Insight:

- The global home care market is expanding at a steady 4.52% CAGR as consumers focus more on health and hygiene.

- Eco-friendly product innovation and the rise of e-commerce are driving growth in the home care industry.

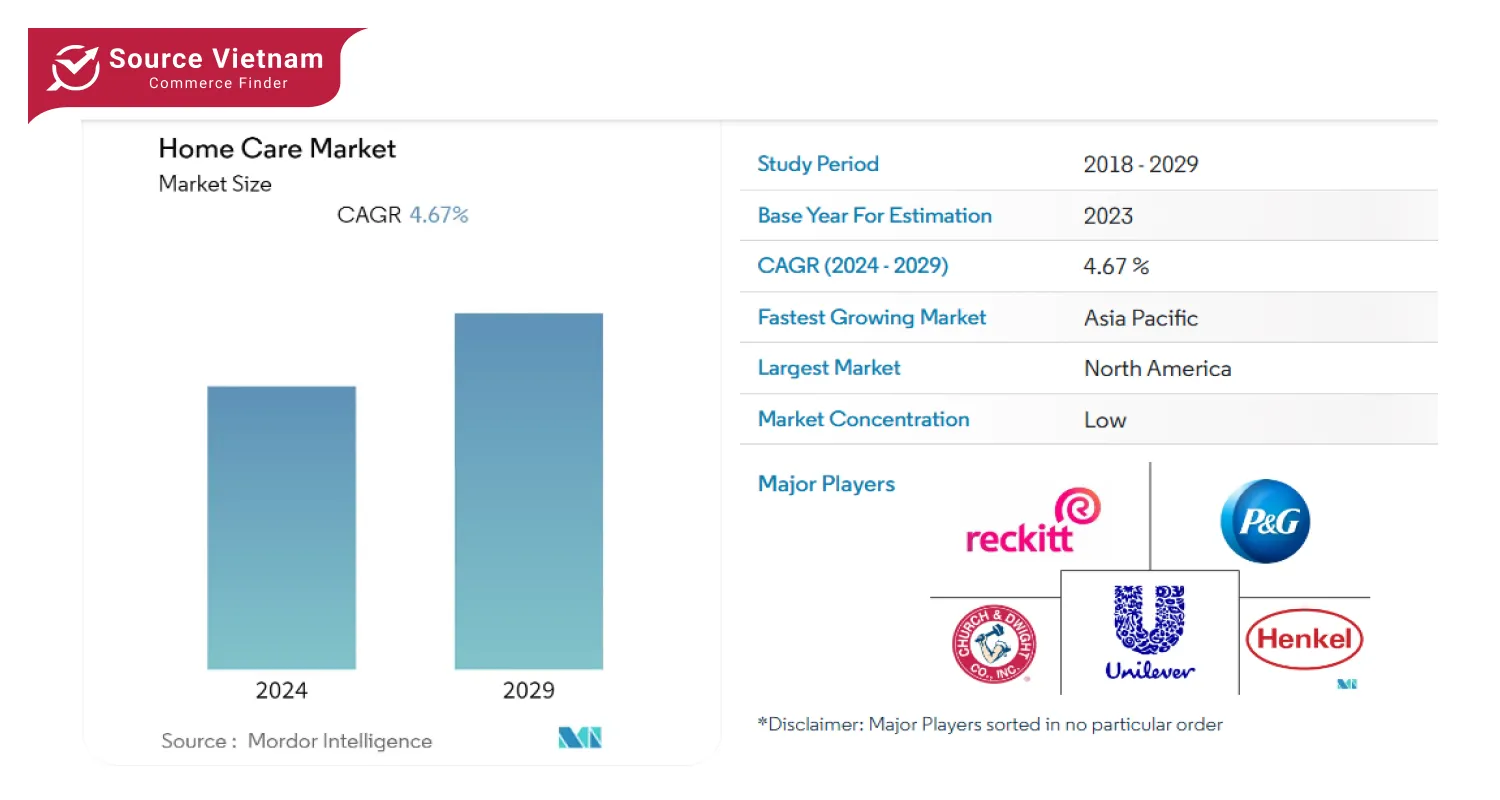

A foreseen growth rate of the global home care market is projected to have a promising figure of 4.67 % in terms of compound annual growth rate from the years 2024 to 2029. Awareness focused on hygiene after COVID-19 has diverted the products of major concern toward laundry care, surface care, and toilet care.

This article gives a thorough analysis of the market size, trends, and forecasts by product type, distribution channel, and regional segments. It gives consideration to the global household care market, a division by product type, distribution channels, and geographical areas.

Market drivers and trends

Rising demand for hygiene products

As a result of the COVID-19 pandemic, the number of requests for home care goods has grown significantly. Consumers are increasingly becoming interested in ensuring that their homes remain tidy and devoid of germs.

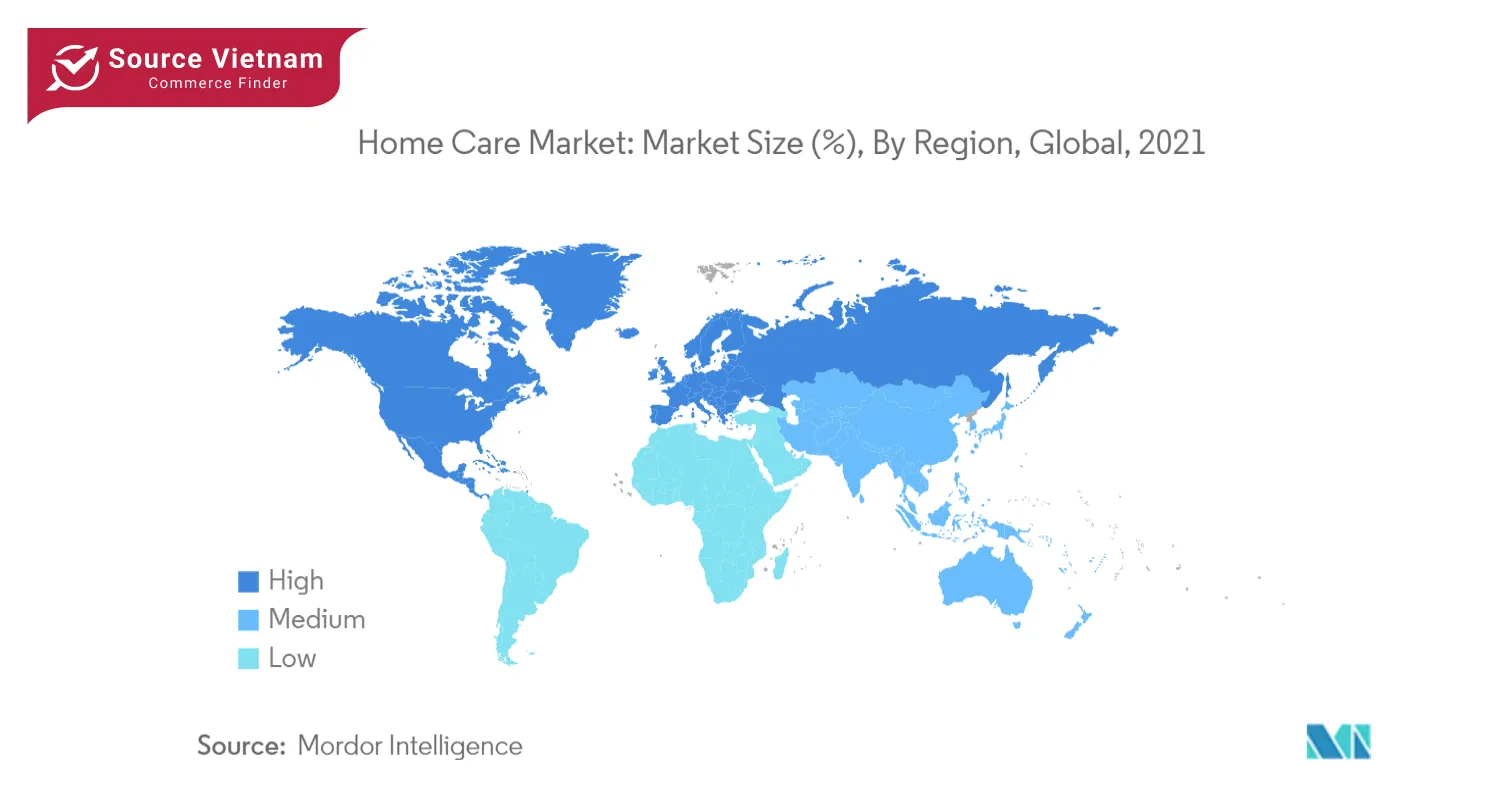

Significant growth in household cleaning agents in regions such as India, China, and Japan has been observed. With the rise in disposable income in India, a corresponding rise in home care products is also Au fait level, which aids in the market’s progress.

Innovation and sustainable practices

With the onset of time, the home care sector has managed to improve service delivery through an integration of conservation measures. Procter and Gamble, Unilever, Henkel, Reckitt Benckiser, and Church and Dwight are among the companies investing in innovations that reduce their carbon footprints through packaging and product design.

For instance, Unilever, in June 2021, rolled out paper bottles for laundry detergent. With rising concerns relating to the environment, the market demand for environmentally friendly products is rising accordingly, leading to market expansion.

Growth of online sales channels

The evolution of the distribution process is visible in the rapidly increasing growth of online shopping. Home care industries have progressively shifted to investing their activities in cyberspace, widening their scope and thus making it more customer-friendly. Distance sales grew greatly as well due to more active citizens’ interest in such a service as delivery and the need for comfortable shopping.

Key market segments

Product type

The home care market covers a wide array of products, including air care, dishwashing, bleach, insecticides, laundry care, surface care, and toilet care. Each category addresses specific cleaning or maintenance needs and is essential for maintaining home hygiene. The market size and value forecasts for each category show considerable growth across the forecast period.

Distribution channel

Consumers can be effectively reached through distribution channels, which have been documented as being effective. Due to the accessibility and popularity of supermarkets and hypermarkets, drugstore items are mainly sold there. Nevertheless, online retail shops have fast catching up and growing rapidly in the last few years as they provide a variety of options and ease of access, which is favored by the current generation.

Geographic trends

The North American market holds the largest share of the home care industry, with the United States and Canada leading due to higher awareness of hygiene and health. In the U.S., the well-developed real estate sector and rising household expenditure are closely tied to home care sales.

As an illustration, the U.S. Census Bureau noted that the number of housing units hit 141.95 million in the year 2021, which added to the growth in demand for home care products. Likewise, European and Asia-Pacific markets are also expected to trend upward on account of the fact that health and hygiene remain a focus.

Major players and competitive landscape

The home care market is quite competitive and quite fragmented. However, major stakeholders such as Procter & Gamble, Unilever, Henkel, Church & Dwight, and Reckitt Benckiser have also put in place various strategies to enhance their market share. These companies focus on product development, marketable green or sustainable packages, and even transparency about ingredients aimed at health-seeking consumers.

As a case in point, in 2021, Procter & Gamble’s fabric and home care accessories contributed $26,014 million of revenue depicting the worth of this market for dominant corporates.

Notable developments in the market

Plant-based products of Unilever: In December 2021, Unilever introduced a dishwashing liquid belonging to the Lux brand. This was done to meet the growing interest in nature-friendly and easily decomposable products.

- Surf Excel’s Sustainable Packaging: In September 2021, Hindustan Unilever announced that Surf Excel, its detergent brand, would transition to recyclable bottles made with 50% post-consumer recycled plastic and 100% biodegradable actives.

- In-Store Refill Stations: In July 2021, Hindustan Unilever introduced an in-store refill station pilot project at Reliance Smart Acme Mall in Mumbai, allowing consumers to refill their home care products sustainably.

Key insights and future outlook

The growing consumer preference for products that ensure cleanliness and prevent disease is expected to keep driving the market. Demand has also prompted brands to come up with effective products that meet the stringent requirements of the industry, which are more convenient and efficient.

The increasing popularity of such products has prompted manufacturers to make them available through online shops and advertise them with stars and unique concepts to appeal to a wider audience.

Conclusion

Given the rise of hygiene consciousness along with product innovations and eco-friendly packaging, the worldwide home care market is well-positioned for consistent growth in the coming years. The demand for such eco-friendly and multifunctional products will, therefore, stay strong as major companies improve their product lines and increase their online visibility.

As the market develops, brands that prioritize sustainability, accessibility, and product efficacy are expected to lead and gain a competitive advantage in this dynamic industry.