Cost of goods sold (COGS) is the direct cost of producing goods sold by a company, encompassing materials, labor, and overhead. Accurate COGS calculation is crucial for determining profitability, managing inventory, and making informed business decisions.

Understanding the costs is vital to ensuring business profitability. By effectively managing cost of good sold (COGS), cost of good manufactured (COGM), you can optimize profit margins, identify areas for cost reduction, and make financially informed decisions. But do you grasp COGS formula and COGM formula? Let’s explore their concept, their calculation, and their significance in the article below.

What is cost of goods sold (COGS)?

Understanding COGS helps you assess the overall profitability of your business. Here’s a quick refresher on COGS for your convenience.

Definition: COGS (cost of goods sold) is an accounting term in financial accounting used for a company or corporation, which includes the direct costs of creating the products and saleable items a company sells to customers. This consists of wages, inventory, and other overhead components directly associated with the production of a product or service delivery.

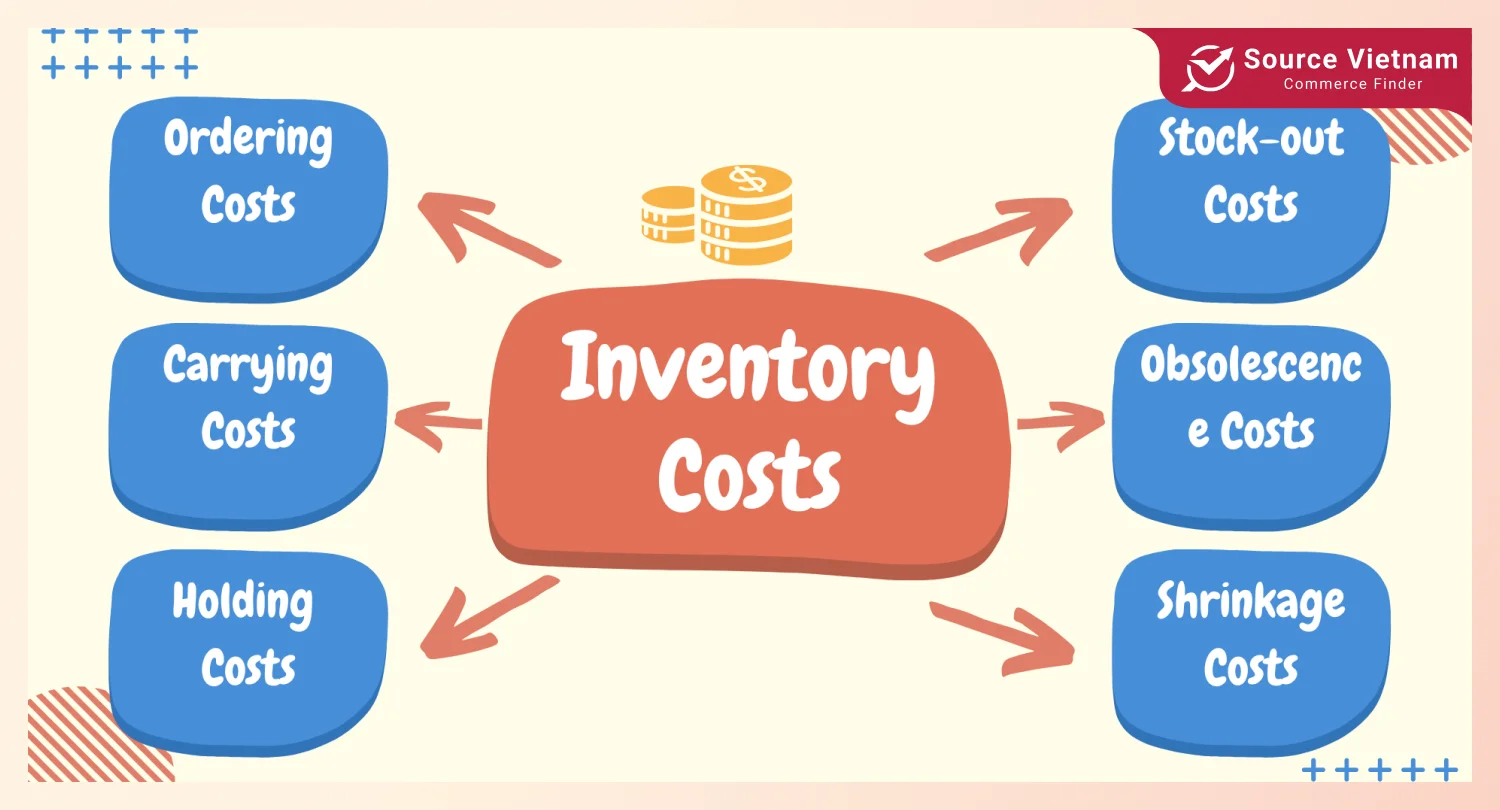

- Components: Cost of goods sold (COGS) basically refers to all the direct costs incurred in generating goods or services like labor, raw materials, and manufacturing overhead. It also includes the other expenses involved, like shipping charges and material handling.

- Importance: Because COGS directly affects profitability, it is important for calculating gross profit and net income. By comparing expenses with inventory counts, it aids in inventory management and helps with pricing decisions to ensure profitability.

- Accounting standards (GAAP): Based on the matching principle of accounting at GAAP, COGS is to be measured where expenses which relate to revenues are matched. The profitability would have been appropriately reflected in this manner as the expenses truly attributable to the production of merchandise and ventures will tumble in the right timeframe in which they happen.

COGS explained: A vital metric for business success.

Read more >>> Cost of Sales – Definition | Calculating | Effective Tactics for Efficiency

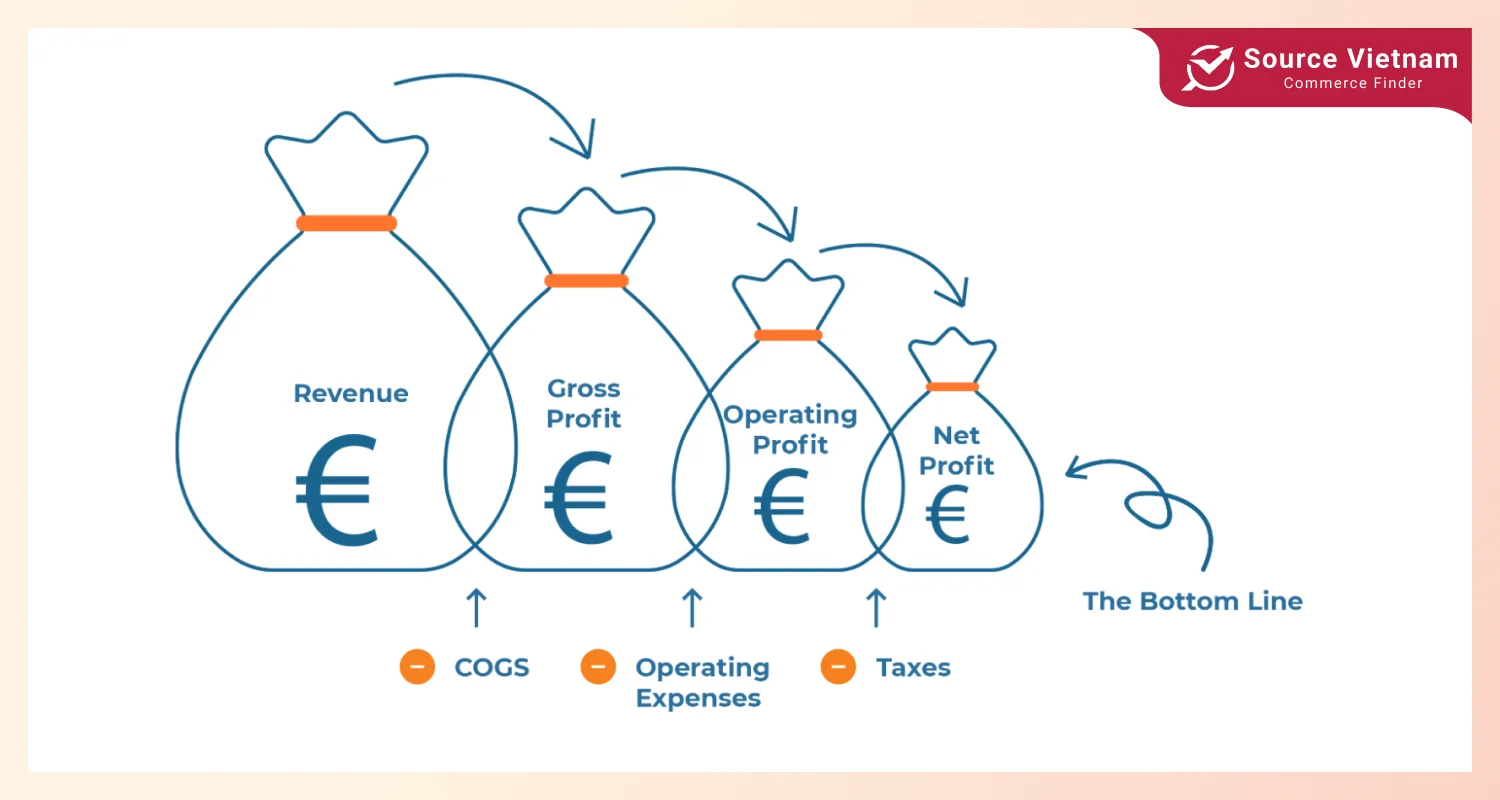

Calculating cost of goods sold

Cost of goods sold is significant in determining both gross profit and net income; it’s deducted from total revenue. In this section, we will discuss what the cost of goods sold formula for manufacturers is and how to calculate the cost of goods sold for a small business

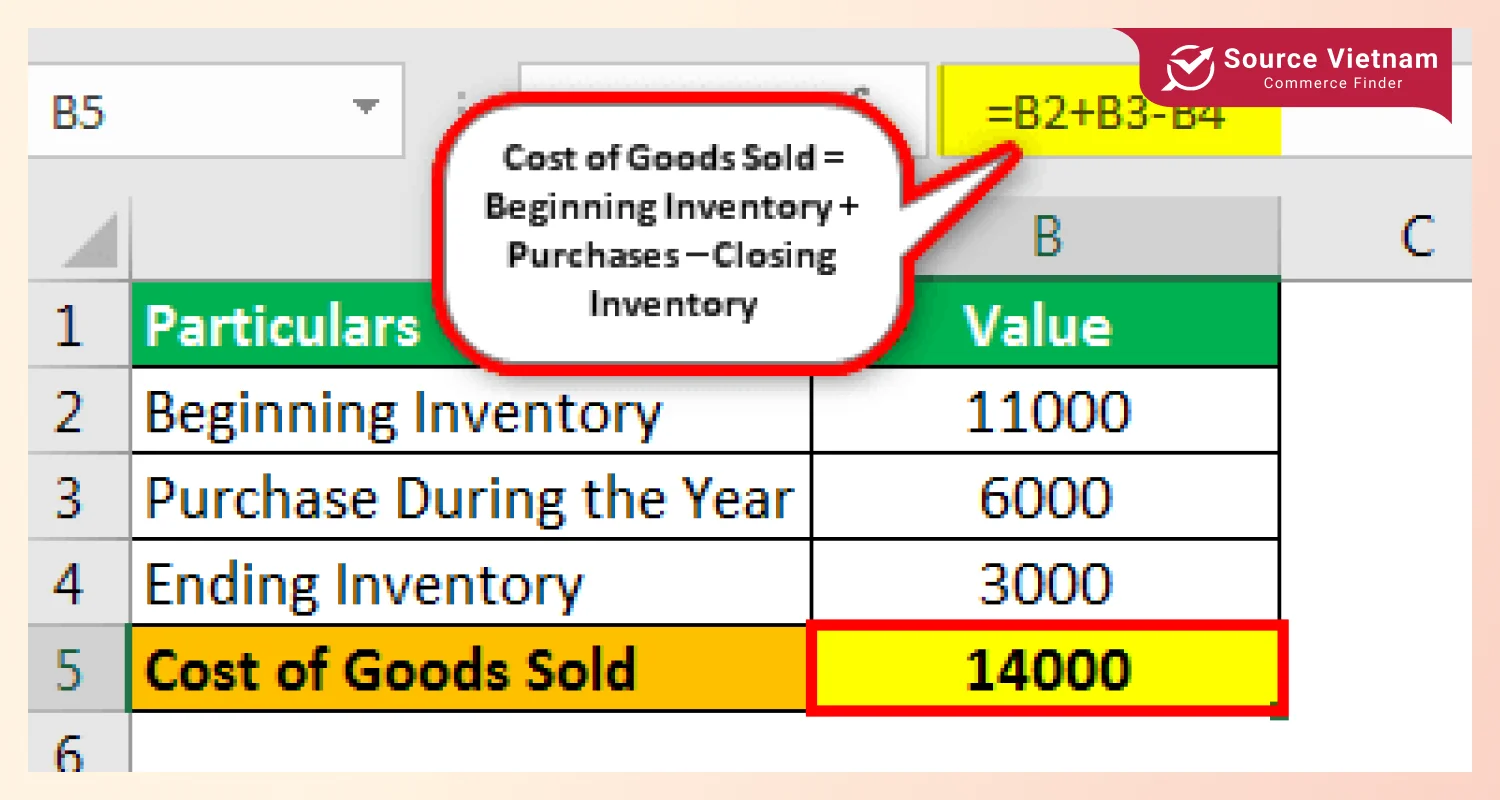

COGS formula:

COGS = Beginning Inventory + Purchases – Ending Inventory

– Cost of goods sold formula breakdown

- Direct costs: Direct costs are the costs relevant to the production like raw materials, labor, and manufacturing overhead. These types of expenses are part of COGS, or cost of goods sold, which are the direct costs associated with producing the goods sold in a specific period.

- Variable vs. fixed costs in COGS: While the raw materials and direct labor in COGS are variable costs, they depend on the amount of production, costs like rent of the factory and depreciation of equipment are not variable. While fixed costs remain constant in total no matter the level of output, variable costs move in proportion to the level of production.

- Inventory and its impact on COGS: Inventory valuation methods such as FIFO, LIFO, and weighted average impact COGS by determining which costs of inventory sold fall into the various sales buckets. If prices tend to increase, the FIFO approach assigns older costs, resulting in lower COGS and higher profits. LIFO uses the most recent costs, so it increases COGS and reduces profitability. Weighted average approach to average inventory costs, which has a moderate effect on COGS and profits.

How to calculate the cost of goods sold for your business:

- Understanding your inventory and expenses: Employ an inventory management system to monitor the level of stock, perform regular counts, and categorize costs in their appropriate heads for tracking inventory and categorizing COGS charges. Choose an inventory valuation method and refresh data periodically to ensure the accuracy of COGS calculation and financial reporting.

- Tips for manufacturers vs. retailers: For manufacturers, COGS can be determined by tracking the cost of direct labor, raw materials, and manufacturing overhead. For retailers, it reflects the cost of products purchased plus shipping and freight.

- Common pitfalls in COGS calculation: Misclassifying expenses, such as assuming indirect costs are direct costs, is one of the mistakes to avoid when calculating COGS. Inaccurate inventory valuation methods and neglecting to account for returns or shrinkage are two more frequent errors in COGS calculations. These could provide inaccurate financial reports that have an impact on profitability and decision-making.

Calculate your COGS accurately: A step-by-step guide.

Read more >>> How to Calculate Total Manufacturing Cost – Full Formula

Cost of goods manufactured (COGM)

COGM is extremely significant to manufacturing industry manufacturers since it is the cost of completed goods that have been moved into inventory and a reflection of overall cost control and manufacturing efficiency.

- Definition: Cost of goods manufactured, or COGM, is the total expenditure of producing finished goods during a period. It entails direct material, direct labor, and plant outflow. You calculate it by adding the costs of product and abating the ending work-in-progress force from the morning work-in-progress force.

- Relevance to COGS: COGM is the overall cost spent on all the products ready for sale during a period. To find COGS, one needs to find the ending inventory of the finished products and then subtract the cost of the goods that were ready for sale. The computation is essential to find the actual cost of the goods sold during the period, which in turn is essential to study profitability.

- COGM schedule: The overall cost of manufacturing incurred over a certain interval—including direct material, direct labor, and manufacturing overhead—is computed using the COGM schedule. Starting with the beginning work-in-process inventory balance, it then subtracts the ending work-in-process inventory while adding production expenses. Firms can use this schedule to determine both the cost of items offered for sale and the cost of goods sold, allowing them to effectively regulate their production costs.

Cost of goods manufactured: Understanding the basics.

Schedule of cost of goods manufactured

What is the schedule of COGM? Let’s find out the cost of goods manufactured schedule template below.

- Explanation of a COGM schedule: COGM schedule is a detailed report that encompasses the whole range of cost to manufacture finished goods. It entails production cost, direct labor, and direct material. In determining the cost of products manufactured—which is vital in figuring out the cost of goods available for sale and COGS—the schedule meticulously considers beginning and ending work-in-progress inventories.

- How to create and use a COGM schedule: To create and use a COGM schedule,

Step 1: Compile information on the direct materials utilized, direct labor expenses, manufacturing overhead, and starting and ending work-in-progress inventories.

Step 2: Start by adding up the purchases made over the time and correcting for the beginning and ending raw material inventories to get the direct materials consumed.

Step 3: Then include the entire direct labor and manufacturing overhead costs, which include indirect production costs such as factory rent and utilities.

Step 4: Use the COGM formula to calculate the total cost of goods manufactured (COGM):

COGM = Direct materials used + direct labor + manufacturing overhead + beginning WIP – Ending WIP

Mastering the COGM schedule: A powerful tool for cost analysis.

Net sales vs. cost of goods sold

Net Sales and COGS are closely related indicators. Understanding the difference between net sales and cost of goods sold will enable your company to reduce costs and enhance profits.

- Net sales: Net sales is the amount of dollar sales transactions resulting from the firm’s operations, returns, allowances, and discounts. This figure is the actual revenue a company earns from its product or service lines, providing an accurate depiction of income by eliminating deductions for returned goods, allowances, and promotional discounts.

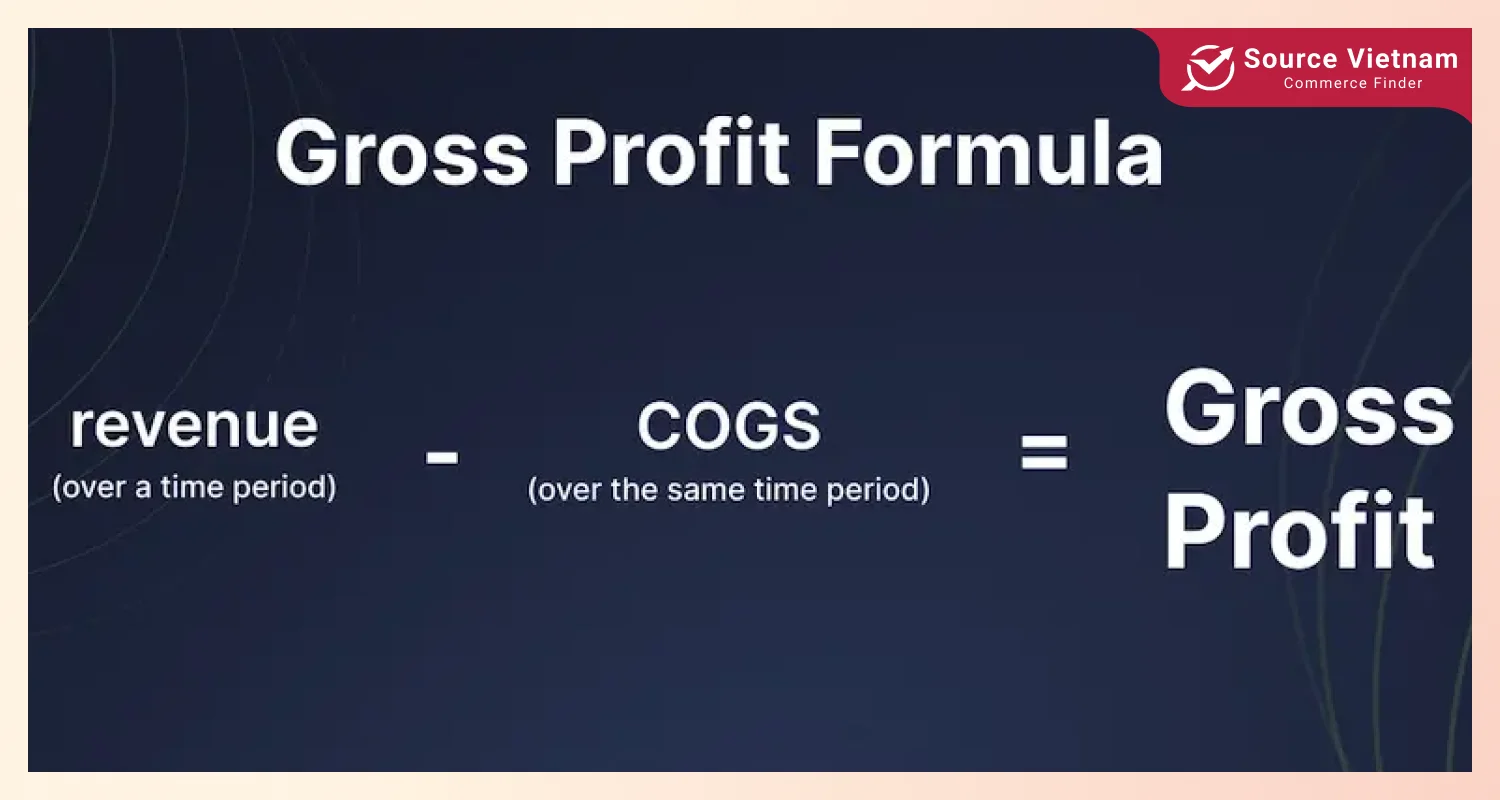

- Relationship to COGS: The relationship between cost of goods sold and net sales has a close association with the gross profit of a company. The relationship enables companies to identify their profitability, indicating the amount of money remaining after subtracting the immediate costs of production or purchasing from sales.

- Formulas:

-

Gross profit = Net sales – COGS

-

Profit margin = (Net Income / Net Sales) x 100

-

Example: A business that has a COGS of$ 60,000 and net earnings of$ 100,000 has a gross profit of$ 40,000($ 100,000-$ 60,000). The profit periphery is calculated by taking the gross profit divided by net deals and multiplying by 100, which equals a 40 profit periphery($ 40,000 ÷$ 100,000). This defines profit periphery as the proportion of profit remaining after direct product costs, illustrating the relationship of net deals and COGS to induce gross profit.

Net sales vs.COGS: Understanding the relationship for profitability.

How to calculate sales revenue with cost of goods sold

Did you know that sales revenue and cost of goods sold (COGS) are critical in evaluating a company’s profitability? Let’s investigate this relationship here.

- The relationship between sales revenue and COGS: Deals profit is principally all of the plutocrat that you’ve made dealing stuff, right? also you also have the cost of goods sold ( COGS), which is actually what it bring to make those effects. You take COGS out of your deals profit and that gets you your gross profit, and that is important in terms of figuring out how well you are making effects. After that, net income is reached by abating other and operating charges from gross profit. So, profitability of a company relies directly on the cost of goods vended and its deals.

- Example calculation using real-world data: Assume a corporation has a gross profit of $50,000 and a cost of goods sold of $30,000. To determine sales revenue, simply add gross profit and COGS:

Sales Revenue=$50,000+$30,000=$80,000

In this example, the company’s sales revenue is $80,000. This explains how to compute sales revenue given the gross profit and COGS.

Unlocking profitability: The connection between sales revenue and COGS.

How to find COGS with net sales and gross profit

You may find out how to find cost of goods sold with net sales and gross profit, as well as understand gross margin and its significance in profitability, by visiting below.

- Formula for calculating COGS: The formula for calculating COGS (cost of goods sold) when net sales and gross profit are known is:

COGS = Net Sales − Gross Profit

- Understanding Gross Margin and its role in profitability: Gross margin is the percentage of revenue that remains after deducting the COGS. The gross margin is determined by the following formula:

Gross Margin= (Gross Profit / Net Sales) × 100

It is one of the main drivers of a company’s profitability, operating efficiency, and pricing strategy. A high gross margin means the company retains a higher percentage of revenue from sales after subtracting the cost of manufacturing, which can be invested in operating costs and profit.

Boost your bottom line: Understanding Gross Margin and COGS.

What type of account is cost of goods sold?

The cost of goods sold is what kind of account?? Let’s find it out in this section below.

- COGS as an expense account: The COGS is a cost account shown on the income statement that equals the direct manufacturing costs of the goods or the merchandise costs of the items being sold during a period. The figure is subtracted from net sales to arrive at the gross profit, which is a key determinant of cost effectiveness in the primary operations of the business.

- Its role in the income statement: COGS comes below net sales on the income statement and indicates the direct costs of manufacturing items. Subtracting COGS from net sales yields gross profit, an important efficiency metric. To calculate net income, operating expenses and other costs are subtracted from gross profit. Thus, COGS is critical in calculating both gross profit and net income.

- Understanding the accounting classification of COGS: COGS is recorded as an item on the income statement and represents direct costs such as materials and labor. When net sales are subtracted, gross profit is calculated, which is an important indicator of operational efficiency. Accurate COGS reporting is critical for profitability, tax computations, and maintaining financial openness.

COGS in financial reporting: Understanding its classification.

Conclusion

COGS represents the direct expenses of making items sold and is used to calculate gross profit and net income. It is estimated by adding supplies, labor, and overhead expenses and adjusting for inventories. Cost of goods sold calculation is critical for financial analysis, profitability, and tax reporting, thus accurate calculations are essential for successful decision-making and cost control. Understanding and effectively calculating COGS is critical to enhancing your company’s financial management and profitability.

If you are business owners or have a passion for business, please visit SourceVietnam.com to better assess your gross profit, optimize pricing strategies, and identify areas for cost control.

FAQs about COGS

What is the formula for calculating cost of goods sold (COGS)?

The method for computing cost of goods sold (COGS) is:

COGS= Beginning Inventory + Purchases − Ending Inventory

This formula adds the starting inventory value to any new purchases made during the time, then subtracts the ending inventory value.

What is included in the cost of goods sold?

The cost of goods sold (COGS) includes all direct costs involved with a company’s manufacture or acquisition of goods for sale.These fees often include:

- Direct materials are the raw components used for the cost of goods sold.

- Direct labor: Wages and benefits for workers directly involved in manufacturing or production.

- Manufacturing overhead: Indirect costs of production such as factory rent, utilities, and equipment depreciation.

- Purchases: The cost of products obtained for resale by retailers.

How does COGS differ for manufacturers and retailers?

Manufacturers and retailers’ COGS calculations change depending on their business structures and operations. For manufacturers, COGS covers the expenses of creating items, such as direct materials, direct labor, and manufacturing overheads, which are combined together to calculate the total cost of goods produced and sold. For merchants, COGS largely covers the purchase price and freight of products purchased for resale, as well as delivery costs.

What is the impact of inventory valuation methods on COGS?

Inventory valuation systems such as FIFO, LIFO, and weighted average affect COGS by selecting which inventory costs are allocated to sales. FIFO uses older costs, which results in reduced COGS and better profits during periods of rising prices. LIFO employs recent expenses, which leads to increased COGS and poorer profits. The weighted average approach averages inventory costs, resulting in a balanced influence on COGS and profitability.

How do I find the cost of goods sold for my business?

To calculate COGS for your firm, use this formula:

COGS = Beginning Inventory + Purchases / Production Costs − Ending Inventory

Simply add your initial inventory, purchases, or manufacturing expenditures, and deduct the finishing inventory. This shows you the direct costs linked with the goods sold.

How does COGS affect my gross profit margin?

COGS directly affects your gross profit margin. The gross profit margin is derived by deducting COGS from net sales and then dividing by net sales. Here’s the formula:

Gross Profit Margin = (Net Sales−COGS) / Net Sales × 100

A greater COGS reduces gross profit, resulting in a reduced profit margin. A lower COGS, on the other hand, boosts gross profit and improves margins. Essentially, COGS decides how much money your company keeps from sales after deducting production or acquisition costs, which has a direct impact on profitability.

How can I reduce my cost of goods sold?

You may lower COGS by negotiating better supplier costs, optimizing inventory management, streamlining production, investing in automation, sourcing cheaper materials, and increasing supply chain efficiency. These tactics help to reduce direct costs and increase profitability.