that the items intended for immediate export and import comply with local regulations regarding their type, quantity, value, and other related requirements.

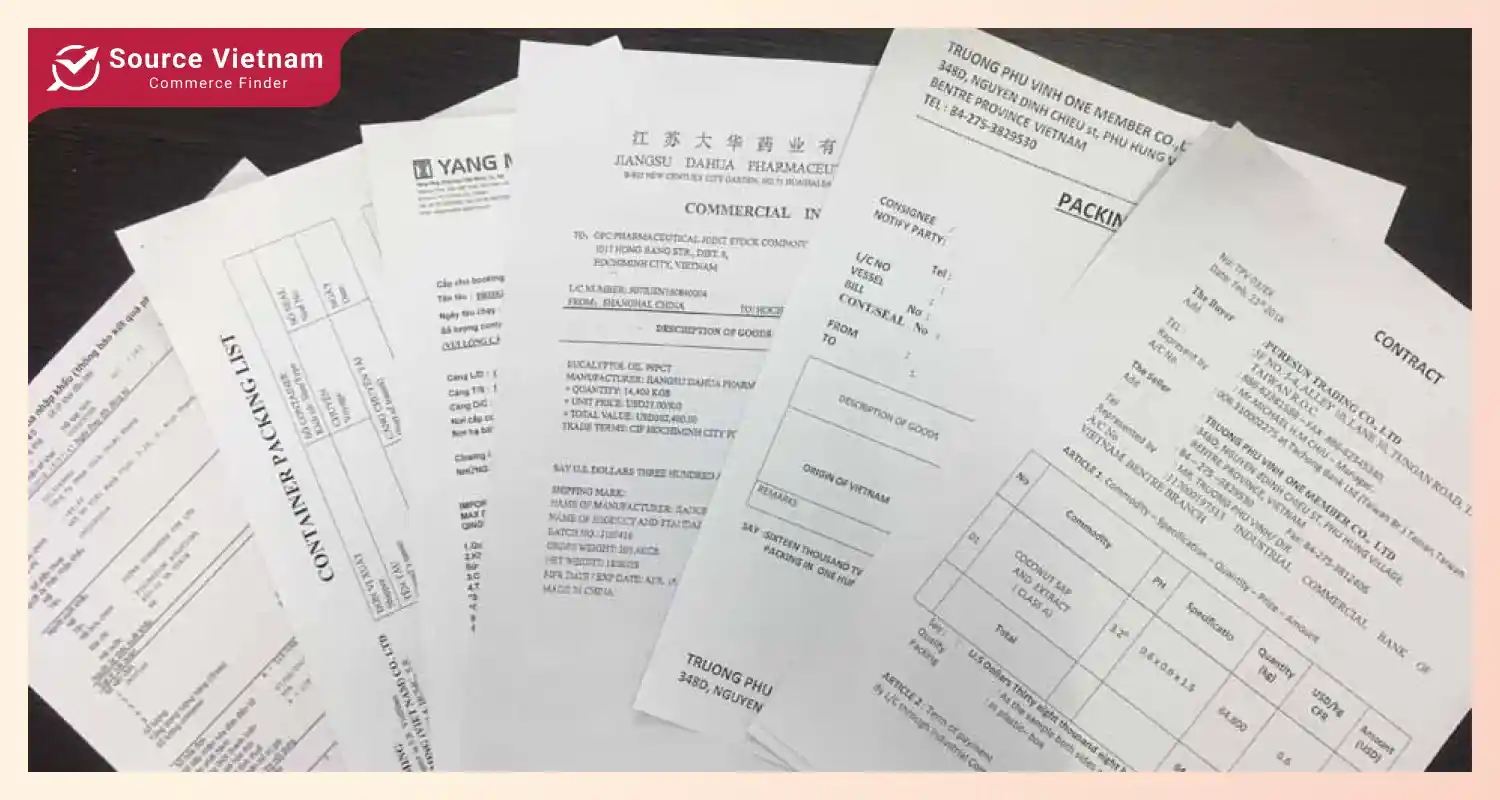

Next, your businesses should prepare relevant documents such as sales contracts, invoices, and transportation documents and register their export and import codes with the customs authority to confirm their eligibility to operate in this field.

Depending on the goods and destination country, your business may also need to register with customs and other relevant authorities, like quarantine or tax agencies. After all preparations are finalized, the transportation process can commence, moving the goods from the export site to the import location.

Upon reaching the import point, businesses must ensure the customs clearance is properly handled by submitting correct customs paperwork and following inspection standards. Finally, all applicable customs taxes and fees related to the exports and imports must be paid.

Rules and documentation for on-spot export and import in Vietnam

Regulations on the list of goods for on-spot export and import

According to Perpoint 1, Article 86 of Decree 38/2015/TT-BTC, goods for on-spot export or import include:

- Processed products; leased or borrowed machinery and equipment; surplus materials; waste and scrap related to processing contracts;

- Goods bought and sold between domestic enterprises and processing enterprises or enterprises in export processing zones;

- Goods bought and sold between Vietnamese enterprises and foreign organizations or individuals without a presence in Vietnam, where the foreign trader designates another Vietnamese enterprise to receive or deliver the goods.

Required customs documents for on-spot export goods

According to Perpoint 3, Article 86 of Decree 38/2015/TT-BTC, customs procedures for on-spot export and import goods shall be carried out following Article 16 of this Circular (as amended by Clause 58, Article 1 of Circular 39/2018/TT-BTC), and shall include:

- Export declaration;

- Commercial invoice or equivalent document if the buyer is responsible for payment to the seller;

- Export license;

- Notice of exemption from inspection or notice of specialized inspection results, or other documents as prescribed by law on specialized management and inspection (from now on referred to as “Specialized Inspection Certificate”);

- Documents that demonstrate the organization or individual meets the legal qualifications for exporting goods as outlined in investment regulations;

- Entrustment contract.

Responsibilities of the exporter in on-spot export and import

Exporters must understand and fully comply with their responsibilities to ensure this business runs smoothly and efficiently. Let’s explore more about the responsibilities of exporters below.

Complete the export customs declaration and combined transportation declaration, specifying the code of the Customs Sub-department handling the import customs clearance in the “Destination for bonded transport” field. In the “Internal management number” field on the export declaration, enter “#&XKTC” or in the “Other notes” section on the paper customs declaration.

- Carry out the export customs procedures as prescribed.

- Notify the importer upon completion of the export customs procedures so that the importer can carry out the import procedures and deliver the goods to the importer.

- Receive the information of the completed on-spot import customs declaration from the importer to carry out the subsequent procedures.

Responsibilities of the importer in on-spot export and import

Next, the importer also needs to understand their responsibilities and scope of work in the on-spot import-export process.

Complete the import customs declaration within the prescribed timeframe, clearly indicating the corresponding on-spot export customs declaration number in the “Business internal management number” field as follows: #&NKTC#&corresponding on-spot export customs declaration number or in the “Other notes” section on the paper customs declaration.

- Carry out the import customs procedures as prescribed.

- Immediately after completing the on-spot import procedures, notify the on-spot exporter of the completion of the procedures for the next steps.

- Goods may only be put into production or consumption after the imported goods have been cleared through customs.

Conclusion

On-spot export and import can be a strategic move for Vietnamese businesses to optimize their operations and expand their market reach. Businesses can successfully navigate this process by understanding the regulations, preparing necessary documents, and building strong relationships with partners.